Hertz 2011 Annual Report Download - page 77

Download and view the complete annual report

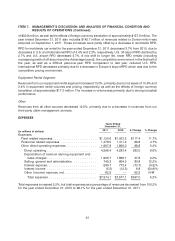

Please find page 77 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

On September 1, 2011, Hertz acquired 100% of the equity interest in Donlen, a leading provider of fleet

leasing and management services for corporate fleets and for the four months ended December 31,

2011 (period it was owned by Hertz), had an average of approximately 137,000 vehicles under lease and

management. Donlen provides Hertz an immediate leadership position in long-term car, truck and

equipment leasing and fleet management. Donlen’s fleet management programs provide outsource

solutions to reduce fleet operating costs and improve driver productivity. These programs include

administration of preventive maintenance, advisory services, and fuel and accident management along

with other complementary services. This transaction is part of the overall growth strategy of Hertz to

provide the most flexible transportation programs for corporate and general consumers. Additionally,

Donlen brings to Hertz a specialized consulting and technology expertise that will enable us to model,

measure and manage fleet performance more effectively and efficiently.

While Hertz Holdings withdrew its exchange offer for Dollar Thrifty’s common stock in October 2011, we

continue to believe that a merger with Dollar Thrifty is in the best interests of both companies. Hertz

Holdings remains engaged with the Federal Trade Commission to secure antitrust clearance with

respect to an acquisition of Dollar Thrifty, which would require (among other things) the disposition of

Advantage. If and when we are in a position to obtain antitrust clearance, we will reassess the

appropriate price and other terms and conditions of an offer for Dollar Thrifty. We can offer no assurance

that any transaction with Dollar Thrifty will be commenced or consummated.

Equipment Rental

HERC experienced higher rental volumes and pricing worldwide for year ended December 31, 2011

compared to the prior year period as the industry continued its recovery and fleet levels began to align

with demand in the industry. Specifically, we continued to see growth in our specialty services such as

Pump & Power, Industrial Plant Services and Hertz Entertainment Services capitalizing on the

opportunities in these strategic market niches. Additionally, there were increased opportunities in 2011

as rental solutions became a more viable alternative to contractors especially with the fluctuating

uncertainty in the economy enabling HERC and other large rental companies to gain market share.

Seasonality

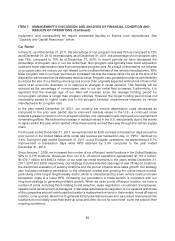

Our car rental and equipment rental operations are seasonal businesses, with decreased levels of

business in the winter months and heightened activity during the spring and summer. We have the ability

to dynamically manage fleet capacity, the most significant portion of our cost structure, to meet market

demand. For instance, to accommodate increased demand, we increase our available fleet and staff

during the second and third quarters of the year. As business demand declines, fleet and staff are

decreased accordingly. A number of our other major operating costs, including airport concession fees,

commissions and vehicle liability expenses, are directly related to revenues or transaction volumes. In

addition, our management expects to utilize enhanced process improvements, including efficiency

initiatives and the use of our information technology systems, to help manage our variable costs.

Approximately two-thirds of our typical annual operating costs represent variable costs, while the

remaining one-third is fixed or semi-fixed. We also maintain a flexible workforce, with a significant

number of part time and seasonal workers. However, certain operating expenses, including rent,

insurance, and administrative overhead, remain fixed and cannot be adjusted for seasonal demand.

Revenues related to our fleet management services are generally not seasonal.

51