Hertz 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

affect the amounts reported in the financial statements and footnotes. Actual results could differ

materially from those estimates.

Significant estimates inherent in the preparation of the consolidated financial statements include

depreciation of revenue earning equipment, reserves for litigation and other contingencies, accounting

for income taxes and related uncertain tax positions, pension costs valuation, useful lives and

impairment of long-lived tangible and intangible assets, valuation of stock-based compensation, public

liability and property damage reserves, reserves for restructuring, allowance for doubtful accounts and

fair value of derivatives.

Reclassifications

Certain prior period amounts have been reclassified to conform with current reporting.

During the third quarter of 2011, we identified certain errors in our previously issued consolidated

financial statements. While these errors did not, individually or in the aggregate, result in a material

misstatement of the Company’s previously issued consolidated financial statements, correcting these

items in the third quarter would have been material to the third quarter and nine-months ending

September 30, 2011 results. Accordingly, management has revised in this filing, its previously reported

balance sheet and consolidated statement of operations as noted below. These errors relate to

additional telecommunication charges and depreciation of revenue earning equipment, as well as

certain corrections to deferred taxes on income for years 2005 through 2010 and the related impact on

the 2008 goodwill impairment. We are recording the cumulative effect $(8.7) million of these adjustments

for the periods prior to 2009 as a decrease to the previously reported December 31, 2008 Accumulated

deficit of $936.3 million, resulting in revised December 31, 2008 Accumulated deficit of $945.0 million.

These adjustments also resulted in a decrease to revenue earning equipment, net and increases to

goodwill, accounts payable and deferred taxes on income as of December 31, 2010. As such, total

assets were revised from the previously reported $17,332.2 million to $17,345.0 million, total liabilities

were revised from the previously reported $15,200.9 million to $15,226.5 million and total equity was

revised from the previously reported $2,131.3 million to $2,118.5 million as of December 31, 2010.

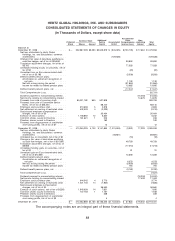

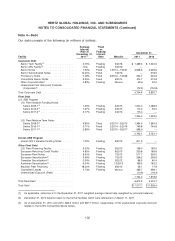

The following tables present the effect of this correction on our Consolidated Statements of Operations

(in thousands, except per share data):

Year Ended December 31, 2010 Year Ended December 31, 2009

As As

Previously As Previously As

Reported Adjustment Revised Reported Adjustment Revised

Direct operating .............. $4,282,351 $1,043 $4,283,394 $4,084,176 $ 2,634 $4,086,810

Depreciation of revenue earning

equipment and lease charges .... 1,868,147 — 1,868,147 1,931,358 2,453 1,933,811

Selling, general and administrative . . — — — 641,148 796 641,944

(Provision) benefit for taxes on

income .................. (17,068) 406 (16,662) 59,666 2,377 62,043

Net loss attributable to Hertz Global

Holdings, Inc. and Subsidiaries’

common stockholders ......... (48,044) (637) (48,681) (126,022) (3,506) (129,528)

Loss per share:

Basic ................... $ (0.12) — $ (0.12) $ (0.34) $ (0.01) $ (0.35)

Diluted .................. $ (0.12) — $ (0.12) $ (0.34) $ (0.01) $ (0.35)

92