Hertz 2011 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

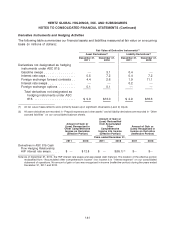

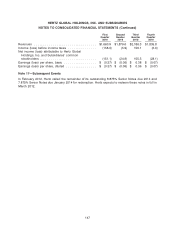

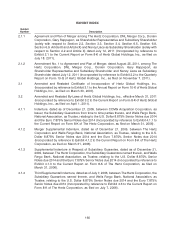

SCHEDULE I (Continued)

HERTZ GLOBAL HOLDINGS, INC.

PARENT COMPANY STATEMENTS OF STOCKHOLDERS’ EQUITY

(In Thousands of Dollars, except share data)

Retained Accumulated

Additional Earnings Other Total

Common Stock Paid-In (Accumulated Comprehensive Stockholders’

Shares Amount Capital Deficit) Income (Loss) Equity

Balance at:

December 31, 2008 .................. 322,987,299 $3,230 $2,503,819 $ (945,025) $(100,135) $ 1,461,889

Net loss ........................ (129,528) (129,528)

Total Comprehensive Income of subsidiaries . . . 96,804 96,804

Total Comprehensive Loss ............. (32,724)

Proceeds from sale of common stock ....... 85,001,182 850 527,908 528,758

Proceeds from debt offering, net of tax of

$46,204 ....................... 68,140 68,140

Stock-based employee compensation charges,

net of tax of $0 .................. 35,464 35,464

Exercise of stock options .............. 1,158,892 12 5,330 5,342

Employee stock purchase plan ........... 513,638 5 2,818 2,823

Proceeds from disgorgement of stockholder

short-swing profits, net of tax of $7 ....... 12 12

Net settlement on vesting of restricted stock . . . 402,593 4 (2,223) (2,219)

Common shares issued to Directors ........ 181,621 1 245 246

Phantom shares issued to Directors ........ 182 182

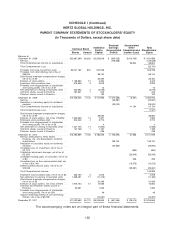

December 31, 2009 .................. 410,245,225 4,102 3,141,695 (1,074,553) (3,331) 2,067,913

Net loss ........................ (25,681) (25,681)

Reduction in subsidiary equity for dividends

received ...................... (23,000) (23,000)

Total Comprehensive Income of subsidiaries . . . 41,154 41,154

Total Comprehensive Loss ............. (7,527)

Stock-based employee compensation charges,

net of tax of $0 .................. 36,560 36,560

Exercise of stock options, net of tax of $(258) . . 1,343,659 14 7,621 7,635

Employee stock purchase plan ........... 344,542 4 3,770 3,774

Proceeds from disgorgement of stockholder

short-swing profits, net of tax of $3 ....... 4 4

Net settlement on vesting of restricted stock . . . 1,421,705 14 (7,850) (7,836)

Common shares issued to Directors ........ 107,758 1 1,187 1,188

Phantom shares issued to Directors ........ 238 238

December 31, 2010 .................. 413,462,889 4,135 3,183,225 (1,123,234) 37,823 2,101,949

Net loss attributable to Hertz Global

Holdings, Inc. and Subsidiaries’ common

stockholders .................... 199,120 199,120

Reduction of subsidiary equity for dividends

received ...................... (22,950) (22,950)

Unrealized loss on investment, net of tax of

$(1,127) ....................... (984) (984)

Translation adjustment changes, net of tax of

$(1,291) ....................... (23,545) (23,545)

Unrealized holding gains on securities, net of tax

of $0 ........................ 226 226

Unrealized loss on Euro-denominated debt, net

of tax of $(4,144) ................. (12,573) (12,573)

Defined benefit pension plans, net of tax of

$15,555 ....................... (29,361) (29,361)

Total Comprehensive Income ............ 109,933

Employee stock purchase plan, net of tax of $0 . 323,752 3 4,205 4,208

Net settlement on vesting of restricted stock . . . 1,238,091 11 (11,476) (11,465)

Stock-based employee compensation charges,

net of tax of $0 .................. 31,093 31,093

Exercise of stock options, net of tax of $474 . . . 1,975,730 21 12,563 12,584

Common and Phantom shares issued to

Directors ...................... 22,391 1,593 1,593

Proceeds from disgorgement of stockholder

short-swing profits, net of tax $24 ........ 48 48

Acquire remaining interest of non-controlling

interest, net of tax of $9,798 ........... (15,287) (15,287)

December 31, 2011 .................. 417,022,853 $4,170 $3,205,964 $ (947,064) $ (28,414) $ 2,234,656

The accompanying notes are an integral part of these financial statements.

150