Hertz 2011 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

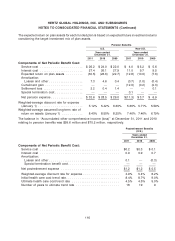

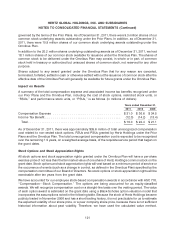

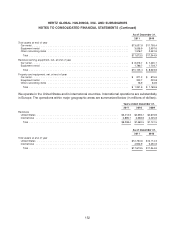

Note 7—Depreciation of Revenue Earning Equipment and Lease Charges

Depreciation of revenue earning equipment and lease charges includes the following (in millions of

dollars):

Years ended December 31,

2011 2010 2009

Depreciation of revenue earning equipment ................. $1,921.8 $1,747.0 $1,780.1

Adjustment of depreciation upon disposal of the equipment ..... (112.2) 42.9 72.0

Rents paid for vehicles leased ........................... 96.1 78.2 81.7

Total ............................................ $1,905.7 $1,868.1 $1,933.8

The adjustment of depreciation upon disposal of revenue earning equipment for the years ended

December 31, 2011, 2010 and 2009 included (in millions of dollars) net gain of $13.3 million, net losses

of $10.0 and $40.7, respectively, on the disposal of industrial and construction equipment used in our

equipment rental operations, and net gain of $98.9 million, net losses of $32.9 and $31.3, respectively,

on the disposal of vehicles used in our car rental operations.

Depreciation rates are reviewed on a quarterly basis based on management’s routine review of present

and estimated future market conditions and their effect on residual values at the time of disposal. During

2011, 2010 and 2009, depreciation rates being used to compute the provision for depreciation of

revenue earning equipment were adjusted on certain vehicles in our car rental operations to reflect

changes in the estimated residual values to be realized when revenue earning equipment is sold. These

depreciation rate changes resulted in a net decrease of $13.8 million and increases of $19.1 million and

$13.2 million in depreciation expense for the years ended December 31, 2011, 2010 and 2009,

respectively. Depreciation rate changes in certain of our equipment rental operations resulted in a

decrease of $4.4 million and increases of $3.6 million and $6.1 million in depreciation expense for the

years ended December 31, 2011, 2010 and 2009, respectively.

For the years ended December 31, 2011, 2010 and 2009, our worldwide car rental operations sold

approximately 164,100, 159,000 and 153,300 non-program cars, respectively, a 3.2% increase in 2011

versus 2010 primarily due to a higher average fleet size.

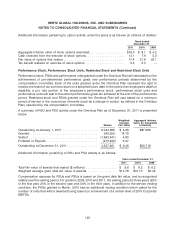

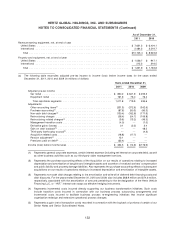

Note 8—Taxes on Income

The components of income (loss) before income taxes for the periods were as follows (in millions of

dollars):

Years ended December 31,

2011 2010 2009

Domestic ................................ $186.3 $(128.1) $(154.0)

Foreign ................................. 138.0 113.5 (22.9)

Total .................................. $324.3 $ (14.6) $(176.9)

125