Hertz 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

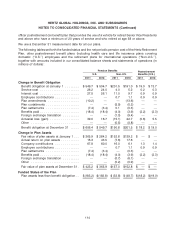

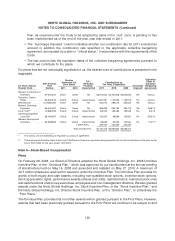

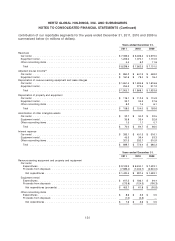

In March 2011 we granted 499,515 PSUs that had a performance vesting condition under which the

number of units that will ultimately be awarded will vary from 0% to 150% of the original grant, based on

the sum of 2011 and 2012 Corporate EBITDA results, in addition to a service vesting condition. An

additional 193,798 PSUs granted in March 2011 contained a market condition whereby the 20 day

average trailing stock price must equal or exceed a certain price target at any time during the five year

performance period, in addition to a service vesting condition. A summary of the PSU activity for this

grant is presented below.

Weighted- Aggregate Intrinsic

Average Value (In thousands

Shares Fair Value of dollars)

Outstanding at January 1, 2011 .................... — $ — $ —

Granted ..................................... 693,313 13.37

Vested ...................................... —

Forfeited or Expired ............................. (15,342) 14.60

Outstanding at December 31, 2011 ................. 677,971 $13.34 $7,946

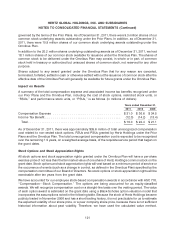

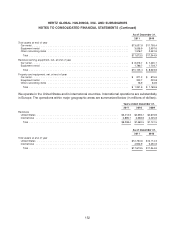

Employee Stock Purchase Plan

On February 28, 2008, upon recommendation of the compensation committee of our Board of Directors,

or ‘‘Committee,’’ our Board of Directors adopted the Hertz Global Holdings, Inc. Employee Stock

Purchase Plan, or the ‘‘ESPP,’’ and the plan was approved by our stockholders on May 15, 2008. The

ESPP is intended to be an ‘‘employee stock purchase plan’’ within the meaning of Section 423 of the

Internal Revenue Code.

The maximum number of shares that may be purchased under the ESPP is 3,000,000 shares of our

common stock, subject to adjustment in the case of any change in our shares, including by reason of a

stock dividend, stock split, share combination, recapitalization, reorganization, merger, consolidation or

change in corporate structure. An eligible employee may elect to participate in the ESPP each quarter (or

other period established by the Committee) through a payroll deduction. The maximum and minimum

contributions that an eligible employee may make under all of our qualified employee stock purchase

plans will be determined by the Committee, provided that no employee may be permitted to purchase

stock with an aggregate fair market value greater than $25,000 per year. At the end of the offering period,

the total amount of each employee’s payroll deduction will be used to purchase shares of our common

stock. The purchase price per share will be not less than 85% of the market price of our common stock

on the date of purchase; the exact percentage for each offering period will be set in advance by the

Committee.

For the years ended December 31, 2011, 2010 and 2009, we recognized compensation cost of

approximately $0.7 million ($0.4 million, net of tax), $0.6 million ($0.3 million, net of tax) and $0.5 million

($0.3 million, net of tax), respectively, for the amount of the discount on the stock purchased by our

employees under the ESPP. Approximately 1,600 employees participated in the ESPP as of

December 31, 2011.

124