Hertz 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Senior Notes and Senior Subordinated Notes

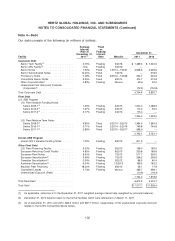

References to our ‘‘Senior Notes’’ include the series of Hertz’s unsecured senior notes set forth in the

table below. As of December 31, 2011, the outstanding principal amount for each such series of the

Senior Notes is also specified below.

Senior Notes Outstanding Principal (in millions)

8.875% Senior Notes due January 2014 . . . $ 162.3

7.875% Senior Notes due January 2014 . . . 276.3 (e213.5)

7.50% Senior Notes due October 2018 .... 700.0

7.375% Senior Notes due January 2021 . . . 500.0

6.75% Senior Notes due April 2019 ....... 1,000.0

$2,638.6

References to the ‘‘Senior Subordinated Notes’’ are to Hertz’s 10.50% Senior Subordinated Notes due

January 2016.

In January 2011, Hertz redeemed in full its outstanding ($518.5 million principal amount) 10.50% Senior

Subordinated Notes due 2016 which resulted in premiums paid of $27.2 million and the write-off of

unamortized debt costs of $8.6 million. In January and February 2011, Hertz redeemed $1,105 million

principal amount of its outstanding 8.875% Senior Notes due 2014 which resulted in premiums paid of

$24.5 million and the write-off of unamortized debt costs of $14.4 million. Hertz used the proceeds from

the September 2010 issuance of $700 million aggregate principal amount of 7.50% Senior Notes, the

December 2010 issuance of $500 million aggregate principal amount of 7.375% Senior Notes and the

February 2011 issuance of $500 million aggregate principal amount of 6.75% Senior Notes (see below)

for these redemptions. Premiums paid are recorded in ‘‘Other (income) expense, net’’ on our

consolidated statement of operations.

In February 2011, Hertz issued $500 million aggregate principal amount of 6.75% Senior Notes due

2019. The 6.75% Senior Notes are guaranteed on a senior unsecured basis by the domestic subsidiaries

of Hertz that guarantee its Senior Credit Facilities. In March 2011, Hertz issued an additional $500 million

aggregate principal of the 6.75% Senior Notes due 2019. The proceeds of this March 2011 offering were

used in April 2011 to redeem $480 million principal amount of Hertz’s outstanding 8.875% Senior Notes

due 2014 which resulted in premiums paid during the year ended December 31, 2011, of $10.7 million

recorded in ‘‘Other (income) expense, net’’ on our consolidated statement of operations and the write-off

of unamortized debt costs of $5.8 million.

Hertz’s obligations under the indentures for the Senior Notes are guaranteed by each of its direct and

indirect domestic subsidiaries that is a guarantor under the Senior Term Facility. The guarantees of all of

the Subsidiary Guarantors may be released to the extent such subsidiaries no longer guarantee our

Senior Credit Facilities in the United States. HERC may also be released from its guarantee under certain

of the Senior Notes at any time at which no event of default under the indenture has occurred and is

continuing, notwithstanding that HERC may remain a subsidiary of Hertz.

The indentures for the Senior Notes contain covenants that, among other things, limit or restrict the

ability of the Hertz credit group to incur additional indebtedness, incur guarantee obligations, prepay

certain indebtedness, make certain restricted payments (including paying dividends, redeeming stock

or making other distributions to parent entities of Hertz and other persons outside of the Hertz credit

group), make investments, create liens, transfer or sell assets, merge or consolidate, and enter into

certain transactions with Hertz’s affiliates that are not members of the Hertz credit group.

106