Hertz 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

flexible transportation programs for corporate and general consumers. Additionally, Donlen brings to

Hertz a specialized consulting and technology expertise that will enable us to model, measure and

manage fleet performance more effectively and efficiently. The combination of the strategic fit and

expected fleet synergies described above are the primary drivers behind the excess purchase price paid

over the fair value of the assets and liabilities acquired. All such goodwill recognized as part of this

acquisition is reported in the car rental segment.

The Donlen base equity valuation for the transaction was $250.0 million, subject to adjustment based on

the net assets of Donlen at closing. The preliminary purchase price adjustment at closing resulted in a

downward adjustment of $2.4 million (resulting in an initial closing cash payment for equity of

$247.6 million). The final purchase price adjustment, based on the final Donlen closing date balance

sheet, resulted in an upward adjustment of $2.4 million (resulting in a final closing cash payment for

equity of $250.0 million. None of the goodwill recognized as part of this acquisition is expected to be

deductible for tax purposes.

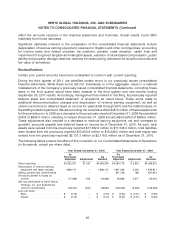

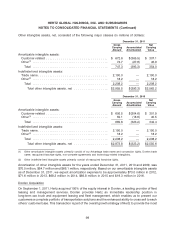

The following summarizes the fair values of the assets purchased and liabilities assumed as of the

acquisition date (in millions):

Cash and cash equivalents ................................ $ 35.6

Receivables ........................................... 64.0

Prepaid expenses and other assets .......................... 7.0

Revenue earning equipment ............................... 1,120.6

Property and equipment .................................. 13.5

Other intangible assets ................................... 75.0

Goodwill .............................................. 51.1

Accounts payable ....................................... (39.3)

Accrued liabilities ....................................... (226.8)

Deferred taxes on income ................................. (121.9)

Debt ................................................. (728.8)

Total ............................................. $ 250.0

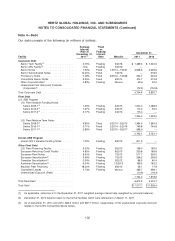

Other intangible assets and their amortization periods are as follows:

Useful life Fair value

(in years) (in millions)

Customer relationships .......................... 16 $65.0

Trademark ................................... 20 7.0

Non-compete agreement ......................... 5 3.0

Total .................................... $75.0

100