Hertz 2011 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

interest, attorneys’ fees and costs. Plaintiffs dropped their claims against Caroline Beteta.

Plaintiffs’ claims against the rental car defendants have been dismissed, except for the federal

antitrust claim. In June 2010, the United States Court of Appeals for the Ninth Circuit affirmed

the dismissal of the plaintiffs’ antitrust case against the CTTC as a state agency immune from

antitrust complaint because the California Legislature foresaw the alleged price-fixing

conspiracy that was the subject of the complaint. The plaintiffs subsequently filed a petition with

the Ninth Circuit seeking a rehearing and that petition was granted. In November 2010, the

Ninth Circuit withdrew its June opinion and instead held that state action immunity was

improperly invoked. The Ninth Circuit reinstated the plaintiffs’ antitrust claims and remanded

the case to the district court for further proceedings. All proceedings in the case are currently

stayed while the parties engage in settlement discussions.

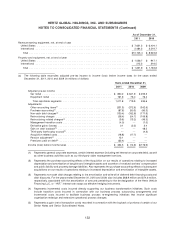

5. Public Liability and Property Damage

We are currently a defendant in numerous actions and have received numerous claims on

which actions have not yet been commenced for public liability and property damage arising

from the operation of motor vehicles and equipment rented from us. The obligation for public

liability and property damage on self-insured U.S. and international vehicles and equipment, as

stated on our balance sheet, represents an estimate for both reported accident claims not yet

paid and claims incurred but not yet reported. The related liabilities are recorded on a

non-discounted basis. Reserve requirements are based on actuarial evaluations of historical

accident claim experience and trends, as well as future projections of ultimate losses,

expenses, premiums and administrative costs. At December 31, 2011 and December 31, 2010

our liability recorded for public liability and property damage matters was $281.5 million and

$278.7 million, respectively. We believe that our analysis is based on the most relevant

information available, combined with reasonable assumptions, and that we may prudently rely

on this information to determine the estimated liability. We note the liability is subject to

significant uncertainties. The adequacy of the liability reserve is regularly monitored based on

evolving accident claim history and insurance related state legislation changes. If our estimates

change or if actual results differ from these assumptions, the amount of the recorded liability is

adjusted to reflect these results.

We intend to assert that we have meritorious defenses in the foregoing matters and we intend to defend

ourselves vigorously.

We have established reserves for matters where we believe that the losses are probable and reasonably

estimated, including for various of the matters set forth above. Other than with respect to the aggregate

reserves established for claims for public liability and property damage, none of those reserves are

material. For matters, including those described above, where we have not established a reserve, the

ultimate outcome or resolution cannot be predicted at this time, or the amount of ultimate loss, if any,

cannot be reasonably estimated. Litigation is subject to many uncertainties and the outcome of the

individual litigated matters is not predictable with assurance. It is possible that certain of the actions,

claims, inquiries or proceedings, including those discussed above, could be decided unfavorably to us

or any of our subsidiaries involved. Accordingly, it is possible that an adverse outcome from such a

proceeding could exceed the amount accrued in an amount that could be material to our consolidated

financial condition, results of operations or cash flows in any particular reporting period.

136