HSBC 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strength, diversity and resilience

2008

HSBC Holdings plc Annual Report and Accounts

Table of contents

-

Page 1

2008 HSBC Holdings plc Annual Report and Accounts Strength, diversity and resilience -

Page 2

... Middle East and Africa; North America and Latin America. With listings on the London, Hong Kong, New York, Paris and Bermuda stock exchanges, shares in HSBC Holdings plc are held by over 210,000 shareholders in 120 countries and territories. The shares are traded on the New York Stock Exchange in... -

Page 3

... in the US ...Limitations affecting equity security holders ...Fourth interim dividend for 2008 ...Interim dividends for 2009 ...Dividends on ordinary shares of HSBC Holdings ...Nature of trading market ...Shareholder profile ...Memorandum and Articles of Association ...Annual General Meeting ...448... -

Page 4

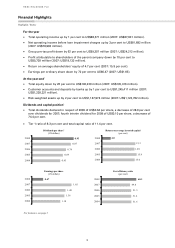

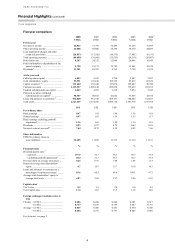

... million). Customer accounts and deposits by banks up by 1 per cent to US$1,245,411 million (2007: US$1,228,321 million). Risk-weighted assets up by 2 per cent to US$1,147,974 million (2007: US$1,123,782 million). Dividends and capital position1 • Total dividends declared in respect of 2008 of US... -

Page 5

....5 5.69 Share information at the year-end 2008 US$0.50 ordinary shares in issue (million) ...Market capitalisation (billion) ...Closing market price per ordinary share: - London ...- Hong Kong ...Closing market price per American Depositary Share7 ...Over 1 year HSBC total shareholder return to 31... -

Page 6

...other credit risk provisions ...Total operating expenses ...Profit before tax ...Profit attributable to shareholders of the parent company ...Dividends2 ...At the year-end Called up share capital ...Total shareholders' equity ...Capital resources1,13 ...Customer accounts ...Undated subordinated loan... -

Page 7

... in North America, was reported in total operating expenses. This amount is excluded from total operating expenses to calculate the ratio. 7 Each American Depositary Share ('ADS') represents five ordinary shares. 8 Total shareholder return is defined on page 19. 9 The Financial Times Stock Exchange... -

Page 8

... the funding of private and public sector defined benefit pensions; and consumer perception as to the continuing availability of credit, and price competition in the market segments served by HSBC. - - - - • changes in government policy and regulation, including: - the monetary, interest rate... -

Page 9

... markets where HSBC operates including increased competition from non-bank financial services companies, including securities firms. • factors specific to HSBC: - the success of HSBC in adequately identifying the risks it faces, such as the incidence of loan losses or delinquency, and managing... -

Page 10

HSBC HOLDINGS PLC Group Chairman's Statement Group Chairman's Statement low. This cheap money fuelled a consumer boom and rising house prices. It encouraged increased borrowing by banks and by their customers, fuelling asset price bubbles particularly in housing markets. Loose monetary conditions ... -

Page 11

... of credit cards, we will write no further consumer finance business through the HFC and Beneficial brands in the US and close the majority of the network. Thus, in terms of new business, we are drawing a line and we will run off our existing business, providing all necessary support to HSBC Finance... -

Page 12

... ordinary share capital following the Rights Issue we are announcing today, prevailing business conditions and capital requirements. The dividend payments remain substantial and reflect management's long-term confidence in the business. HSBC will continue to aim to pay progressive dividends in line... -

Page 13

.... Our strategy has served HSBC well and positions it for long-term growth with attractive returns. HSBC continues to combine its position as the world's leading emerging markets bank with an extensive international network across both developed and faster growing markets. At the same time, as... -

Page 14

... services. Headquartered in London, HSBC operates through long-established businesses and has an international network of some 10,000 properties in 86 countries and territories in five geographical regions: Europe; Hong Kong; Rest of Asia-Pacific, including the Middle East and Africa; North America... -

Page 15

...the capital markets or deteriorating investor sentiment. Market developments may affect consumer confidence and may cause declines in credit card usage and adverse changes in payment patterns, leading to increases in delinquencies and default rates, write-offs and loan impairment charges beyond HSBC... -

Page 16

...customers are likely to seek capital protection and become increasingly rate and risk sensitive, seeking out products which offer deposit insurance and government guarantees. Regulatory reforms in the areas of wealth management product complexity, sales requirements and liquidity and reserve ratios... -

Page 17

... the risk of deposit migration. HSBC's Global Banking and Markets business operates in the markets affected by illiquidity and extreme price volatility, either directly or indirectly, through exposures to securities, loans, derivatives and other commitments, and HSBC has made substantial write-downs... -

Page 18

... HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Challenges and uncertainties / KPIs transactions with counterparties in financial services, including brokers and dealers, commercial banks, investment banks, mutual and hedge funds, and other institutional clients... -

Page 19

... to increase their capital in response to deteriorating market conditions may have secondary effects on lending, which could exacerbate the current market downturn. These measures, alone or in combination, could have an adverse effect on HSBC's operations. In the UK for example, the Banking Act 2009... -

Page 20

... paid in respect of the year to which the dividend relates. 8 Basic earnings per ordinary share is defined in Note 13 on the Financial Statements. 9 The return on average total shareholders' equity is defined as profit attributable to shareholders of the parent company divided by the average total... -

Page 21

.... In 2008, the ratio of 4.0 per cent was 11.3 percentage points lower than that reported in 2007. This decrease reflected the decline in profit driven by goodwill impairment, the significant increase in loan impairment charges, write-downs in credit trading, leveraged and acquisition finance, and... -

Page 22

... increase. The following chart shows the 2005 to 2008 volumes per delivery channel: Number of customer transactions (millions) 2,500 2,000 1,500 1,000 500 0 Branch/Call Centre-Agent Credit card Internet Self-Service Terminal Other e-Channels Others (payment, clearing, etc) 2005 2006... -

Page 23

... and Vietnam Technological and Commercial Joint Stock Bank ('Techcombank') following their share issues; the disposal of the Hamilton Insurance Company Limited and Hamilton Life Assurance Company Limited in the UK in October 2007; the sale of Wealth and Tax Advisory Services to its management in... -

Page 24

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Reconciliation of reported and underlying profit before tax / Financial summary Reconciliation of reported and underlying profit before tax 2008 compared with 2007 2007 acquisitions, disposals & dilution Currency... -

Page 25

......Net insurance claims incurred and movement in liabilities to policyholders . Loan impairment charges and other credit risk provisions ...Operating expenses ...Share of profit in associates and joint ventures ...Economic profit ...Balance sheet ...Movement from 31 December 2007 to 31 December 2008... -

Page 26

... carried on the balance sheet in respect of the Group's investment in its North America Personal Financial Services business. This non-cash charge arose substantially in the second half of 2008 as heightened risk premia in the market increased discount rates and cash flows estimated from ongoing... -

Page 27

... businesses within Global Banking and Markets, including foreign exchange, payments and cash management, equities, HSBC Global Asset Management and securities services. The deterioration in credit quality which began in 2006 in a particular portfolio of purchased mortgages in the US consumer finance... -

Page 28

... balance growth in North America, Europe and Hong Kong. Balance Sheet Management revenues increased compared with 2006, particularly in Hong Kong and Rest of Asia-Pacific as deposits grew strongly. Lending spreads in 2007 reflected the continued benign corporate and commercial credit conditions... -

