Hertz 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

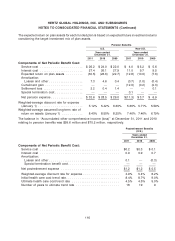

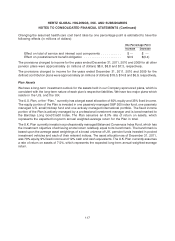

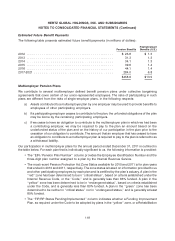

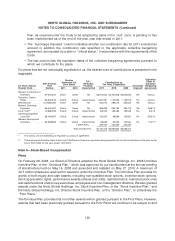

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Some of these special purpose entities are consolidated variable interest entities, of which Hertz is the

primary beneficiary, whose sole purpose is to provide commitments to lend in various currencies subject

to borrowing bases comprised of rental vehicles and related assets of certain of Hertz

International, Ltd.’s subsidiaries. As of December 31, 2011 and 2010, our International Fleet Financing

No. 1 B.V., International Fleet Financing No. 2 B.V. and HA Funding Pty, Ltd. variable interest entities had

total assets primarily comprised of loans receivable and revenue earning equipment of $456.3 million

and $652.1 million, respectively, and total liabilities primarily comprised of debt of $455.8 million and

$651.6 million, respectively.

Accrued Interest

As of December 31, 2011 and 2010, accrued interest was $87.8 million and $166.4 million, respectively,

which is reflected in our consolidated balance sheet in ‘‘Other accrued liabilities.’’

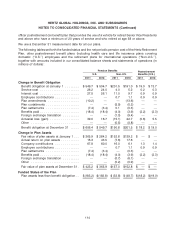

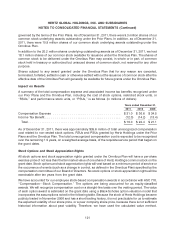

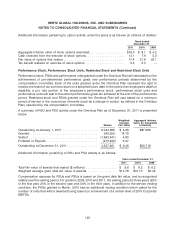

Note 5—Employee Retirement Benefits

Qualified U.S. employees, after completion of specified periods of service, are eligible to participate in

The Hertz Corporation Account Balance Defined Benefit Pension Plan, or the ‘‘Hertz Retirement Plan,’’ a

cash balance plan. Under this qualified Hertz Retirement Plan, we pay the entire cost and employees are

not required to contribute.

Most of our international subsidiaries have defined benefit retirement plans or participate in various

insured or multiemployer plans. In certain countries, when the subsidiaries make the required funding

payments, they have no further obligations under such plans.

Company plans are generally funded, except for certain nonqualified U.S. defined benefit plans and in

Germany, where unfunded liabilities are recorded.

We sponsor defined contribution plans for certain eligible U.S. and non-U.S. employees. We match

contributions of participating employees on the basis specified in the plans.

An amendment to the Hertz Corporation Account Balance Defined Benefit Plan took effect on January 1,

2012. A fixed interest rate of 3% will be applied to cash balance credits in 2012 and later years.

Previously, it was the rate published by the Pension Benefit Guarantee Corporation, or ‘‘PGBC,’’ for the

December prior to the year the credit was earned. Also effective January 1, 2012, service credit rates for

each employee will be determined on the first day of the year.

We sponsored a defined benefit pension plan in the U.K. On June 30, 2011, we approved an agreement

with the trustees of that plan to cease all future benefit accruals to existing members and to close the

plan to new members. Effective July 1, 2011, we introduced a defined contribution plan with company

matching contributions to replace the defined benefit pension plan. The company matching

contributions are generally 100% of the employee contributions, up to 8% of pay, except that former

members of the defined benefit plan receive an enhanced match for five years. This will result in lower

contributions this year into the defined benefit plan, which will be offset by matching contributions to the

new defined contribution plan. In the year ended December 31, 2011, we recognized a gain of

$13.1 million for the U.K. plan that represented unamortized prior service cost from a 2010 amendment

that eliminated discretionary pension increases related to pre-1997 service primarily related to inactive

employees.

We also sponsor postretirement health care and life insurance benefits for a limited number of

employees with hire dates prior to January 1, 1990. The postretirement health care plan is contributory

with participants’ contributions adjusted annually. An unfunded liability is recorded. We also have a key

113