Hertz 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

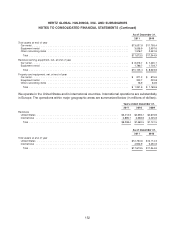

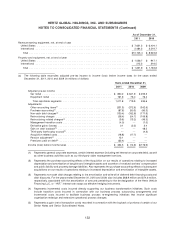

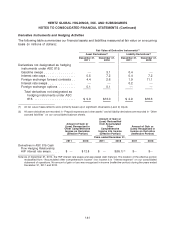

As of December 31,

2011 2010

Revenue earning equipment, net, at end of year

United States ..................................................... $ 7,621.2 $ 6,404.1

International ...................................................... 2,484.2 2,519.7

Total .......................................................... $10,105.4 $ 8,923.8

Property and equipment, net, at end of year

United States ..................................................... $ 1,036.7 $ 947.1

International ...................................................... 215.2 216.5

Total .......................................................... $1,251.9 $ 1,163.6

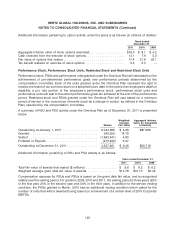

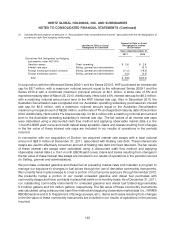

(a) The following table reconciles adjusted pre-tax income to income (loss) before income taxes for the years ended

December 31, 2011, 2010 and 2009 (in millions of dollars):

Years ended December 31,

2011 2010 2009

Adjusted pre-tax income

Car rental ........................................ $ 850.2 $ 641.9 $ 459.2

Equipment rental ................................... 161.6 78.0 76.4

Total reportable segments ............................ 1,011.8 719.9 535.6

Adjustments:

Other reconciling items(1) .............................. (331.3) (372.8) (342.6)

Purchase accounting(2) ................................ (87.6) (90.3) (90.3)

Non-cash debt charges(3) .............................. (130.4) (182.6) (171.9)

Restructuring charges ................................ (56.4) (54.7) (106.8)

Restructuring related charges(4) .......................... (9.8) (13.2) (46.5)

Management transition costs ............................ (4.0) — (1.0)

Derivative gains (losses) ............................... 0.1 (3.2) 2.4

Gain on debt buyback(5) ............................... — — 48.5

Third-party bankruptcy accrual(6) .......................... — — (4.3)

Acquisition related costs ............................... (18.8) (17.7) —

Pension adjustment(7) ................................ 13.1 — —

Premiums paid on debt(8) .............................. (62.4) — —

Income (loss) before income taxes ......................... $ 324.3 $ (14.6) $(176.9)

(1) Represents general corporate expenses, certain interest expense (including net interest on corporate debt), as well

as other business activities such as our third-party claim management services.

(2) Represents the purchase accounting effects of the Acquisition on our results of operations relating to increased

depreciation and amortization of tangible and intangible assets and accretion of revalued workers’ compensation

and public liability and property damage liabilities. Also represents the purchase accounting effects of subsequent

acquisitions on our results of operations relating to increased depreciation and amortization of intangible assets.

(3) Represents non-cash debt charges relating to the amortization and write-off of deferred debt financing costs and

debt discounts. For the years ended December 31, 2010 and 2009, also includes $68.9 million and $74.6 million,

respectively, associated with the amortization of amounts pertaining to the de-designation of the Hertz Vehicle

Financing LLC, or ‘‘HVF,’’ interest rate swaps as effective hedging instruments.

(4) Represents incremental costs incurred directly supporting our business transformation initiatives. Such costs

include transition costs incurred in connection with our business process outsourcing arrangements and

incremental costs incurred to facilitate business process re-engineering initiatives that involve significant

organization redesign and extensive operational process changes.

(5) Represents a gain (net of transaction costs) recorded in connection with the buyback of portions of certain of our

Senior Notes and Senior Subordinated Notes.

133