Page 29

... enhancement services on cards also increased. In Mexico, the credit card business continued to grow, both in balances and in transaction volumes. Higher income from funds under management products, broking services, unit trusts and global custody was driven by buoyant stock markets in Hong Kong and... -

Page 30

... short-term interest rates. Revenues were also boosted by an increased number of deals, widening spreads and increased customer demand for trading and hedging products. The decline in equities trading income reflected weaker equity markets, particularly in Hong Kong, where demand for structured... -

Page 31

... investment losses driven by falling equity and bond markets, predominantly affecting the value of assets held in unit-linked and participating funds in Hong Kong, France and the UK. The negative movement in fair value is partially offset by a corresponding reduction in 'Net insurance claims... -

Page 32

... investment returns on the portfolios held by the insurance businesses in the UK and Hong Kong. The change in fair value of liabilities under investment contracts declined by 7 per cent. 2008 US$m Net gain from disposal of: - debt securities ...- equity securities ...- other financial investments... -

Page 33

...death benefits to pension contracts. New product launches also aided growth in Hong Kong. In Latin America, higher premiums in Brazil were driven by increased sales of pension products with linked-life policies. In non-life insurance, the UK benefited from a decision to reduce the proportion of risk... -

Page 34

... sale of property fund assets and a reduction in Group real estate disposals in 2008. Similarly, in Hong Kong revaluation gains on investment properties did not recur. Life assurance enhancements to pension products resulted in increased present value of inforce long-term insurance ('PVIF') business... -

Page 35

... investment returns on unit-linked and participating policies. This was most notable in Hong Kong, the UK and Brazil. There was an offsetting increase in 'Net income from financial instruments designated at fair value' which reflected these investment returns. In addition, FSA rule changes in the UK... -

Page 36

... house price depreciation restricted refinancing options for customers. In HSBC USA, loan impairment charges rose as credit quality worsened across the real estate secured portfolio and private label cards. Delinquencies rose in the prime first lien residential mortgage portfolio, Home Equity Line... -

Page 37

... the commercial portfolio in the second half of 2008. In Global Banking and Markets, credit impairment charges within Balance Sheet Management principally reflected losses on debt securities and paper issued by financial institutions previously rated at investment grade which failed in the year. In... -

Page 38

... awards under the HSBC Holdings Group Share Option Plan. 2008 compared with 2007 Reported operating expenses increased by US$10.1 billion to US$49.1 billion, due to an impairment charge of US$10.6 billion to fully write off goodwill in Personal Financial Services in North America. Excluding this... -

Page 39

... costs. Staff numbers in North America fell as the consumer finance business was restructured, resulting in the discontinuation of certain business channels in mortgage services and the closing of branch offices in consumer lending. Premises and equipment costs increased on investments in technology... -

Page 40

... market value. Profits from the Saudi British Bank were higher by 16 per cent due to strong balance sheet growth, particularly in the lending portfolio, augmented by higher fees from cards, account services and trade. Profits from Industrial Bank grew by 72 per cent, driven by increased investment... -

Page 41

... The decline in profit was predominately driven by the US$10.6 billion goodwill impairment charge relating to the North American Personal Financial Services business, alongside a significant increase in loan impairment charges and write-downs in credit trading, leveraged and acquisition finance, and... -

Page 42

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Movement in 2008 Balance sheet 2008 US$m ASSETS Cash and balances at central banks ...Trading assets ...Financial assets designated at fair value ...Derivatives ...Loans and ... -

Page 43

... mainly in Hong Kong and the UK where Balance Sheet Management invested a greater proportion of its assets in government and government-guaranteed debt. HSBC also reduced counterparty credit risk in the UK by channelling an increasing proportion of lending to banks through the London Clearing House... -

Page 44

... in holdings of asset-backed securities. Liabilities under insurance contracts increased by 10 per cent, largely due to new business sales in Hong Kong, France and the UK, partly offset by reduced liabilities on unit-linked policies. Other liabilities rose by 50 per cent due to the consolidation of... -

Page 45

...loans and advances to banks Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East . HSBC Bank USA ...HSBC Bank Canada... -

Page 46

... Loans and advances to customers Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...HSBC Finance ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East HSBC Bank USA... -

Page 47

... assets Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East . HSBC Bank USA ...HSBC Finance ...HSBC Bank Canada... -

Page 48

...63 4.47 6.40 9.78 4.87 6.94 6.30 4.29 North America Latin America Other operations ... Financial liabilities designated at fair value - own debt issued11 Europe HSBC Holdings ...HSBC Bank ...HSBC France ...Hang Seng Bank ...HSBC Bank USA ...HSBC Finance ...18,675 8,805 1,515 127 1,504 32,126 1,083... -

Page 49

...3.48 North America Latin America Other operations ... Debt securities in issue Europe HSBC Bank ...HSBC France ...HSBC Finance ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East HSBC Bank USA ...HSBC Finance ...HSBC Bank Canada ...HSBC... -

Page 50

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Average balance sheet and NII Total equity and liabilities (continued) Average balance US$m Other interest-bearing liabilities Europe HSBC Bank ...HSBC Private Banking Holdings... -

Page 51

... assets 2008 % Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...HSBC Finance ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East ...HSBC Bank USA ...HSBC Finance... -

Page 52

...838 2008 US$m Short-term funds and loans and advances to banks Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East... -

Page 53

... Deposits by banks Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East ...HSBC Bank USA ...HSBC Bank Canada ...HSBC... -

Page 54

... designated at fair value - own debt issued Debt securities in issue Europe HSBC Bank ...HSBC France ...HSBC Finance ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East ...HSBC Bank USA ...HSBC Finance ...HSBC Bank Canada ...HSBC Mexico... -

Page 55

... shall on a poll have one vote for every share he or she holds. Where any shareholder is, under the rules governing the listing of securities on any stock exchange on which all or any shares of HSBC Holdings are for the time being listed or traded, required to abstain from voting on any particular... -

Page 56

... issue at 2 March 2009 are paid quarterly at the sole and absolute discretion of the Board of Directors. The Board of Directors will not declare a dividend on the Dollar Preference Shares if payment of the dividend would cause HSBC Holdings not to meet the applicable capital adequacy requirements of... -

Page 57

... for 2008. The market value per share used to calculate shareholders' entitlements to new shares was US$15.2466, being the US dollar equivalent of £8.266. 3. 4. All-Employee share plans 5. In connection with the exercise of options under the HSBC Holdings savings-related share option plans: 27... -

Page 58

... Stock Rights under HSBC Finance share plans that have been converted into rights over HSBC Holdings ordinary shares. Authority to purchase ordinary shares 12. At the Annual General Meeting in 2008, shareholders renewed the authority for the Company to make market purchases of ordinary shares... -

Page 59

... 5 years US$m 63,402 - 736 1,573 - 9,618 - 8,536 83,865 Total US$m Long-term debt obligations ...Term deposits and certificates of deposit ...Capital (finance) lease obligations ...Operating lease obligations ...Purchase obligations ...Short positions in debt securities and equity shares ...Current... -

Page 60

... international trade...Real estate and other property related ...Non-bank financial institutions ...Governments ...Other commercial ...Hong Kong Government Home Ownership Scheme ...Residential mortgages and other personal loans ...Loans and advances to customers ...Interest rate sensitivity of loans... -

Page 61

... of bank deposits, customer deposits and certificates of deposit ('CDs') and other money market instruments (which are included within 'Debt securities in issue' in the balance sheet), together with the average interest rates paid thereon for each of the past three years. The geographical analysis... -

