Hertz 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

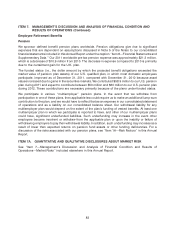

Employee Retirement Benefits

Pension

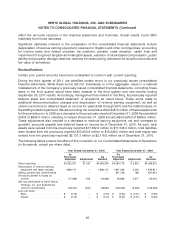

We sponsor defined benefit pension plans worldwide. Pension obligations give rise to significant

expenses that are dependent on assumptions discussed in Note 5 of the Notes to our consolidated

financial statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’ Our 2011 worldwide pre-tax pension expense was approximately $21.3 million,

which is a decrease of $10.9 million from 2010. The decrease in expense compared to 2010 is primarily

due to the curtailment gain for the U.K. plan.

The funded status (i.e., the dollar amount by which the projected benefit obligations exceeded the

market value of pension plan assets) of our U.S. qualified plan, in which most domestic employees

participate, improved as of December 31, 2011, compared with December 31, 2010 because asset

values increased due to gains in the securities markets. We contributed $58.9 million to our U.S. pension

plan during 2011 and expect to contribute between $50 million and $60 million to our U.S. pension plan

during 2012. These contributions are necessary primarily because of the plans under-funded status.

We participate in various ‘‘multiemployer’’ pension plans. In the event that we withdraw from

participation in one of these plans, then applicable law could require us to make an additional lump-sum

contribution to the plan, and we would have to reflect that as an expense in our consolidated statement

of operations and as a liability on our consolidated balance sheet. Our withdrawal liability for any

multiemployer plan would depend on the extent of the plan’s funding of vested benefits. At least one

multiemployer plan in which we participate is reported to have, and other of our multiemployer plans

could have, significant underfunded liabilities. Such underfunding may increase in the event other

employers become insolvent or withdraw from the applicable plan or upon the inability or failure of

withdrawing employers to pay their withdrawal liability. In addition, such underfunding may increase as a

result of lower than expected returns on pension fund assets or other funding deficiencies. For a

discussion of the risks associated with our pension plans, see ‘‘Item 1A—Risk Factors’’ in this Annual

Report.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

See ‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and Results of

Operations—Market Risks’’ included elsewhere in this Annual Report.

83