Hertz 2011 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2011 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

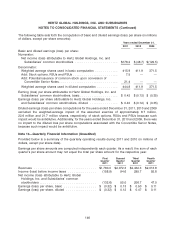

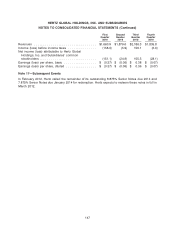

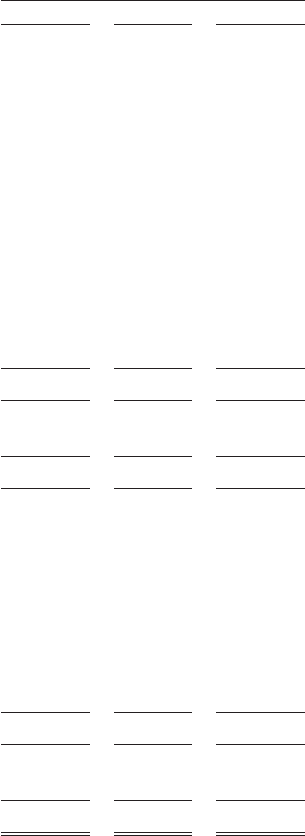

SCHEDULE I (Continued)

HERTZ GLOBAL HOLDINGS, INC.

PARENT COMPANY STATEMENTS OF CASH FLOWS

(In Thousands of Dollars)

Years ended December 31,

2011 2010 2009

Cash flows from operating activities:

Net income (loss) ................................ $199,120 $(25,680) $(129,528)

Adjustments to reconcile net income (loss) to net cash used

in operating activities:

Amortization and write-off of deferred financing costs ..... 2,297 2,294 1,363

Amortization of debt discount ...................... 22,172 19,733 10,715

Deferred taxes on income ......................... (5,583) (6,652) 6,189

Changes in assets and liabilities:

Taxes receivable ............................... (9,723) (10,007) (17,450)

Prepaid expenses and other assets .................. (64) (16) —

Accounts payable .............................. — (4,315) 4,095

Accrued liabilities ............................... 39 12 2,036

Accrued taxes ................................. — — (7)

Equity in losses of subsidiaries, net of tax ............... (210,489) 18,382 114,041

Net cash flows used in operating activities ................ (2,231) (6,249) (8,546)

Cash flows from investing activities:

Investment in and advances to consolidated subsidiaries .... — — (990,117)

Net cash used in investing activities ..................... — — (990,117)

Cash flows from financing activities:

Repayment of long-term debt ........................ (15) — —

Proceeds from sale of Convertible Senior Notes .......... — — 459,483

Proceeds from exercise of stock options ................ 13,058 7,894 5,342

Accounts receivable from Hertz affiliate ................. 984 6,173 7,186

Proceeds from disgorgement of stockholders short swing

profits ....................................... 76 7 19

Net settlement on vesting of restricted stock ............. (11,465) (7,836) (2,219)

Proceeds from the sale of common stock ............... — — 528,758

Net cash provided by financing activities ................. 2,638 6,238 998,569

Net change in cash and cash equivalents during the period . . . 407 (11) (94)

Cash and cash equivalents at beginning of period .......... 164 175 269

Cash and cash equivalents at end of period ............... $ 571 $ 164 $ 175

Supplemental disclosures of cash flow information:

Cash paid (received) during the period for:

Interest (net of amounts capitalized) ................... $ 24,897 $ 24,861 $ 12,538

Income taxes ................................... — — —

The accompanying notes are an integral part of these financial statements.

151