Page 62

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Deposits / CDs // Critical accounting policies 2008 Average Average balance rate US$m % Customer accounts Europe Demand and other - non-interest bearing ...Demand - interest ... -

Page 63

...on the location of the office in which the deposits are recorded and excludes balances with HSBC companies. The majority of certificates of deposit and time deposits are in amounts of US$100,000 and over or the equivalent in other currencies. Critical accounting policies (Audited) Introduction The... -

Page 64

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review Critical accounting policies (continued) Impairment of loans and advances HSBC's accounting policy for losses arising from the impairment of customer loans and advances is described in Note 2g on the Financial Statements. ... -

Page 65

... carrying amount of loans and advances. Goodwill impairment HSBC's accounting policy for goodwill is described in Note 2(p) on the Financial Statements. Note 22 on the Financial Statements lists the Group's cash generating units ('CGUs') by geographical region and global business. Total goodwill for... -

Page 66

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review Critical accounting policies (continued) The best evidence of fair value is a quoted price in an actively traded market. In the event that the market for a financial instrument is not active, a valuation technique is used. ... -

Page 67

... by external investors, the availablefor-sale holdings in these categories within Global Banking and Markets amounted to US$5.2 billion at 31 December 2008 (2007: US$11.8 billion). The deficit in the available-for-sale fair value reserve as at 31 December 2008 in relation to these securities was US... -

Page 68

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review Critical accounting policies / Customer groups > Summary (continued) impairment on available-for-sale debt securities, as a result of which, evidence of impairment may be identified in available-for-sale debt securities ... -

Page 69

....0 Summary HSBC manages its business through two customer groups, Personal Financial Services and Commercial Banking, and two global businesses, Global Banking and Markets (previously Corporate, Investment Banking and Markets), and Private Banking. Personal Financial Services incorporates the Group... -

Page 70

...fees from retail securities and investments, particularly in Hong Kong, and changes in fee billing practices in the credit card business to improve the customer proposition in North America. A net expense of US$2.9 billion was recorded on financial instruments designated at fair value, compared with... -

Page 71

... in credit quality in the North American Personal Financial Services business. Delinquency rates increased across all portfolios in HSBC Finance, particularly consumer lending, and in the real estate secured portfolios in HSBC USA, following the sustained downturn in the housing market and... -

Page 72

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Personal Financial Services Subsequent developments The branch-based US consumer lending business of HSBC Finance has historically focused on sub-prime customers who rely on drawing cash against... -

Page 73

... income4 ...Net operating income5 ...Loan impairment charges and other credit risk provisions ...Net operating income ...Operating expenses ...Operating profit ...Income from associates ...Profit before tax ...For footnotes, see page 143. 2006 2006 acquisitions and as disposals1 reported US$m US... -

Page 74

...of the UK merchant acquiring division, recorded in 'Other operating income'. Profit growth was most significant in Australia, India, mainland China, United Arab Emirates ('UAE'), Turkey, Brazil and Argentina. HSBC remained committed to new lending, increasing lending balances by 10 per cent. Deposit... -

Page 75

... in new assets under management, while referrals from Private Banking led to a three-fold increase in new relationships. Sales of Global Markets products were particularly strong in foreign exchange under Commercial Banking's strategy to be the leading bank for international business. Business... -

Page 76

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Commercial Banking / Global Banking and Markets Reconciliation of reported and underlying profit before tax 2008 compared with 2007 2007 acquisitions, disposals & dilution Currency gains1 ... -

Page 77

...decline over the last four half-years. Core businesses such as foreign exchange, Rates, Balance Sheet Management and financing and equity capital markets posted record revenues. In 2008, some US$5.4 billion of write-downs were absorbed on legacy positions in credit trading, leveraged and acquisition... -

Page 78

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Global Banking and Markets Management view of total operating income 2008 US$m Global Markets18 ...Credit ...Rates ...Foreign exchange ...Equities ...Securities services ...Asset and structured ... -

Page 79

... decrease in funds under management following recent equity market declines. Nevertheless, HSBC remained one of the leading emerging markets asset managers. Reconciliation of reported and underlying profit before tax 2008 compared with 2007 2007 acquisitions, disposals & dilution Currency gains1... -

Page 80

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Global Banking and Markets / Private Banking Balance sheet data significant to Global Banking and Markets15 Hong Kong US$m 45,398 26,989 23,042 20,970 46,964 225,853 11,509 30,866 13,056 28,536 ... -

Page 81

...a result of an increase in customer deposit balances in Switzerland, the UK and Hong Kong as customers reduced risk in response to market turbulence, choosing HSBC for its strength and switching from investment securities to cash deposits. Spreads improved as interest rates declined sharply. Net fee... -

Page 82

...) Customer groups > Private Banking • Trading income fell by 21 per cent to US$422 million, driven by lower demand for structured products in Asia following the decline in the Hong Kong stock market which led to clients preferring more stable cash deposits. Partly offsetting this was an increase... -

Page 83

... 2008 at 2008 acquisitions exchange and rates3 disposals1 US$m US$m 1,205 1,536 704 3,445 - - - - Private Banking Net interest income ...Net fee income ...Other income4 ...Net operating income5 ...Loan impairment charges and other credit risk provisions ...Net operating income ...Operating expenses... -

Page 84

... declines in equity market prices. These investments were primarily in Asian financial services companies which are held for the long term. In 2007, the results included dilution gains of US$1.1 billion following share offerings made by HSBC's associates, Ping An Insurance, Bank of Communications... -

Page 85

Balance sheet data15 2008 US$m Loans and advances to customers (net) ...Total assets ...Customer accounts ...2,621 135,001 2,041 2007 US$m 2,678 155,685 2,006 2006 US$m 2,095 137,291 1,245 Reconciliation of reported and underlying profit/(loss) before tax 2008 compared with 2007 2007 acquisitions, ... -

Page 86

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Profit/(loss) before tax Analysis by customer group and global business Profit/(loss) before tax 2008 Personal Financial Commercial Services Banking US$m US$m 29,419 10,107 175 79 254 9,494 4,... -

Page 87

......Net operating income5 ...Loan impairment charges and other credit risk provisions ...Net operating income ...Total operating expenses ...Operating profit ...Share of profit in associates and joint ventures ...Profit before tax ...Share of HSBC's profit before tax...Cost efficiency ratio ... Total... -

Page 88

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Profit/(loss) before tax // Geographical regions > Summary Profit/(loss) before tax (continued) 2006 Personal Financial Services US$m 26,076 8,762 391 220 611 Commercial Banking US$m 7,514 3,207... -

Page 89

..., accounting for more than 65 per cent by value of banknotes in circulation in 2007. Rest of Asia-Pacific (including the Middle East) HSBC offers personal, commercial, global banking and markets services in mainland China, mainly through its local subsidiary, HSBC Bank (China) Company Limited ('HSBC... -

Page 90

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Summary / Europe In the analysis of profit by geographical regions that follows, operating income and operating expenses Profit/(loss) before tax 2008 US$m Europe ...Hong Kong ...Rest of ... -

Page 91

...customer groups and global businesses Personal Financial Commercial Banking Services US$m US$m 2008 United Kingdom ...France22 ...Germany ...Malta ...Switzerland ...Turkey ...Other ...1,546 139 - 59 - 3 (89) 1,658 2007 United... Loans and advances to customers (net) by country 2008 US$m United Kingdom... -

