Hertz 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

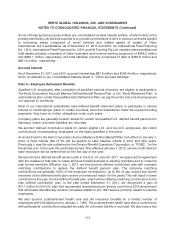

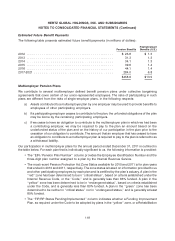

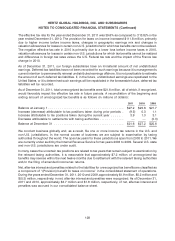

Additional information pertaining to option activity under the plans is as follows (in millions of dollars):

Years ended

December 31,

2011 2010 2009

Aggregate intrinsic value of stock options exercised .................. $15.0 $ 8.1 $ 4.2

Cash received from the exercise of stock options .................... 13.1 7.9 5.3

Fair value of options that vested ................................ 17.4 21.6 23.1

Tax benefit realized on exercise of stock options .................... 0.5 0.3 —

Performance Stock, Performance Stock Units, Restricted Stock and Restricted Stock Units

Performance stock, PSUs and performance units granted under the Omnibus Plan will vest based on the

achievement of pre-determined performance goals over performance periods determined by the

compensation committee. Each of the units granted under the Omnibus Plan represent the right to

receive one share of our common stock on a specified future date. In the event of an employee’s death or

disability, a pro rata portion of the employee’s performance stock, performance stock units and

performance units will vest to the extent performance goals are achieved at the end of the performance

period. Restricted stock and RSUs granted under the Omnibus Plan will vest based on a minimum

period of service or the occurrence of events (such as a change in control, as defined in the Omnibus

Plan) specified by the compensation committee.

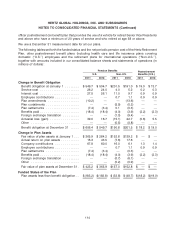

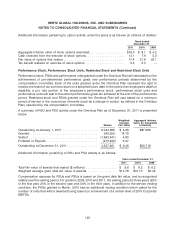

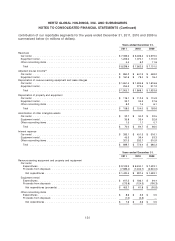

A summary of RSU and PSU activity under the Omnibus Plan as of December 31, 2011 is presented

below.

Weighted- Aggregate Intrinsic

Average Value (In thousands

Shares Fair Value of dollars)

Outstanding at January 1, 2011 .................. 6,044,589 $ 5.08 $87,586

Granted ................................... 549,253 14.78

Vested .................................... (1,992,441) 4.80

Forfeited or Expired ........................... (273,940) 5.47

Outstanding at December 31, 2011 ................ 4,327,461 $ 6.46 $50,718

Additional information pertaining to RSU and PSU activity is as follows:

Years ended December 31,

2011 2010 2009

Total fair value of awards that vested ($ millions) ................ $ 9.6 $ 8.2 $ 6.2

Weighted average grant date fair value of awards ............... $14.78 $10.10 $3.42

Compensation expense for RSUs and PSUs is based on the grant date fair value, and is recognized

ratably over the vesting period. For grants in 2009, 2010 and 2011, the vesting period is three years (25%

in the first year, 25% in the second year and 50% in the third year). In addition to the service vesting

condition, the PSUs granted in March, 2010 had an additional vesting condition which called for the

number of units that will be awarded being based on achievement of a certain level of 2010 Corporate

EBITDA.

123