Hertz 2011 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

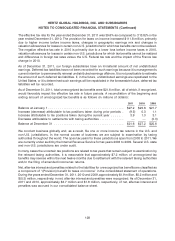

On January 1, 2009, Bank of America acquired Merrill Lynch & Co. For U.S. income tax purposes the

transaction, when combined with other unrelated transactions during the previous 36 months, resulted

in a change in control as that term is defined in Section 382 of the Internal Revenue Code. Consequently,

utilization of all pre-2009 U.S. net operating losses is subject to an annual limitation. We have calculated

the expected annual base limitation as well as additional limitation resulting from a net unrealized built in

gain as of the acquisition date and other adjustments. Based on the calculations, the limitation is not

expected to result in a loss of net operating losses or have a material adverse impact on taxes.

As of December 31, 2011, deferred tax assets of $208.6 million were recorded for foreign NOL carry

forwards of $886.7 million. A valuation allowance of $169.9 million at December 31, 2011 was recorded

against these deferred tax assets because those assets relate to jurisdictions that have historical losses

and the likelihood exists that a portion of the NOL carry forwards may not be utilized in the future.

The foreign NOL carry forwards of $886.7 million include $719.3 million which have an indefinite carry

forward period and associated deferred tax assets of $159.6 million. The remaining foreign NOLs of

$167.4 million are subject to expiration beginning in 2015 and have associated deferred tax assets of

$49.0 million.

As of December 31, 2011, deferred tax assets for U.S. Foreign Tax Credit carry forwards were

$20.8 million which relate to credits generated as of December 31, 2007. The carry forwards will begin to

expire in 2015. A valuation allowance of $13.5 million at December 31, 2011 was recorded against a

portion of the U.S. foreign tax credit deferred tax assets in the likelihood that they may not be utilized in

the future. A deferred tax asset was also recorded for various state tax credit carry forwards of

$3.0 million, which will begin to expire in 2027.

In determining the valuation allowance, an assessment of positive and negative evidence was performed

regarding realization of the net deferred tax assets in accordance with ASC 740-10, ‘‘Accounting for

Income Taxes,’’ or ‘‘ASC 740-10.’’ This assessment included the evaluation of scheduled reversals of

deferred tax liabilities, the availability of carry forwards and estimates of projected future taxable income.

Based on the assessment, as of December 31, 2011, total valuation allowances of $186.7 million were

recorded against deferred tax assets. Although realization is not assured, we have concluded that it is

more likely than not the remaining deferred tax assets of $1,996.2 million will be realized and as such no

valuation allowance has been provided on these assets.

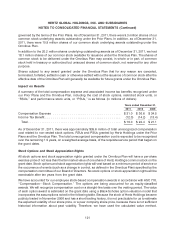

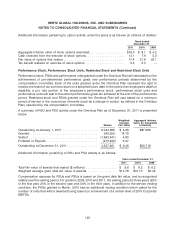

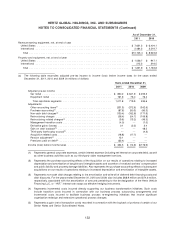

The significant items in the reconciliation of the statutory and effective income tax rates consisted of the

following:

Years ended December 31,

2011 2010 2009

Statutory Federal Tax Rate ................................ 35.0% 35.0% 35.0%

Foreign tax differential ................................... (0.7) 108.3 20.6

State and local income taxes, net of federal income tax benefit ..... 3.9 13.1 5.7

Change in state statutory rates, net of federal income tax benefit .... 0.7 (11.2) 3.4

Federal permanent differences ............................. (1.6) 5.8 1.9

Withholding taxes ...................................... 2.3 (58.0) (4.7)

Uncertain tax positions .................................. (1.0) (24.8) (2.6)

Change in valuation allowance ............................. 0.7 (187.7) (25.2)

All other items, net ..................................... 0.3 5.7 1.0

Effective Tax Rate ..................................... 39.6% (113.8)% 35.1%

127