Page 92

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe > 2008 Profit before tax Europe Net interest income ...Net fee income ...Net trading income ...Changes in fair value of long-term debt issued and related derivatives ...Net income/(... -

Page 93

...sale of the card acquiring business in the UK to a joint venture with Global Payments, Inc. in June 2008. Excluding these disposals and, in 2007, the acquisition of HSBC Assurances and the disposal of Hamilton Insurance Company Limited and Hamilton Life Assurance Company Limited and substantial fair... -

Page 94

... value adjustment following HSBC's introduction of enhanced benefits to existing commercial pension products in the first half of 2008. These benefits were partially offset by costs associated with the support of money market funds in the global asset management business. Net insurance claims... -

Page 95

... European property company, and additional credit risk provisions on debt securities held within the Group's available-for-sale portfolio, mainly in Solitaire Funding Limited ('Solitaire'), a special purpose entity managed by HSBC. A modest improvement in the UK personal finance sector reflected... -

Page 96

... the Private Banking business earned higher net interest income from lending to existing clients as they further leveraged their portfolios. Net fee income rose by 11 per cent. Account services increased on higher customer balances and volumes of transactions in the UK and France, supported by sales... -

Page 97

...the part sale of HSBC's investment in it. Trading income rose by 41 per cent, driven by the equities business and foreign exchange trading, where income increased strongly, with volume and profitability reflecting market volatility. The increase was partly offset by write-downs in credit, structured... -

Page 98

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe > Profit/(loss) before tax by customer group Analysis by customer group and global business Profit/(loss) before tax 2008 Personal Financial Commercial Services Banking US$m US$m 6,... -

Page 99

...at fair value ...Gains less losses from financial investments ...Dividend income ...Net earned insurance premiums . Other operating income/ (expense) ...Total operating income ...Net insurance claims17 ...Net operating income5 ...Loan impairment (charges)/ recoveries and other credit risk provisions... -

Page 100

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe > Profit/(loss) before tax by customer group // Hong Kong Analysis by customer group and global business (continued) Profit/(loss) before tax 2006 Personal Financial Services US$m 5,... -

Page 101

Hong Kong Profit/(loss) before tax by customer group and global business 2008 US$m Personal Financial Services ...Commercial Banking ...Global Banking and Markets ...Private Banking ...Other ...3,428 1,315 1,436 237 (955) 5,461 2007 US$m 4,212 1,619 1,578 305 (375) 7,339 2006 US$m 2,880 1,321 955 ... -

Page 102

... rates. Savings and deposit balances grew strongly, particularly in Personal Financial Services, as customers revealed a preference for security and liquidity following declines in equity markets. Deposit growth was augmented by the launch of campaigns offering both preferential time deposit rates... -

Page 103

... and bankruptcy increased in Hong Kong. Although property market declines reduced equity levels for residential mortgage customers, the impact on loan impairment charges was limited as this lending was well-secured and regulatory restrictions constrained origination loanto-value ratios to below... -

Page 104

... in balance sheet management and strong results from the trading businesses and securities services in the buoyant economic environment. Higher demand for structured products and mutual funds drove the increase in Private Banking profits. Cost efficiency ratios improved in all customer groups. Net... -

Page 105

... of a new portfolio wealth management sales tool in the branch network. An increase in IPO activity in Hong Kong, mainly derived from mainland China, had a positive effect on underwriting fees. Life insurance commission income increased, boosted by new product offerings. Credit card fee income... -

Page 106

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Hong Kong > Profit/(loss) before tax by customer group Analysis by customer group and global business Profit/(loss) before tax 2008 Personal Financial Commercial Services Banking US$m US$m ... -

Page 107

... risk provisions ...Net operating income ...Total operating expenses ...Operating profit/(loss) ...Share of profit in associates and joint ventures ...Profit/(loss) before tax ... Share of HSBC's profit before tax ...Cost efficiency ratio ... 17.4 27.2 Balance sheet data15 US$m Loans and advances... -

Page 108

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Hong Kong > Profit/(loss) before tax by customer group // Rest of Asia-Pacific Analysis by customer group and global business (continued) Profit/(loss) before tax 2006 Personal Financial ... -

Page 109

... within customer groups and global businesses Personal Financial Commercial Banking Services US$m US$m 2008 Australia ...India ...Indonesia ...Japan ...Mainland China ...Associates ...Other mainland China ...Malaysia ...Middle East ...Egypt ...United Arab Emirates ...Other Middle East ...Middle East... -

Page 110

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > 2008 Profit/(loss) before tax by country within customer groups and global businesses (continued) Personal Financial Services US$m 2006 Australia ...India ...... -

Page 111

... levels and private and public investment expenditure. High oil revenues continued to boost fiscal and current account surpluses throughout the region during 2008, although the impact of the decline in oil prices during the final months of the year, together with the OPEC-mandated production cuts... -

Page 112

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > 2008 Profit before tax Rest of Asia-Pacific (including the Middle East) Net interest income ...Net fee income ...Net trading income ...Changes in fair value of long-... -

Page 113

... Services and Commercial Banking rose due to customer acquisition, notably among small businesses following the launch of the HSBC Direct for Business product. These deposits were deployed in increasing lending, where spreads improved on the corporate lending and credit card portfolios and mortgage... -

Page 114

... fees from investment products and broking across the region, driven by a decline in equity markets and weakened investor sentiment. Fee income from credit facilities rose, notably in the Middle East, India, Australia and Singapore, reflecting increases in the number of customers. Net trading income... -

Page 115

... account surpluses throughout the Middle East, boosting reserves and holdings of overseas assets. Rapid economic growth, low interest rates and currency weakness increased inflation, however, fuelling demands in some quarters for adjustments to the long-standing dollar pegs. Regional equity markets... -

Page 116

...and trade. In Global Banking and Markets, the rise in net interest income was driven by the recovery in Balance Sheet Management revenues and, as trade and investment flows increased, by higher transactional balances in the payments and cash management businesses. In Personal Financial Services, net... -

Page 117

... where an additional 27 new branches or sub-branches were opened. In India, the branch network and the consumer finance and credit card businesses were all expanded. Marketing, technology and infrastructure costs were incurred in support of business expansion. Share of profit in associates and joint... -

Page 118

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > Profit before tax by customer group Analysis by customer group and global business Profit before tax 2008 Personal Financial Commercial Services Banking US$m US$m 2,... -

Page 119

... other credit risk provisions ...Net operating income ...Total operating expenses ...Operating profit ...Share of profit in associates and joint ventures ...Profit before tax ... Share of HSBC's profit before tax ...Cost efficiency ratio ... 3.1 73.9 Balance sheet data15 US$m Loans and advances to... -

Page 120

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > Profit before tax by customer group // North America > 2008 Analysis by customer group and global business (continued) Profit before tax 2006 Personal Financial ... -

Page 121

North America Profit/(loss) before tax by country within customer groups and global businesses Personal Financial Commercial Services Banking US$m US$m 2008 United States23 ...Canada ...Bermuda ...Other ...(17,364) 106 31 (1) (17,228) 2007 United States ...Canada ...Bermuda ...Other ...226 380 51 1 ... -

Page 122

... HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America > 2008 Profit/(loss) before tax North America Net interest income ...Net fee income ...Net trading income/(expense) ...Changes in fair value of long-term debt issued and related... -

Page 123

... for retail deposits in which HSBC refrained from passing on the full effects of interest rate cuts to customers. Asset spreads widened, particularly in vehicle finance and credit cards and, to a lesser extent, the real estate secured portfolios as yields declined by less than funding costs in... -

