Hertz 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

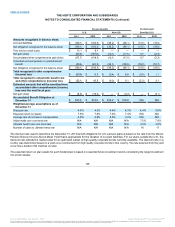

As of December 31, 2013, the Senior ABL Facility had $1,026.1 million available under the letter of credit facility sublimit, subject to

borrowing base restrictions.

Substantially all of our revenue earning equipment and certain related assets are owned by special purpose entities, or are encumbered in

favor of our lenders under our various credit facilities.

Some of these special purpose entities are consolidated variable interest entities, of which Hertz is the primary beneficiary, whose sole

purpose is to provide commitments to lend in various currencies subject to borrowing bases comprised of rental vehicles and related assets of

certain of Hertz International, Ltd.'s subsidiaries. As of December 31, 2013 and December 31, 2012, our International Fleet Financing No. 1

B.V., International Fleet Financing No. 2 B.V. and HA Funding Pty, Ltd. variable interest entities had total assets primarily comprised of loans

receivable and revenue earning equipment of $689.7 million and $440.8 million, respectively, and total liabilities primarily comprised of debt

of $689.1 million and $440.3 million, respectively.

As of December 31, 2013 and 2012, accrued interest was $73.5 million and $86.4 million, respectively, which is reflected in our

consolidated balance sheet in “Accrued liabilities.”

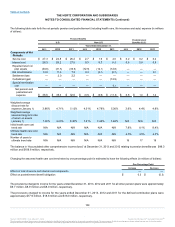

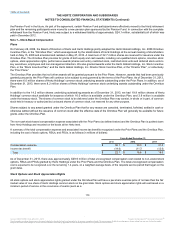

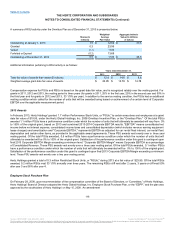

Qualified U.S. employees, after completion of specified periods of service, are eligible to participate in The Hertz Corporation Account Balance

Defined Benefit Pension Plan, or the “Hertz Retirement Plan,” a cash balance plan. Under this qualified Hertz Retirement Plan, we pay the

entire cost and employees are not required to contribute.

Most of our international subsidiaries have defined benefit retirement plans or participate in various insured or multiemployer plans. In

certain countries, when the subsidiaries make the required funding payments, they have no further obligations under such plans.

Company plans are generally funded, except for certain nonqualified U.S. defined benefit plans and in Germany and France, where

unfunded liabilities are recorded.

We sponsor defined contribution plans for certain eligible U.S. and non-U.S. employees. We match contributions of participating employees

on the basis specified in the plans.

An amendment to the Hertz Corporation Account Balance Defined Benefit Plan took effect on January 1, 2012. A fixed interest rate of 3% will

be applied to cash balance credits in 2012 and later years. Previously, it was the rate published by the Pension Benefit Guarantee

Corporation, or “PGBC,” for the December prior to the year the credit was earned. Also effective January 1, 2012, service credit rates for each

employee will be determined on the first day of the year.

Effective January 1, 2014, The Hertz Corporation Account Balance Defined Benefit Pension Plan will be amended to provide a maximum

annual compensation credit equal to 5.0% of eligible compensation paid to all plan members who are hired or rehired before January 1,

2014, unless as of December 31, 2013 the member has at least 120 months of continuous service, in which case the member continues

with an annual credit of 6.5%. All Hertz employees who are hired on or after January 1, 2014 and Dollar Thrifty employees who become plan

members on or after January 1, 2014 are eligible for a flat 3.0% annual compensation credit, regardless of the member's number of months

of continuous service. This plan change had a favorable impact on the amount of pension expense recorded in 2013 of $2.8 million.

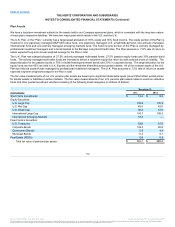

We sponsored a defined benefit pension plan in the U.K. On June 30, 2011, we approved an agreement with the trustees of that plan to

cease all future benefit accruals to existing members and to close the plan to new members. Effective July 1, 2011, we introduced a defined

contribution plan with company matching contributions to replace the defined benefit pension plan. The company matching contributions are

generally 100% of the employee contributions, up to 8% of pay, except that former members of the defined benefit plan receive an enhanced

match for five years. This resulted in lower contributions this year into the defined benefit plan, which were offset by matching contributions

to the new defined contribution plan. In the year ended December 31, 2011, we recognized a gain of $13.1 million for the U.K. plan that

represented unamortized prior service cost from a 2010 amendment that eliminated discretionary pension increases related to pre-1997

service primarily related to inactive employees.

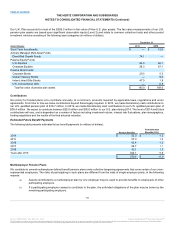

We also sponsor postretirement health care and life insurance benefits for a limited number of employees with hire dates prior to January 1,

1990. The postretirement health care plan is contributory with participants' contributions

106

Source: HERTZ CORP, 10-K, March 31, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.