Hertz 2011 Annual Report Download - page 79

Download and view the complete annual report

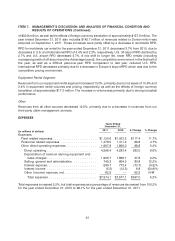

Please find page 79 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

guaranteed depreciation programs, subject to certain manufacturers’ car condition and mileage

requirements, at a specific price during a specified time period. These programs limit our residual risk

with respect to vehicles purchased under these programs. For all other vehicles, as well as equipment

acquired by our equipment rental business, we use historical experience and monitor market conditions

to set depreciation rates. Generally, when revenue earning equipment is acquired, we estimate the

period that we will hold the asset, primarily based on historical measures of the amount of rental activity

(e.g., automobile mileage and equipment usage) and the targeted age of equipment at the time of

disposal. We also estimate the residual value of the applicable revenue earning equipment at the

expected time of disposal. The residual values for rental vehicles are affected by many factors, including

make, model and options, age, physical condition, mileage, sale location, time of the year and channel

of disposition (e.g., auction, retail, dealer direct). The residual value for rental equipment is affected by

factors which include equipment age and amount of usage. Depreciation is recorded on a straight-line

basis over the estimated holding period. Depreciation rates are reviewed on a quarterly basis based on

management’s ongoing assessment of present and estimated future market conditions, their effect on

residual values at the time of disposal and the estimated holding periods. Market conditions for used

vehicle and equipment sales can also be affected by external factors such as the economy, natural

disasters, fuel prices and incentives offered by manufacturers of new cars. These key factors are

considered when estimating future residual values and assessing depreciation rates. As a result of this

ongoing assessment, we make periodic adjustments to depreciation rates of revenue earning

equipment in response to changing market conditions. Upon disposal of revenue earning equipment,

depreciation expense is adjusted for the difference between the net proceeds received and the

remaining net book value.

Within our Donlen subsidiary, revenue earning equipment is under longer term lease agreements with

our customers. These leases contain provisions whereby we have a contracted residual value

guaranteed to us by the lessee, such that we do not experience any gains or losses on the disposal of

these vehicles. Therefore depreciation rates on these vehicles are not adjusted at any point in time per

the associated lease contract.

See Note 7 to the Notes to our consolidated financial statements included in this Annual Report under

the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Public Liability and Property Damage

The obligation for public liability and property damage on self-insured U.S. and international vehicles

and equipment represents an estimate for both reported accident claims not yet paid, and claims

incurred but not yet reported. The related liabilities are recorded on a non-discounted basis. Reserve

requirements are based on actuarial evaluations of historical accident claim experience and trends, as

well as future projections of ultimate losses, expenses, premiums and administrative costs. The

adequacy of the liability is regularly monitored based on evolving accident claim history and insurance

related state legislation changes. If our estimates change or if actual results differ from these

assumptions, the amount of the recorded liability is adjusted to reflect these results. Our actual results as

compared to our estimates have historically resulted in relatively minor adjustments to our recorded

liability.

Pensions

Our employee pension costs and obligations are dependent on our assumptions used by actuaries in

calculating such amounts. These assumptions include discount rates, salary growth, long-term return

53