Hertz 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(1) Includes the amortization of amounts in ‘‘Accumulated other comprehensive income’’ associated with the de-designation of

a previous cash flow hedging relationship.

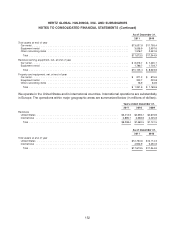

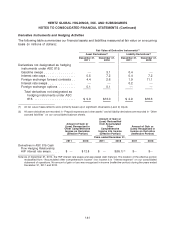

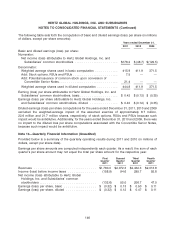

Amount of Gain or (Loss)

Location of Gain or (Loss) Recognized in Income

Recognized on Derivative on Derivative

Years ended December 31,

2011 2010

Derivatives Not Designated as Hedging

Instruments under ASC 815:

Gasoline swaps ............... Direct operating $ 2.6 $ 2.8

Interest rate caps .............. Selling, general and administrative — (3.1)

Foreign exchange forward contracts . . Selling, general and administrative (11.0) (19.5)

Foreign exchange options ......... Selling, general and administrative (0.2) (0.2)

Total ..................... $ (8.6) $(20.0)

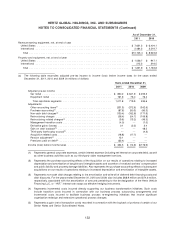

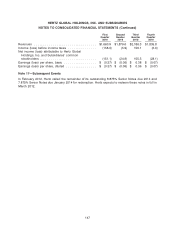

In conjunction with the refinanced Series 2009-1 and the Series 2010-2, HVF purchased an interest rate

cap for $6.7 million, with a maximum notional amount equal to the refinanced Series 2009-1 and the

Series 2010-2 with a combined maximum principal amount of $2.1 billion, a strike rate of 5% and

expected maturity date of March 25, 2013. Additionally, Hertz sold a 5% interest rate cap for $6.2 million,

with a matching notional amount and term to the HVF interest rate cap. Also in December 2010, the

Australian Securitization was completed and our Australian operating subsidiary purchased an interest

rate cap for $0.5 million, with a maximum notional amount equal to the Australian Securitization

maximum principal amount of A$250 million, a strike rate of 7% and expected maturity date of December

2012. Additionally, Hertz sold a 7% interest rate cap, for $0.4 million with a matching notional amount and

term to the Australian operating subsidiary’s interest rate cap. The fair values of all interest rate caps

were calculated using a discounted cash flow method and applying observable market data (i.e. the

1-month LIBOR yield curve and credit default swap spreads). Gains and losses resulting from changes

in the fair value of these interest rate caps are included in our results of operations in the periods

incurred.

In connection with our acquisition of Donlen, we acquired interest rate swaps with a total notional

amount of $28.0 million at December 31, 2011, associated with floating rate debt. These interest rate

swaps are used to effectively convert an amount of floating rate debt into fixed rate debt. The fair values

of these interest rate swaps were calculated using a discounted cash flow method and applying

observable market data (i.e. the 1-month LIBOR yield curve). Gains and losses resulting from changes in

the fair value of these interest rate swaps are included in our results of operations in the periods incurred

(in Selling, general and administrative).

We purchase unleaded gasoline and diesel fuel at prevailing market rates and maintain a program to

manage our exposure to changes in fuel prices through the use of derivative commodity instruments.

We currently have in place swaps to cover a portion of our fuel price exposure through November 2012.

We presently hedge a portion of our overall unleaded gasoline and diesel fuel purchases with

commodity swaps and have contracts in place that settle on a monthly basis. As of December 31, 2011,

our outstanding commodity instruments for unleaded gasoline and diesel fuel totaled approximately

5.0 million gallons and 0.9 million gallons, respectively. The fair value of these commodity instruments

was calculated using a discounted cash flow method and applying observable market data (i.e., NYMEX

RBOB Gasoline and U.S. Department of Energy surveys, etc.). Gains and losses resulting from changes

in the fair value of these commodity instruments are included in our results of operations in the periods

incurred.

142