Hertz 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

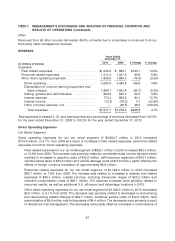

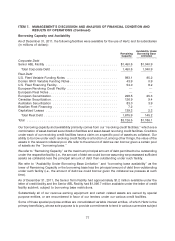

Borrowing Capacity and Availability

As of December 31, 2011, the following facilities were available for the use of Hertz and its subsidiaries

(in millions of dollars):

Availability Under

Remaining Borrowing Base

Capacity Limitation

Corporate Debt

Senior ABL Facility ...................................... $1,450.6 $1,040.9

Total Corporate Debt ................................... 1,450.6 1,040.9

Fleet Debt

U.S. Fleet Variable Funding Notes ........................... 993.1 95.2

Donlen GN II Variable Funding Notes ......................... 43.9 0.9

U.S. Fleet Financing Facility ................................ 54.0 8.2

European Revolving Credit Facility ........................... — —

European Fleet Notes .................................... — —

European Securitization ................................... 228.5 25.3

Canadian Securitization ................................... 126.9 9.4

Australian Securitization .................................. 83.0 3.9

Brazilian Fleet Financing .................................. 7.2 —

Capitalized Leases ...................................... 139.3 2.3

Total Fleet Debt ....................................... 1,675.9 145.2

Total ................................................ $3,126.5 $1,186.1

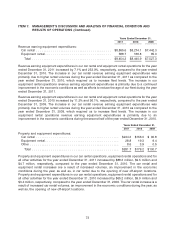

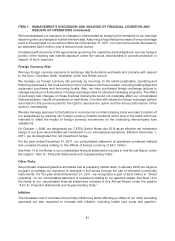

Our borrowing capacity and availability primarily comes from our ‘‘revolving credit facilities,’’ which are a

combination of asset-backed securitization facilities and asset-based revolving credit facilities. Creditors

under each of our revolving credit facilities have a claim on a specific pool of assets as collateral. Our

ability to borrow under each revolving credit facility is a function of, among other things, the value of the

assets in the relevant collateral pool. We refer to the amount of debt we can borrow given a certain pool

of assets as the ‘‘borrowing base.’’

We refer to ‘‘Remaining Capacity’’ as the maximum principal amount of debt permitted to be outstanding

under the respective facility (i.e., the amount of debt we could borrow assuming we possessed sufficient

assets as collateral) less the principal amount of debt then-outstanding under such facility.

We refer to ‘‘Availability Under Borrowing Base Limitation’’ and ‘‘borrowing base availability’’ as the

lower of Remaining Capacity or the borrowing base less the principal amount of debt then-outstanding

under such facility (i.e., the amount of debt we could borrow given the collateral we possess at such

time).

As of December 31, 2011, the Senior Term Facility had approximately $1.2 million available under the

letter of credit facility and the Senior ABL Facility had $1,096.7 million available under the letter of credit

facility sublimit, subject to borrowing base restrictions.

Substantially all of our revenue earning equipment and certain related assets are owned by special

purpose entities, or are encumbered in favor of our lenders under our various credit facilities.

Some of these special purpose entities are consolidated variable interest entities, of which Hertz is the

primary beneficiary, whose sole purpose is to provide commitments to lend in various currencies subject

77