Hertz 2011 Annual Report Download - page 119

Download and view the complete annual report

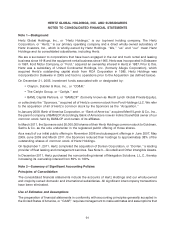

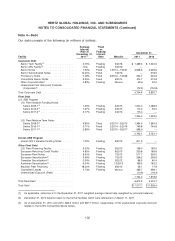

Please find page 119 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Revenue Recognition

Rental and rental related revenue (including cost reimbursements from customers where we consider

ourselves to be the principal versus an agent) are recognized over the period the revenue earning

equipment is rented or leased based on the terms of the rental or leasing contract. Maintenance

management administrative fees are recognized monthly and maintenance management service

revenue is recognized when services are performed. Revenue related to new equipment sales and

consumables is recognized at the time of delivery to, or pick-up by, the customer and when collectability

is reasonably assured. Fees from our licensees are recognized over the period the underlying licensees’

revenue is earned (over the period the licensees’ revenue earning equipment is rented). Certain truck

and equipment leases are originated with the intention of syndicating to banks, and upon the sale of

rights to these direct financing leases, the net gain is recorded in revenue.

Sales tax amounts collected from customers have been recorded on a net basis.

Cash and Cash Equivalents and Other

We consider all highly liquid debt instruments purchased with an original maturity of three months or less

to be cash equivalents.

In our Consolidated Statements of Cash Flows, we net cash flows from revolving borrowings in the line

item ‘‘Proceeds (payments) under the revolving lines of credit, net.’’ The contractual maturities of such

borrowings may exceed 90 days in certain cases.

Restricted Cash and Cash Equivalents

Restricted cash and cash equivalents includes cash and cash equivalents that are not readily available

for our normal disbursements. Restricted cash and cash equivalents are restricted for the purchase of

revenue earning vehicles and other specified uses under our Fleet Debt facilities, for our Like-Kind

Exchange Program, or ‘‘LKE Program,’’ and to satisfy certain of our self-insurance regulatory reserve

requirements. As of December 31, 2011 and 2010, the portion of total restricted cash and cash

equivalents that was associated with our Fleet Debt facilities was $213.6 million and $115.6 million,

respectively. The increase in restricted cash and cash equivalents associated with our fleet debt of

$98.0 million from December 31, 2010 to December 31, 2011, primarily related to the timing of

purchases and sales of revenue earning vehicles.

Receivables

Receivables are stated net of allowances for doubtful accounts, and represent credit extended to

manufacturers and customers that satisfy defined credit criteria. The estimate of the allowance for

doubtful accounts is based on our historical experience and our judgment as to the likelihood of ultimate

payment. Actual receivables are written-off against the allowance for doubtful accounts when we

determine the balance will not be collected. Bad debt expense is reflected as a component of Selling,

general and administrative in our consolidated statements of operations.

93