Page 124

... due to higher customer acceptance rates of Account Secure Plus and Identity Protection Plan, a rise in syndication, credit and service fees in Commercial Banking and increased fees from asset management. Trading losses were dominated by write-downs in Global Banking and Markets on legacy exposures... -

Page 125

... 11 per cent lower. Staff costs declined, primarily in HSBC Finance, following decisions taken in 2007 to close the acquisition channels for new business in Mortgage Services and a number of consumer lending branches, and integrate the operations of the card businesses. HSBC USA made the decision to... -

Page 126

... Banking and Markets arose from credit-related and liquidity event writedowns as asset-backed securities markets became illiquid and credit spreads widened markedly. Net interest income rose by 4 per cent, as higher revenues from payments and cash management, commercial lending and cards were offset... -

Page 127

... lending businesses, communication expenses increased due to higher mailing volumes on cards and consumer lending as credit collection policies were tightened. In the third quarter, however, expenditure on card marketing declined in line with a decision to slow lending growth. Share of profit... -

Page 128

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America > Profit/loss before tax by customer group Analysis by customer group and global business Profit/(loss) before tax 2008 Personal Financial Commercial Services Banking US$m US... -

Page 129

...241) 22,783 (12,156) 10,627 (10,556) 71 20 91 % 0.4 46.3 Share of HSBC's profit before tax ...Cost efficiency ratio ... (6.4) 42.3 Balance sheet data15 US$m Loans and advances to customers (net) ...Total assets ...Customer accounts ...For footnotes, see page 143. 218,676 237,475 61,824 US$m 38,930... -

Page 130

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America > Profit/loss before tax by customer group // Latin America Analysis by customer group and global business (continued) Profit/(loss) before tax 2006 Personal Financial ... -

Page 131

... country within customer groups and global businesses Personal Financial Commercial Banking Services US$m US$m 2008 Argentina ...Brazil ...Mexico ...Panama ...Other ...- 250 360 51 7 668 2007 Argentina ...Brazil ...Mexico ...Panama ...Other ...111 348 157 37 53 706 Global Banking & Markets US$m 113... -

Page 132

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Latin America > 2008 Profit before tax Latin America Net interest income ...Net fee income ...Net trading income ...Changes in fair value of long-term debt issued and related derivatives ... -

Page 133

... in 2008. Commercial loan volume growth was driven by increased lending for working capital and trade finance loans in Brazil, and medium-sized businesses and the real estate sector in Mexico. Increased income on customer liabilities, which was driven by volume growth, particularly in time deposits... -

Page 134

... of long-term insurance contracts in Brazil in 2008 was offset by a similar adjustment in Mexico in 2007. Loan impairment charges and other credit risk provisions rose by 42 per cent, mainly relating to credit cards, as organically grown portfolios in Mexico seasoned following market share growth... -

Page 135

...offset by increased loan impairment charges in Mexico. Profit before tax in Global Banking and Markets increased as strong growth in net fee and net interest income was partly offset by a decrease in trading income and higher costs related to business expansion. Notwithstanding continuing investment... -

Page 136

... assets and liabilities. In particular, credit card balances increased, driven by marketing and portfolio management initiatives designed to improve customer retention and card usage. Volume growth was achieved in mortgages, commercial real estate lending, trade and factoring. Customer relationship... -

Page 137

Analysis by customer group and global business Profit/(loss) before tax 2008 Personal Financial Commercial Services Banking US$m US$m 4,582 1,339 123 7 130 1,637 536 27 4 31 Global Banking & Markets US$m 579 248 200 8 208 Private Banking US$m 22 35 3 - 3 Intersegment elimination21 US$m (327) - - 327... -

Page 138

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Latin America > Profit/(loss) before tax by customer group Analysis by customer group and global business (continued) Profit/(loss) before tax 2007 Personal Financial Services US$m 3,983 1,... -

Page 139

...Net trading income ...Changes in fair value of long-term debt issued and related derivatives ...Net income from other financial instruments designated at fair value ...Net income/(expense) from financial instruments designated at fair value ...Gains less losses from financial investments ...Dividend... -

Page 140

... personal banking products (current and savings accounts, mortgages and personal loans, credit cards, and local and international payment services), together with consumer finance and wealth management services. In other markets, HSBC participates more selectively, targeting only those customer... -

Page 141

...international trade, under both open account terms and traditional trade finance instruments. HSBC also provides international factoring, commodity and insured export finance, and forfaiting services. The Group utilises its extensive international network to build customer relationships at both ends... -

Page 142

...exchange traded futures; equity services, including research, sales and trading for institutional, corporate and private clients and asset management services; distribution of capital markets instruments, including debt, equity and structured products, utilising HSBC's global network; and securities... -

Page 143

... the year, Global Asset Management remained one of the world's largest emerging market asset managers, with US$52 billion of funds under management. Private Banking's funds under management decreased by 20 per cent to US$219 billion, driven by equity market performance. Net new money, while positive... -

Page 144

... Securities. Various non-US HSBC group companies provide custodial, administration and similar services to a number of funds incorporated outside the United States of America whose assets were invested with Madoff Securities. Based on information provided by Madoff Securities, as at 30 November 2008... -

Page 145

... of shared services and Group Service Centres included within 'Other' which are recovered from customer groups, and (ii) the intra-segment funding costs of trading activities undertaken within Global Banking and Markets. HSBC's balance sheet management business, reported within Global Banking and... -

Page 146

... to direct lending held at fair value through profit or loss and ABSs, including mortgage-backed securities ('MBS's) and collateralised debt obligations ('CDO's), and exposures to and contingent claims on monoline insurers in respect of structured credit activities and leveraged finance transactions... -

Page 147

... longer marked-to-market through the income statement. Amounts reclassified as loans and receivables are accounted as such from the date of reclassification and tested thereafter for the write-downs of ABSs taken to the income statement - US$3.4 billion; the movement in fair values on available... -

Page 148

... of future Effective Amount cash flows2 interest rate reclassified1 US$m US$m % Reclassification to loans and receivables ABSs ...Trading loans - commercial mortgage loans ...Leveraged finance loans ...Reclassification to available for sale Corporate debt and other securities ...8,194 650 6,458 15... -

Page 149

... principal holdings of ABSs are in the Global Banking and Markets' business through special purpose entities ('SPE's) which have the benefit of external investor first loss protection support, positions held directly and by Solitaire Funding Limited ('Solitaire') where HSBC has first loss risk. The... -

Page 150

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Overview > Global Banking and Markets ABSs / Stress analysis // Business model > ABSs / SPEs Global Banking and Markets available-for-sale ABSs exposure At 31 December 2008 Directly held1 SPEs US$m US$m Total carrying ... -

Page 151

...-for-sale ABS positions, based on the fair value of the positions at that date. The outcome of the stress test was particularly sensitive to expected loss and prepayment rates for Alt-A securities and the loss of credit protection from certain monoline insurers on US Home Equity Lines of Credit... -

Page 152

... fair value through profit or loss; ABSs including MBSs and CDOs; monoline insurers; credit derivative product companies ('CDPC's); and leveraged finance transactions. MBSs are securities that represent interests in a group of mortgages. Investors in these securities have the right to cash received... -

Page 153

... relating to leveraged finance loans; student loan-related assets: securities with collateral relating to student loans; and other assets: securities with other receivablerelated collateral. • • • • Carrying amount of HSBC's consolidated holdings of ABSs, and direct lending held at fair... -

