Hertz 2011 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

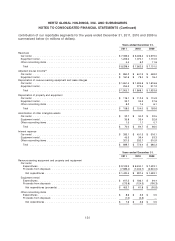

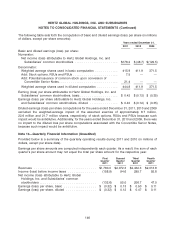

Years ended December 31,

2011 2010 2009

By Segment:

Car rental ............................................... $16.6 $18.1 $ 58.7

Equipment rental .......................................... 40.5 34.7 38.2

Other reconciling items ..................................... (0.7) 1.9 9.9

Total ................................................. $56.4 $54.7 $106.8

During the years ended December 31, 2011, 2010 and 2009, the after-tax effect of the restructuring

charges decreased earnings per share by $0.09 and increased the loss per share by $0.09 and $0.23,

respectively.

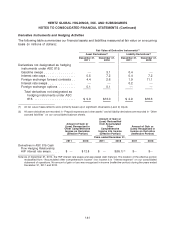

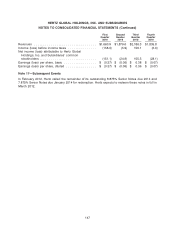

The following table sets forth the activity affecting the restructuring accrual during the years ended

December 31, 2011 and 2010 (in millions of dollars). We expect to pay the remaining restructuring

obligations relating to involuntary termination benefits over the next twelve months. The remainder of the

restructuring accrual relates to future lease obligations which will be paid over the remaining term of the

applicable leases.

Pension

Involuntary and Post

Termination Retirement Consultant

Benefits Expense Costs Other Total

Balance as of January 1, 2010 ............ $19.6 $ — $ 0.4 $ 9.7 $ 29.7

Charges incurred .................... 12.2 0.4 1.1 41.0 54.7

Cash payments ..................... (23.5) — (1.5) (12.4) (37.4)

Other(1) ........................... (2.0) (0.2) 0.1 (27.4) (29.5)

Balance as of December 31, 2010 ......... 6.3 0.2 0.1 10.9 17.5

Charges incurred .................... 14.4 0.4 1.3 40.3 56.4

Cash payments ..................... (15.5) — (0.6) (2.3) (18.4)

Other(2) ........................... 3.9 (0.4) (0.2) (37.2) (33.9)

Balance as of December 31, 2011 ......... $ 9.1 $0.2 $0.6 $11.7 $ 21.6

(1) Consists of decreases of $20.4 million for asset writedowns, $6.5 million for facility closures, $1.6 million loss in foreign

currency translation, $0.9 million in involuntary benefits and $0.2 million for executive pension liability settlements, partly

offset by an increase in consultant costs of $0.1 million.

(2) Consists of decreases of $23.2 million for asset writedowns, $13.9 million for facility closures, $0.4 million FAS 88 pension

adjustment and $0.2 million of consultant costs, partly offset by a $3.8 million increase for involuntary benefits.

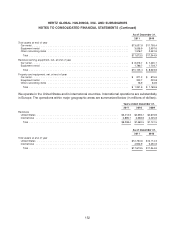

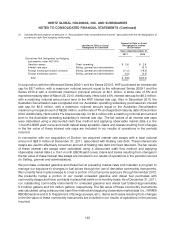

Note 13—Financial Instruments

Financial instruments, which potentially subject us to concentrations of credit risk, consist principally of

cash equivalents, short-term investments and trade receivables. We place our cash equivalents and

short-term investments with a number of financial institutions and investment funds to limit the amount of

credit exposure to any one financial institution. Concentrations of credit risk with respect to trade

receivables are limited due to the large number of customers comprising our customer base, and their

dispersion across different businesses and geographic areas. As of December 31, 2011, we had no

significant concentration of credit risk.

GAAP establishes a three-tier value hierarchy, which prioritizes the inputs used in measuring fair value as

follows: (Level 1) observable inputs such as quoted prices in active markets; (Level 2) inputs other than

139