Hertz 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

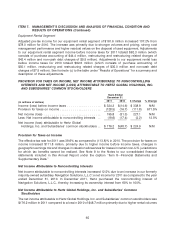

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

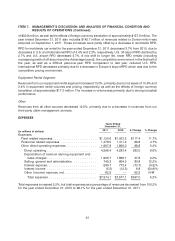

Other

Revenues from all other sources decreased 46.6%, primarily due to a decrease in revenues from our

third-party claim management services.

EXPENSES

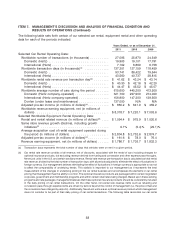

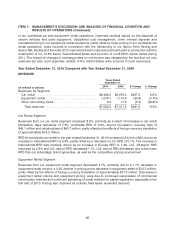

Years Ended

December 31,

2010 2009 $ Change % Change

(in millions of dollars)

Expenses:

Fleet related expenses ....................... $1,003.2 $ 880.1 $123.1 14.0%

Personnel related expenses ................... 1,411.2 1,321.3 89.9 6.8%

Other direct operating expenses ................ 1,869.0 1,885.4 (16.4) (0.9)%

Direct operating .......................... 4,283.4 4,086.8 196.6 4.8%

Depreciation of revenue earning equipment and

lease charges .......................... 1,868.1 1,933.8 (65.7) (3.4)%

Selling, general and administrative ............ 664.5 642.0 22.5 3.5%

Interest expense .......................... 773.4 680.3 93.1 13.7%

Interest income .......................... (12.3) (16.0) 3.7 (22.9)%

Other (income) expense, net ................. — (48.5) 48.5 (100.0)%

Total expenses ......................... $7,577.1 $7,278.4 $298.8 4.1%

Total expenses increased 4.1%, and total expenses as a percentage of revenues decreased from 102.5%

for the year ended December 31, 2009 to 100.2% for the year ended December 31, 2010.

Direct Operating Expenses

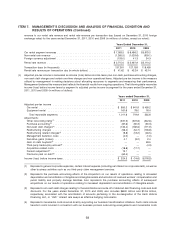

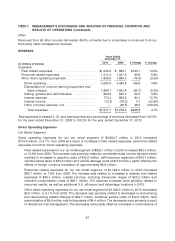

Car Rental Segment

Direct operating expenses for our car rental segment of $3,604.7 million in 2010 increased

$174.0 million, or 5.1%, from 2009 as a result of increases in fleet related expenses, personnel related

expenses and other direct operating expenses.

Fleet related expenses for our car rental segment of $822.1 million in 2010 increased $92.3 million,

or 12.6% from 2009. The increase was primarily related to worldwide rental volume demand which

resulted in increases in gasoline costs of $35.0 million, self insurance expenses of $33.1 million,

vehicle license taxes of $16.5 million and vehicle damage costs of $14.8 million, partly offset by the

effects of foreign currency translation of approximately $5.8 million.

Personnel related expenses for our car rental segment of $1,162.0 million in 2010 increased

$83.7 million, or 7.8% from 2009. The increase was related to increases in salaries and related

expenses of $35.2 million, outside services, including transporter wages of $22.2 million and

incentive compensation costs of $26.1 million. The expense increases were primarily related to

improved results, as well as additional U.S. off-airport and Advantage locations in 2010.

Other direct operating expenses for our car rental segment of $1,620.6 million in 2010 decreased

$2.0 million, or 0.1% from 2009. The decrease was primarily related to decreases in restructuring

and restructuring related charges of $52.7 million, customer service costs of $12.5 million, field

administrative of $5.0 million and field systems of $4.4 million. The decreases were primarily a result

of disciplined cost management. The decreases were partly offset by increases in commissions of

67