Page 154

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Nature and extent of exposures Carrying amount of HSBC's consolidated holdings of ABSs, and direct lending held at fair value through profit or loss (continued) At 31 December 2007 Designated at fair value through Held... -

Page 155

...284 262 22 284 691 755 697 58 1,446 677 614 574 40 1,291 Commercial property mortgage-related assets MBS and MBS CDOs1 ...- high grade2 ...- rated C to A ...- not publicly rated ...Balance carried forward ... (57) (57) - - (2,286) (19) (18) (1) - (8) (1,709) (1,696) (13) - (9,333) - - - - (560... -

Page 156

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Nature and extent of exposures HSBC's consolidated holdings of US ABSs, and direct lending held at fair value through profit or loss (continued) 2008 Fair value Realised movements through gains and equity5 (losses)4 US... -

Page 157

... 756 - 1,172 Commercial property mortgage-related assets MBS and MBS CDOs1 ...- high grade2 ...- not publicly rated ...Leveraged finance-related assets ABSs and ABS CDOs1 - high grade2 ...Student loan-related assets ABSs and ABS CDOs1 ...- high grade2 ...- rated C to A ...Other assets ABS and ABS... -

Page 158

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Nature and extent of exposures HSBC's consolidated holdings of UK ABSs, and direct lending held at fair value through profit or loss (continued) 2008 Fair value Realised movements through gains and equity5 (losses)4 US... -

Page 159

... non-US and non-UK residential mortgage-related assets MBSs1 ...- high grade2 ...- rated C to A ...- not publicly rated ...Commercial property mortgage-related assets MBS and MBS CDOs1 ...- high grade2 ...- rated C to A ...- not publicly rated ...Leveraged finance-related assets ABSs and ABS CDOs1... -

Page 160

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Nature and extent of exposures > Monolines HSBC's consolidated holdings of ABSs, and direct lending held at fair value through profit or loss, other than those supported by US and UK-originated assets (continued) 2007 ... -

Page 161

... was drawn at 31 December 2008 (2007: US$158 million, none drawn). HSBC's exposure to debt securities which benefit from guarantees provided by monoline insurers Within both the trading and available-for-sale portfolios, HSBC holds bonds that are 'wrapped' with a credit enhancement from a monoline... -

Page 162

... / Leveraged finance HSBC's exposure to Credit Derivative Product Companies CDPCs are independent companies that specialise in selling credit default protection on corporate exposures. As corporate credit spreads widened during the second half of 2008, increasing the potential value of claims... -

Page 163

... financial markets developed in the second half of 2007 and continued throughout 2008. Consequently, income statement write-downs on leveraged finance transactions are presented for the three half-year periods affected to date. Half-year to 30 June 2008 US$m 278 - 31 December 2008 US$m Write-downs... -

Page 164

... by a function independent of the risk-taker. To this end, ultimate responsibility for the determination of fair values lies with Finance, which reports functionally to the Group Finance Director. Finance establishes the accounting policies and procedures governing valuation, and is responsible for... -

Page 165

... from several independent support functions (Product Control, Market Risk Management, Derivative Model Review Group and Finance) in addition to senior management. The members of each Valuation Committee consider the appropriateness and adequacy of the fair value adjustments and the effectiveness of... -

Page 166

... Private equity HSBC's private equity positions are generally classified as available for sale and are not traded in active markets. In the absence of an active market, an investment's fair value is estimated on the basis of an analysis of the investee's financial position and results, risk profile... -

Page 167

... fair value in the consolidated financial statements: Bases of valuing financial assets and liabilities measured at fair value Quoted market price US$m At 31 December 2008 Assets Trading assets ...Financial assets designated at fair value ...Derivatives ...Financial investments: available for sale... -

Page 168

... at fair value through Held for trading profit or loss US$m US$m - - - - 5,294 - - 1,215 6,509 - - - - 5,396 - - 588 5,984 Available for sale US$m At 31 December 2008 Private equity investments ...Asset-backed securities ...Leveraged finance ...Loans held for securitisation ...Structured notes... -

Page 169

..., and (ii) a general increase in the fair value of derivative assets during 2008. Trading liabilities valued using a valuation technique with significant unobservable inputs principally comprised equity-linked structured note transactions. These notes, which HSBC issues to investors, provide the... -

Page 170

... including, for example, multiples for comparable listed companies and discounts for marketability. For ABSs whose prices are unobservable, models are used to generate the expected value of the asset, incorporating benchmark information on factors such as prepayment speeds, default rates, loss... -

Page 171

... loans acquired for the purpose of securitisation and credit derivative transactions executed against monoline insurers. HSBC Holdings The following table provides an analysis of the basis for valuing financial assets and financial liabilities measured at fair value in the financial statements... -

Page 172

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Fair values of financial instruments > Carried at fair value / Not carried at fair value Debt securities When assessing available-for-sale debt securities for objective evidence of impairment at the balance sheet date,... -

Page 173

... coupon rates. In general, contractual cash flows are discounted using HSBC's estimate of the discount rate that a market participant would use in valuing instruments with similar maturity, repricing and credit risk characteristics. The fair value of a loan portfolio reflects both loan impairments... -

Page 174

.... No block discount or premium adjustments are made. The fair values of intangible assets related to the businesses which originate and hold the financial instruments subject to fair value measurement, such as values placed on portfolios of core deposits, credit card and customer relationships, are... -

Page 175

... provides an analysis of the fair value of financial instruments not carried at fair value on the balance sheet: Fair values of HSBC Holdings' financial instruments not carried at fair value on the balance sheet 2008 Carrying amount US$m Assets Loans and advances to HSBC undertakings ...Liabilities... -

Page 176

... operation of SIVs to changes in the market value of their underlying assets. In order to remove the risk of having to make forced asset sales, HSBC established three new securities investment conduits (defined below) to take on the assets held in Cullinan and Asscher. Mazarin Funding Limited... -

Page 177

...US$bn Asset class at 31 December 2008 Structured finance Vehicle loans and equipment leases ...Consumer receivables ...Credit card receivables ...Residential MBSs ...Commercial MBSs ...Auto floor plan ...Trade receivables ...Student loan securities ...Vehicle finance loan securities ...Leverage loan... -

Page 178

... Commercial bank securities and deposits ...Investment bank debt securities ...Investment bank securities ...Finance company debt securities ...Other assets ...- - - - 0.9 0.9 12.1 US sub-prime mortgages ...US Alt-A ...0.6 2.3 2.9 Asset class at 31 December 2007 Structured finance Vehicle loans... -

Page 179

... the geographical origin of the mortgage loans held at fair value and ABSs, including those represented by MBSs and CDOs held in consolidated SIVs and securities investment conduits, see 'Nature and extent of HSBC's exposures' on page 150. Total assets by balance sheet classification Other SICs US... -

Page 180

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) SPEs > SIVs and conduits The revolving credit facilities of multi-seller conduits will predominantly have expected average Funding structure Solitaire Provided Total by HSBC US$bn US$bn At 31 December 2008 Capital ... -

Page 181

... only cash and equivalent assets held within the HSBC Group. Consequently, HSBC retains no exposure to the vehicle. Money market funds HSBC has established and manages a number of money market funds which provide customers with tailored investment opportunities with a set of narrow and well-defined... -

Page 182

...money market funds invest in diverse portfolios of highly-rated debt instruments, including limited holdings in instruments issued by SIVs. At 31 December 2008, the exposure of these funds to SIVs was US$0.5 billion (2007: US$3.9 billion). Constant Net Asset Value funds CNAV funds price their assets... -

