Hertz 2011 Annual Report Download - page 94

Download and view the complete annual report

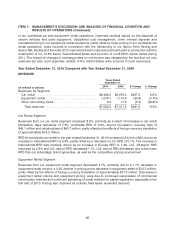

Please find page 94 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

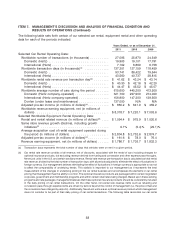

$30.2 million, concession fees of $27.4 million, charge card fees of $13.8 million and reservation

costs of $5.2 million primarily related to improved car rental volume demand.

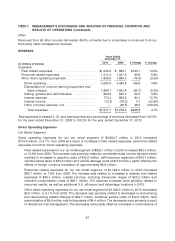

Equipment Rental Segment

Direct operating expenses for our equipment rental segment of $677.3 million in 2010 increased 2.1%

from $663.4 million in 2010 as a result of increases in fleet related expenses and personnel related

expenses, partly offset by a decrease in other direct operating expenses.

Fleet related expenses for our equipment rental segment of $180.8 million in 2010 increased

$24.4 million, or 15.6% from 2009. Equipment maintenance costs and freight costs increased by

$13.7 million and $9.0 million, respectively, relating to efforts to maximize the use of our existing

fleet.

Personnel related expenses for our equipment rental segment of $209.8 million in 2010 increased

$4.1 million, or 2.0% from 2009. The increase was related to increases in incentives of $3.1 million

primarily related to improved results, as well as the effects of foreign currency translation of

approximately $2.7 million. The increase was partly offset by a decrease in salaries and related

expenses of $1.7 million primarily related to restructuring.

Other direct operating expenses for our equipment rental segment of $286.7 million in 2010

decreased $14.6 million, or 4.8% from 2009. The decrease was primarily related to decreases in

equipment rental cost of goods sold of $10.9 million, credit and collections expense of $7.3 million,

facilities expenses of $3.9 million and field systems of $3.0 million, partly offset by the effects of

foreign currency translation of approximately $4.6 million and an increase in re-rent expense of

$2.3 million. The decreases were primarily a result of disciplined cost management and reductions

in equipment rental volume.

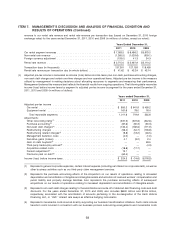

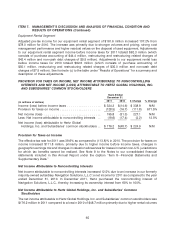

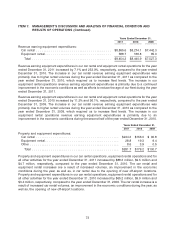

Depreciation of Revenue Earning Equipment and Lease Charges

Car Rental Segment

Depreciation of revenue earning equipment and lease charges for our car rental segment of

$1,594.6 million for the year ended December 31, 2010 decreased 1.4% from $1,616.6 million for the

year ended December 31, 2009. The decrease was primarily due to an improvement in certain vehicle

residual values and a change in mix of vehicles, partly offset by the effects of foreign currency translation

of approximately $9.2 million.

Equipment Rental Segment

Depreciation of revenue earning equipment and lease charges in our equipment rental segment of

$273.5 million for the year ended December 31, 2010 decreased 13.8% from $317.2 million for the year

ended December 31, 2009. The decrease was primarily due to a 4.9% reduction in average acquisition

cost of rental equipment operated during the period and higher residual values on the disposal of used

equipment.

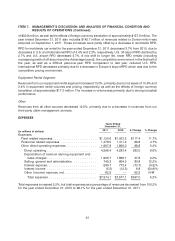

Selling, General and Administrative Expenses

Selling, general and administrative expenses increased 3.5%, due to increases in advertising, sales

promotion expenses and administrative expenses.

Advertising expenses increased $20.7 million, or 18.3%, primarily due to a new television campaign

in the U.S., as well as, a reduction in advertising funding received from third parties.

68