Hertz 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

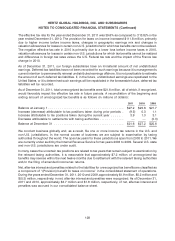

Note 9—Lease and Concession Agreements

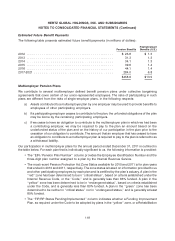

We have various concession agreements, which provide for payment of rents and a percentage of

revenue with a guaranteed minimum, and real estate leases under which the following amounts were

expensed (in millions of dollars):

Years ended December 31,

2011 2010 2009

Rents ................................................ $130.6 $133.9 $133.2

Concession fees:

Minimum fixed obligations ................................ 248.7 252.0 260.1

Additional amounts, based on revenues ...................... 311.8 278.7 231.5

Total .............................................. $691.1 $664.6 $624.8

For the years ended December 31, 2011, 2010 and 2009, sublease income reduced rent expense

included in the above table by $5.0 million, $4.5 million and $5.0 million, respectively.

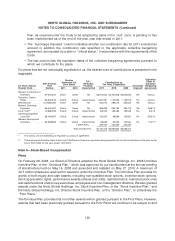

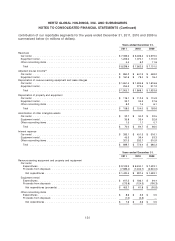

As of December 31, 2011, minimum obligations under existing agreements referred to above are

approximately as follows (in millions of dollars):

Rents Concessions

2012 ..................................................... $119.4 $315.6

2013 ..................................................... 96.6 263.4

2014 ..................................................... 74.5 182.2

2015 ..................................................... 55.6 120.1

2016 ..................................................... 37.4 73.6

Years after 2016 ............................................. 151.2 387.6

The future minimum rent payments in the above table have been reduced by minimum future sublease

rental inflows in aggregate of $16.4 million.

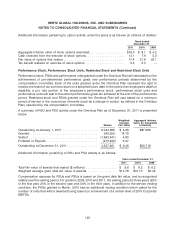

Many of our concession agreements and real estate leases require us to pay or reimburse operating

expenses, such as common area charges and real estate taxes, to pay concession fees above

guaranteed minimums or additional rent based on a percentage of revenues or sales (as defined in

those agreements) arising at the relevant premises, or both. Such obligations are not reflected in the

table of minimum future obligations appearing immediately above. We operate from various leased

premises under operating leases with terms up to 25 years. A number of our operating leases contain

renewal options. These renewal options vary, but the majority include clauses for renewal for various

term lengths at various rates, both fixed and market.

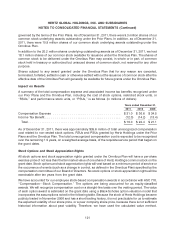

In addition to the above, we have various leases on revenue earning equipment and office and computer

equipment under which the following amounts were expensed (in millions of dollars):

Years ended December 31,

2011 2010 2009

Revenue earning equipment .................................. $ 96.1 $78.2 $81.7

Office and computer equipment ............................... 10.1 10.4 8.9

Total ................................................. $106.2 $88.6 $90.6

129