Page 183

...Non-money market investment funds HSBC, through its fund management business, has established a large number of non-money market funds to enable customers to invest in a range of assets, typically equities and debt securities. At the launch of a fund HSBC, as fund manager, usually provides a limited... -

Page 184

... assets of HSBC's non-money market funds which are on-balance sheet by balance sheet classification At 31 December 2008 2007 US$bn US$bn Cash ...Trading assets ...Financial instruments designated at fair value ...Financial investments ...0.4 0.2 2.3 0.8 3.7 0.4 0.5 3.0 0.2 4.1 Total assets of HSBC... -

Page 185

..., and in structured loans and deposits, where SPEs introduce cost efficiencies. HSBC consolidates these SPEs when the substance of the relationship indicates that HSBC controls the SPE. HSBC's risks and rewards of ownership in these SPEs are in respect of its on-balance sheet assets and liabilities... -

Page 186

... 2008 Total assets ...Direct lending4 ...ABSs4 ...Other 0.4 - - 0.4 Funding provided by HSBC ...CP ...MTNs ...Junior notes ...Term repos executed ...Investments in funds ...Drawn liquidity facility ...Capital notes5 ... Total maximum exposure to consolidated SPEs ... Report of the Directors... -

Page 187

...-wide limited credit enhancements ...Other liquidity and credit enhancements ... 1 2 3 4 The securities investment conduits include Mazarin, Barion, Malachite and Solitaire. Local investment management funds. Also includes consolidated SPEs that hold mortgage loans held at fair value. These assets... -

Page 188

... market funds have been classified as available-for-sale securities, and measured at fair value. HSBC's financial investments in off-balance sheet securitisations have been classified as trading assets and available-for-sale securities, and measured at fair value. 2 In the US, HSBC has established... -

Page 189

... 40 on the Financial Statements. The majority by value of undrawn credit lines arise from 'open to buy' lines on personal credit cards, advised overdraft limits and other pre-approved loan products, and mortgage offers awaiting customer acceptance. HSBC generally has the right to change or terminate... -

Page 190

... these exchanges. In the UK, these are the Listing Rules of the Financial Services Authority ('FSA'); in Hong Kong, The Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited ('HKSE'); in the US, where the shares are traded in the form of ADSs, HSBC Holdings' shares are... -

Page 191

.... These include deposit-taking, retail banking, life and general insurance, pensions, investments, mortgages, custody and share dealing businesses, and treasury and capital markets activity. HSBC Bank plc is HSBC's principal authorised institution in the UK. FSA rules establish the minimum criteria... -

Page 192

..., the furnishing of accurate reports. The HKMA implemented Basel II with effect from 1 January 2007 for all Authorised Institutions incorporated in Hong Kong. The marketing of, dealing in and provision of advice and asset management services in relation to securities in Hong Kong are subject to the... -

Page 193

... sustainability (environmental and social) risks. Market risk includes foreign exchange, interest rate and equity price risks. The management of these various risk categories is discussed below. Insurance risk is managed by the Group's insurance businesses together with their own credit, liquidity... -

Page 194

.... It arises principally from direct lending, trade finance and leasing business, but also from certain off-balance sheet products such as guarantees and credit derivatives, and from the Group's holdings of assets in the form of debt securities. HSBC has standards, policies and procedures 192 -

Page 195

... levels report to GMO Risk. GMO helps build the Group's credit risk management capacity through staff selection, training, development, performance assessment and remuneration - the GCRO is jointly responsible with business heads for setting the performance goals of senior Global Risk officers... -

Page 196

... unit in the development of stress-testing scenarios, economic capital measurement and the refinement of key risk indicators and their reporting, the tools for this being increasingly embedded within the Group's business planning processes. Reporting on aspects of the HSBC credit risk portfolio... -

Page 197

... adopted by the Group to support calculation of its minimum credit regulatory capital requirement. The integration of this methodology into HSBC's risk processes and structures is well advanced and supports reporting on the new basis to senior management in line with the Group's IRB obligations. For... -

Page 198

...established in each reporting entity is documented and reviewed by senior Finance and Credit Risk management to ensure conformity with Group policy. Homogeneous groups of loans Two methodologies are used to calculate impairment allowances where large numbers of relatively lowvalue assets are managed... -

Page 199

... other than credit cards. Cases of write-off periods exceeding 360 days past due are few but arise, for example, in a few countries where local regulation or legislation constrain earlier write-off, or where the realisation of collateral for secured real estate lending extends beyond this time. In... -

Page 200

.... HSBC reduced exposure to banks as it tightened lending limits in response to declining credit quality. Much of this lending was instead placed into government issued or guaranteed debt, which contributed to an increase in financial investments. Loans and advances to customers in the commercial... -

Page 201

... credit risk (Audited) At 31 December 2008 Maximum exposure US$m Items in the course of collection from other banks Trading assets ...- treasury and other eligible bills ...- debt securities ...- loans and advances to banks ...- loans and advances to customers ...Financial assets designated at fair... -

Page 202

...the Financial Statements and an analysis by credit quality is provided on page 218. The insurance businesses held diversified portfolios of debt and equity securities designated at fair value (2008: US$20 billion; 2007: US$34 billion) and debt securities classified as financial investments (2008: US... -

Page 203

...single exposure type. Corporate, commercial and financial lending, including settlement accounts, amounted to 53 per cent of total loans and advances to customers at 31 December 2008. The largest industry concentrations were in non-bank financial institutions and commercial real estate lending at 10... -

Page 204

... for new originations. In HSBC USA, balances declined by 32 per cent, primarily due to the sale of US$7.0 billion of mortgage portfolios during 2008 and the fact that the majority of loan originations continued to be sold in the secondary markets. In line with HSBC's reduced risk appetite... -

Page 205

... large corporates. Balances declined in France due to the sale of the regional banks in July 2008. In Hong Kong, corporate and commercial lending rose by 19 per cent, driven by higher lending in commercial, industrial and international trade, commercial real estate and other property-related sectors... -

Page 206

... in the trade loans portfolio and working capital products. Loans and advances to the financial sector rose by 15 per cent with strong growth in the UK and North America, largely in collateralised lending. Lending balance were 46 per cent higher in the UK due to the increased use of secured funding... -

Page 207

... ...Corporate and commercial ...Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government ...Other commercial2 ...Financial ...Non-bank financial institutions Settlement accounts ...Asset-backed securities reclassified...Total gross loans and... -

Page 208

... a credit card portfolio as impaired. There has been no effect on impairment allowances. Gross loans and advances to customers by principal country within Rest of Asia-Pacific and Latin America (Audited) Commercial, international trade and other US$m Residential mortgages US$m At 31 December 2008... -

Page 209

...outstandings comprise loans and advances (excluding settlement accounts), amounts receivable under finance leases, acceptances, commercial bills, CDs and debt and equity securities (net of short positions), and exclude accrued interest and intra-HSBC exposures. In-country foreign currency and cross... -

Page 210

...assets being acquired. HSBC also offers loans secured on existing assets, such as first and second liens on residential property; unsecured lending products such as overdrafts, credit cards and payroll loans; and debt consolidation loans which may be secured or unsecured. At the end of February 2009... -

Page 211

... to end new correspondent channel originations in Mortgage Services and limit new originations in the consumer lending business through tighter underwriting standards. Portfolio run-off, charge-off of impaired loans and the sale of US$8.2 billion of loans during 2008 from the US real estate secured... -

