Hertz 2011 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 12—Restructuring

As part of our ongoing effort to implement our strategy of reducing operating costs, we have evaluated

our workforce and operations and made adjustments, including headcount reductions and business

process reengineering resulting in optimized work flow at rental locations and maintenance facilities as

well as streamlined our back-office operations and evaluated potential outsourcing opportunities. When

we made adjustments to our workforce and operations, we incurred incremental expenses that delay the

benefit of a more efficient workforce and operating structure, but we believe that increased operating

efficiency and reduced costs associated with the operation of our business are important to our

long-term competitiveness.

During 2007 through 2011, we announced several initiatives to improve our competitiveness and

industry leadership through targeted job reductions. These initiatives included, but were not limited to,

job reductions at our corporate headquarters and back-office operations in the U.S. and Europe. As part

of our re-engineering optimization we outsourced selected functions globally. In addition, we

streamlined operations and reduced costs by initiating the closure of targeted car rental locations and

equipment rental branches throughout the world. The largest of these closures occurred in 2008 which

resulted in closures of approximately 250 off-airport locations and 22 branches in our U.S. equipment

rental business. These initiatives impacted approximately 8,960 employees.

From January 1, 2007 through December 31, 2011, we incurred $530.5 million ($256.3 million for our car

rental segment, $221.5 million for our equipment rental segment and $52.7 million of other) of

restructuring charges.

Additional efficiency and cost saving initiatives are being developed, however, we presently do not have

firm plans or estimates of any related expenses.

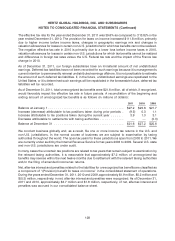

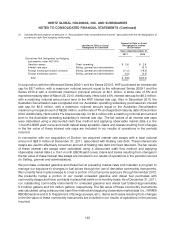

Restructuring charges in our consolidated statement of operations can be summarized as follows (in

millions of dollars):

Years ended December 31,

2011 2010 2009

By Type:

Involuntary termination benefits ................................ $14.4 $12.2 $ 44.1

Pension and post retirement expense ........................... 0.4 0.4 0.7

Consultant costs .......................................... 1.3 1.1 7.6

Asset writedowns .......................................... 23.2 20.4 36.1

Facility closure and lease obligation costs ........................ 16.5 14.3 9.3

Relocation costs .......................................... 0.6 5.0 4.1

Contract termination costs ................................... — — 1.7

Other .................................................. — 1.3 3.2

Total ................................................. $56.4 $54.7 $106.8

Years ended December 31,

2011 2010 2009

By Caption:

Direct operating ........................................... $46.6 $43.5 $ 65.4

Selling, general and administrative ............................. 9.8 11.2 41.4

Total ................................................. $56.4 $54.7 $106.8

138