Hertz 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

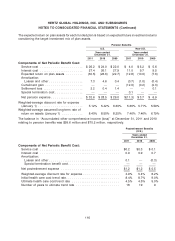

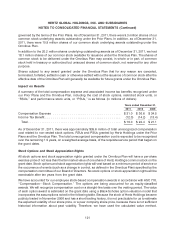

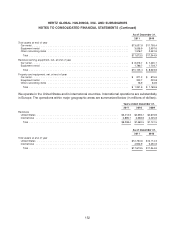

The total provision (benefit) for taxes on income consists of the following (in millions of dollars):

Years ended December 31,

2011 2010 2009

Current:

Federal ................................. $ 0.6 $ 0.1 $ 1.0

Foreign ................................. 30.6 41.5 16.1

State and local ............................ 28.5 1.5 (1.2)

Total current ............................ 59.7 43.1 15.9

Deferred:

Federal ................................. 76.2 (25.0) (36.3)

Foreign ................................. (3.2) 1.3 (23.8)

State and local ............................ (4.2) (2.7) (17.9)

Total deferred ........................... 68.8 (26.4) (78.0)

Total provision (benefit) ................... $128.5 $ 16.7 $(62.1)

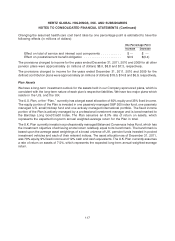

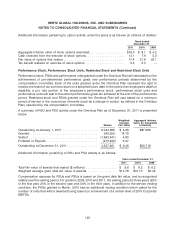

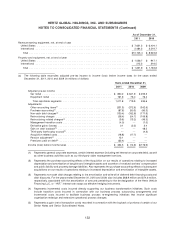

The principal items of the U.S. and foreign net deferred tax assets and liabilities at December 31, 2011

and 2010 are as follows (in millions of dollars):

2011 2010

Deferred Tax Assets:

Employee benefit plans ..................................... $ 102.8 $ 83.3

Net operating loss carryforwards .............................. 1,743.5 1,407.4

Foreign tax credit carryforwards ............................... 20.8 20.8

Federal, state and foreign local tax credit carryforwards .............. 15.0 4.8

Accrued and prepaid expenses ............................... 300.8 191.9

Total Deferred Tax Assets .................................... 2,182.9 1,708.2

Less: Valuation Allowance ................................... (186.7) (185.8)

Total Net Deferred Tax Assets ................................. 1,996.2 1,522.4

Deferred Tax Liabilities:

Depreciation on tangible assets ............................... (2,742.3) (2,003.5)

Intangible assets .......................................... (942.4) (1,027.0)

Total Deferred Tax Liabilities .................................. (3,684.7) (3,030.5)

Net Deferred Tax Liability .................................. $(1,688.5) $(1,508.1)

As of December 31, 2011, deferred tax assets of $1,481.7 million were recorded for unutilized U.S.

Federal Net Operating Losses, or ‘‘NOL,’’ carry forwards of $4,233.3 million. The total Federal NOL carry

forwards are $4,278.1 million of which $44.8 million relate to excess tax deductions associated with

stock option plans which have yet to reduce taxes payable. Upon the utilization of these carry forwards,

the associated tax benefits of approximately $15.7 million will be recorded to Additional Paid-in Capital.

The Federal NOLs begin to expire in 2025. State NOLs exclusive of the effects of the excess tax

deductions, have generated a deferred tax asset of $77.4 million. The state NOLs expire over various

years beginning in 2012 depending upon particular jurisdiction.

126