Hertz 2011 Annual Report Download - page 75

Download and view the complete annual report

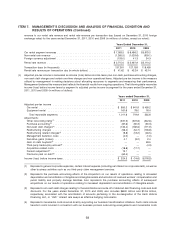

Please find page 75 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The statements in this discussion and analysis regarding industry outlook, our expectations regarding the

performance of our business and the other non-historical statements are forward-looking statements.

These forward-looking statements are subject to numerous risks and uncertainties, including, but not

limited to, the risks and uncertainties described in ‘‘Item 1A—Risk Factors.’’ The following discussion and

analysis provides information that we believe to be relevant to an understanding of our consolidated

financial condition and results of operations. Our actual results may differ materially from those contained

in or implied by any forward-looking statements. You should read the following discussion and analysis

together with the sections entitled ‘‘Cautionary Note Regarding Forward-Looking Statements,’’

‘‘Item 1A—Risk Factors,’’ ‘‘Item 6—Selected Financial Data’’ and our consolidated financial statements

and related notes included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

Overview

We are engaged principally in the business of renting and leasing of cars and equipment.

Our revenues primarily are derived from rental and related charges and consist of:

• Car rental revenues (revenues from all company-operated car rental and fleet leasing operations

and management services, including charges to customers for the reimbursement of costs

incurred relating to airport concession fees and vehicle license fees, the fueling of vehicles and

the sale of loss or collision damage waivers, liability insurance coverage and other products);

• Equipment rental revenues (revenues from all company-operated equipment rental operations,

including amounts charged to customers for the fueling and delivery of equipment and sale of

loss damage waivers, as well as revenues from the sale of new equipment and consumables);

and

• Other revenues (primarily relates to fees and certain cost reimbursements from our licensees and

revenues from our third-party claim management services).

Our expenses primarily consist of:

• Direct operating expenses (primarily wages and related benefits; commissions and concession

fees paid to airport authorities, travel agents and others; facility, self-insurance and reservation

costs; the cost of new equipment and consumables purchased for resale; and other costs relating

to the operation and rental of revenue earning equipment, such as damage, maintenance and

fuel costs);

• Depreciation expense and lease charges relating to revenue earning equipment (including net

gains or losses on the disposal of such equipment). Revenue earning equipment includes cars

and rental equipment;

• Selling, general and administrative expenses (including advertising); and

• Interest expense.

Our profitability is primarily a function of the volume, mix and pricing of rental transactions and the

utilization of cars and equipment. Significant changes in the purchase price or residual values of cars

and equipment or interest rates can have a significant effect on our profitability depending on our ability

to adjust pricing for these changes. We continue to balance our mix of non-program and program

vehicles based on market conditions. Our business requires significant expenditures for cars and

49