Hertz 2011 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

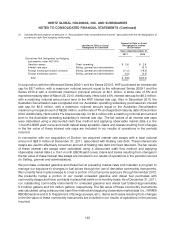

the quoted prices in active markets that are observable either directly or indirectly; and (Level 3)

unobservable inputs in which there is little or no market data, which require the reporting entity to

develop its own assumptions.

Cash and Cash Equivalents and Restricted Cash and Cash Equivalents

Fair value approximates the amount indicated on the balance sheet at December 31, 2011 and

December 31, 2010 because of the short-term maturity of these instruments. Money market accounts,

whose fair value at December 31, 2011, is measured using Level 1 inputs, totaling $566.0 million and

$142.9 million are included in ‘‘Cash and cash equivalents’’ and ‘‘Restricted cash and cash equivalents,’’

respectively. Money market accounts, whose fair value at December 31, 2010, is measured using Level 1

inputs, totaling $1,747.9 million and $24.1 million are included in ‘‘Cash and cash equivalents’’ and

‘‘Restricted cash and cash equivalents,’’ respectively.

Marketable Securities

Marketable securities held by us consist of equity securities classified as available-for-sale, which are

carried at fair value and are included within ‘‘Prepaid expenses and other assets.’’ Unrealized gains and

losses, net of related income taxes, are included in ‘‘Accumulated other comprehensive income.’’ As of

December 31, 2011 and December 31, 2010, the fair value of marketable securities was $33.2 million

and $0.0 million, respectively. For the year ended December 31, 2011, unrealized gains of $0.3 million

were recorded in ‘‘Accumulated other comprehensive income (loss).’’ Fair values for marketable

securities are based on Level 1 inputs consisting of quoted market prices.

Debt

For borrowings with an initial maturity of 93 days or less, fair value approximates carrying value because

of the short-term nature of these instruments. For all other debt, fair value is estimated based on quoted

market rates as well as borrowing rates currently available to us for loans with similar terms and average

maturities (Level 2 inputs). The aggregate fair value of all debt at December 31, 2011 was

$11,832.5 million, compared to its aggregate unpaid principal balance of $11,400.3 million. The

aggregate fair value of all debt at December 31, 2010 was $12,063.5 million, compared to its aggregate

unpaid principal balance of $11,429.6 million.

140