Hertz 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

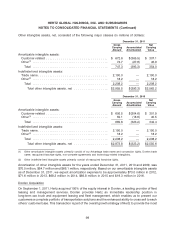

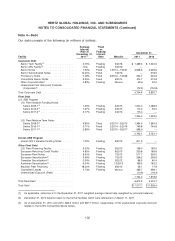

Note 4—Debt

Our debt consists of the following (in millions of dollars):

Average Fixed

Interest or

Rate at Floating December 31,

December 31, Interest

Facility 2011(1) Rate Maturity 2011 2010

Corporate Debt

Senior Term Facility(2) ................ 3.75% Floating 3/2018 $ 1,389.5 $ 1,345.0

Senior ABL Facility(2) ................. N/A Floating 3/2016 — —

Senior Notes ...................... 7.32% Fixed 1/2014—1/2021 2,638.6 3,229.6

Senior Subordinated Notes ............. 10.50% Fixed 1/2016 — 518.5

Promissory Notes ................... 7.48% Fixed 6/2012—1/2028 224.7 345.6

Convertible Senior Notes .............. 5.25% Fixed 6/2014 474.7 474.8

Other Corporate Debt ................ 4.83% Floating Various 49.6 22.0

Unamortized Net (Discount) Premium

(Corporate)(3) .................... (72.3) (104.8)

Total Corporate Debt .................. 4,704.8 5,830.7

Fleet Debt

U.S. ABS Program

U.S. Fleet Variable Funding Notes:

Series 2009-1(4) ................... 1.35% Floating 3/2013 1,000.0 1,488.0

Series 2010-2(4) ................... 1.37% Floating 3/2013 170.0 35.0

Series 2011-2(4) ................... 2.77% Floating 4/2012 175.0 —

1,345.0 1,523.0

U.S. Fleet Medium Term Notes

Series 2009-2(4) ................... 4.95% Fixed 3/2013—3/2015 1,384.3 1,384.3

Series 2010-1(4) ................... 3.77% Fixed 2/2014—2/2018 749.8 749.8

Series 2011-1(4) ................... 2.86% Fixed 3/2015—3/2017 598.0 —

2,732.1 2,134.1

Donlen ABS Program

Donlen GN II Variable Funding Notes ...... 1.22% Floating 8/2012 811.2 —

Other Fleet Debt

U.S. Fleet Financing Facility ............ 3.03% Floating 9/2015 136.0 163.0

European Revolving Credit Facility ........ 4.85% Floating 6/2013 200.6 168.6

European Fleet Notes ................ 8.50% Fixed 7/2015 517.7 529.0

European Securitization(4) .............. 3.56% Floating 7/2013 256.2 236.9

Canadian Securitization(4) .............. 2.09% Floating 3/2012 68.3 80.4

Australian Securitization(4) .............. 6.04% Floating 12/2012 169.3 183.2

Brazilian Fleet Financing .............. 18.52% Floating 6/2012 23.1 77.8

Capitalized Leases .................. 4.73% Floating Various 363.7 398.1

Unamortized Discount (Fleet) ........... (10.9) (18.4)

1,724.0 1,818.6

Total Fleet Debt ..................... 6,612.3 5,475.7

Total Debt ......................... $11,317.1 $11,306.4

(1) As applicable, reference is to the December 31, 2011 weighted average interest rate (weighted by principal balance).

(2) December 31, 2010 balance refers to the former facilities which were refinanced on March 11, 2011.

(3) As of December 31, 2011 and 2010, $65.5 million and $87.7 million, respectively, of the unamortized corporate discount

relates to the 5.25% Convertible Senior Notes.

102