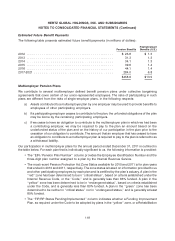

Hertz 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Series 2010-1: In July 2010, HVF issued the Series 2010-1 Rental Car Asset Backed Notes, or the

‘‘Series 2010-1,’’ in an aggregate original principal amount of $749.8 million.

Series 2011-1: In June 2011, HVF issued the Series 2011-1 Rental Car Asset Backed Notes, or the

‘‘Series 2011-1,’’ in an aggregate original principal amount of $598 million.

Donlen ABS Program

Donlen GN II Variable Funding Notes

On September 1, 2011, in connection with our acquisition of Donlen Corporation, Donlen’s GN II

Variable Funding Notes remained outstanding and lender commitments thereunder were increased to

permit aggregate maximum borrowings of $850.0 million (subject to borrowing base availability).

Fleet Debt—Other

U.S. Fleet Financing Facility

In September 2006, Hertz and Puerto Ricancars, Inc., a Puerto Rican corporation and wholly-owned

indirect subsidiary of Hertz, or ‘‘PR Cars,’’ entered into a credit agreement that provides for aggregate

maximum borrowings of $165.0 million (subject to borrowing base availability) on a revolving basis

under an asset-based revolving credit facility, or the ‘‘U.S. Fleet Financing Facility.’’ The U.S. Fleet

Financing Facility is the primary fleet financing for our rental car operations in Hawaii, Kansas, Puerto

Rico and the U.S. Virgin Islands.

The obligations of each of Hertz and PR Cars under the U.S. Fleet Financing Facility are guaranteed by

certain of Hertz’s direct and indirect domestic subsidiaries. In addition, the obligations of PR Cars under

the U.S. Fleet Financing Facility are guaranteed by Hertz. The lenders under the U.S. Fleet Financing

Facility have been granted a security interest primarily in the owned rental car fleet used in our car rental

operations in Hawaii, Puerto Rico and the U.S. Virgin Islands and certain contractual rights related to

rental vehicles in Kansas, Hawaii, Puerto Rico and the U.S. Virgin Islands.

In September 2011, we extended the maturity of our U.S. Fleet Financing Facility to September 2015 and

increased the facility size to $190.0 million. In connection with the extension, we made a number of

modifications to the financing arrangement including decreasing the advance rate and increasing

pricing.

European Revolving Credit Facility and European Fleet Notes

In June 2010, Hertz Holdings Netherlands B.V., an indirect wholly-owned subsidiary of Hertz organized

under the laws of The Netherlands, or ‘‘HHN BV,’’ entered into a credit agreement that provides for

aggregate maximum borrowings of e220.0 million (the equivalent of $284.7 million as of December 31,

2011) (subject to borrowing base availability) on a revolving basis under an asset-based revolving credit

facility, or the ‘‘European Revolving Credit Facility,’’ and issued the 8.50% Senior Secured Notes due

July 2015, or the ‘‘European Fleet Notes,’’ in an aggregate original principal amount of e400 million (the

equivalent of $517.6 million as of December 31, 2011). References to the ‘‘European Fleet Debt’’ include

HHN BV’s European Revolving Credit Facility and the European Fleet Notes, collectively.

The European Fleet Debt is the primary fleet financing for our rental car operations in Germany, Italy,

Spain, Belgium, Luxembourg and Switzerland, and can be expanded to provide fleet financing in

Australia, Canada, France, The Netherlands, New Zealand, and the United Kingdom.

109