Page 212

... Finance in North America (see page 70). Mortgage lending in HSBC USA also declined, following a series of management actions to reduce risk in the portfolio. These included closing the prime wholesale and third-party correspondent mortgage business in November 2008, selling US$7.0 billion in loans... -

Page 213

... of 2008 in generating new business, and an increase at First Direct due to growth in offset mortgage lending following a similarly successful campaign. The maintenance of good credit quality in difficult market conditions is attributable to the business model pursued by HSBC in the UK. HSBC Bank... -

Page 214

...) Credit risk > Areas of special interest > Mortgage lending / US personal lending above. Additionally, HSBC Bank is now benefiting from having intentionally reduced its market share in 2006 and 2007 as property prices continued to rise. The portion of mortgages with a loan to value ratio greater... -

Page 215

... sold during the year. Both dollar and percentage two months and over contractual delinquency in the real estate secured portfolios of HSBC Finance and HSBC USA increased following a voluntary one month suspension of final court proceedings in foreclosure cases relating to owner-occupied properties... -

Page 216

... in 2007. At HSBC USA, delinquencies rose as credit quality deterioration was experienced across the real estate secured portfolio, driven by house price depreciation and the US economic weakness. Delinquency rates of prime first lien mortgages were also affected by the sale of US$7.0 billion... -

Page 217

... earlier terminated a number of dealer relationships, particularly in the Northeast of the US. Other personal lending Higher delinquency rates were experienced in the HSBC Finance unsecured lending portfolio, excluding credit cards. The increase was driven by a deterioration in credit quality due to... -

Page 218

... related to loans secured on real estate. US loan modifications (Unaudited) In 2008, HSBC Finance continued to refine and expand its customer account management policies and practices. Through its ARM Reset Modification Programme, established in October 2006, HSBC Finance proactively contacts... -

Page 219

...Credit quality of HSBC's lending, debt securities and other bills under previous programmes. Innovations included lowering the interest rate for qualifying customers on fixed rate loans as well as ARMs, and implementing longer term modifications, providing assistance generally for two to five years... -

Page 220

... with short-term issue ratings are reported against the long-term rating of the issuer of those securities. If major rating agencies have different ratings for the same debt securities, a prudent rating selection is made in line with regulatory requirements. Additional credit quality information in... -

Page 221

...overdue loans fully secured by cash collateral; mortgages that are individually assessed for impairment, and that are in arrears more than 90 days, but where the value of collateral is sufficient to repay both the principal debt and all potential interest for at least one year; and short-term trade... -

Page 222

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Credit quality > Past due but not impaired // Impaired loans and advances > 2008 Past due but not impaired loans and advances to customers and banks by industry sector At 31 December 2008 US$m Banks ...Customers ...Personal1... -

Page 223

... the end of 2007. The increase was driven by the UK where credit quality in the UK commercial portfolio deteriorated sharply in the final quarter of the year. A small number of exposures in the commercial real estate sector were particularly affected by a sharp deterioration in market conditions in... -

Page 224

... ...Number of properties added to foreclosed inventory in the year/quarter ...Average loss on sale of foreclosed properties1 ...Average total loss on foreclosed properties2 ...Average time to sell foreclosed properties (days) ...9,589 20,051 13% 42% 177 customer. HSBC does not generally occupy... -

Page 225

... to EL8 but excluding retail loans 90 days past due. 4 The 2007 collectively assessed impaired loans and advances for North America have been increased from US$7,963 million to US$9,241 million as a result of the reclassification of an element of a credit card portfolio as impaired. There has been... -

Page 226

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Impairment allowances > Movements Impairment allowances on loans and advances to customers and banks by industry sector (Audited) At 31 December 2008 Individually Collectively assessed assessed Total allowances allowances ... -

Page 227

...mortgages ...- other personal ...Corporate and commercial ...- commercial, industrial and international trade ...- commercial real estate and other property-related ...- other commercial ...Financial4 ...Governments ...General provisions ...Exchange... customers as a percentage of loans and advances to... -

Page 228

... and international trade ...- commercial real estate and other property-related - other commercial ...Financial4 ...Exchange and other movements ...Impairment allowances at 31 December ...Impairment allowances against banks: - individually assessed ...Impairment allowances against customers... -

Page 229

... statement1 ...Personal ...- residential mortgages ...- other personal ...Corporate and commercial ...- commercial, industrial and international trade ...- commercial real estate and other property-related - other commercial ...Financial4 ...Governments ...Exchange and other movements ...Impairment... -

Page 230

... (Unaudited) 2008 Individually Collectively assessed assessed US$m US$m Banks ...Personal ...Residential mortgages ...Other personal ...Corporate and commercial ...Commercial, industrial and international trade ...Commercial real estate and other property-related ...Other commercial ...Financial... -

Page 231

... per cent compared with 2007. This primarily reflected higher impairment charges in Global Banking and Markets following a significant charge against a single European commercial real estate corporate customer. Loan impairment charges increased by 40 per cent to US$24.1 billion from US$17.2 billion... -

Page 232

... uncovered in the UK residential property market. Credit quality in the unsecured portfolios of M&S Money, HSBC Bank and Partnership Cards deteriorated slightly in 2008, particularly in the second half of the year, due to the weakening UK economy. Releases and recoveries in Europe declined by 27 per... -

Page 233

... of the portfolio seasoned. Releases and recoveries in North America decreased to US$116 million. In the US consumer finance business, collection staff increased in all lending portfolios as part of the response to the deteriorating credit environment. In Latin America, new loan impairment charges... -

Page 234

... their business. These risks are reviewed and managed within regulatory and internal limits for exposures by the HSBC Global Risk function, which provides highHSBC Holdings - maximum exposure to credit risk Maximum exposure 2008 2007 US$m US$m Derivatives ...Loans and advances to HSBC undertakings... -

Page 235

...100 per cent). The credit quality of loans and advances to HSBC undertakings is assessed as satisfactory risk, with 100 per cent of the exposure being neither past due nor impaired (2007: 100 per cent). The long-term debt ratings of HSBC Group issuers of financial investments are within the Standard... -

Page 236

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Risk elements / Liquidity and funding > Policies / Primary sources of funding Analysis of risk elements (Unaudited) 2008 US$m Impaired loans Europe ...Hong Kong ...Rest of Asia-Pacific ...North America1 ...Latin America ... -

Page 237

...operates. HSBC's liquidity and funding management process includes: • projecting cash flows by major currency under various stress scenarios and considering the level of liquid assets necessary in relation thereto; monitoring balance sheet liquidity and advances to deposits ratios against internal... -

Page 238

... upon. Advances to deposits ratio (Audited) HSBC emphasises the importance of core current accounts and savings accounts as a source of funds to finance lending to customers, and discourages reliance on short-term professional funding. This is achieved by placing limits on Group banking entities... -

Page 239

..., HSBC defines liquid assets as cash balances, short-term interbank deposits and highly-rated debt securities available for immediate sale and for which a deep and liquid market exists. Contingent liquidity risk associated with committed loan facilities is not reflected in the ratios. The Group... -

Page 240

...under the contingent liquidity risk limit structure (Audited) HSBC Bank 2008 2007 US$bn US$bn Conduits Client-originated assets1 ...- total lines ...- largest individual lines ...HSBC-managed assets2 ...Other conduits3 ...Single-issuer liquidity facilities - five largest4 ...- largest market sector5... -

Page 241

... credit markets. As part of these plans, asset portfolios totalling US$15.3 billion were transferred from HSBC Finance to HSBC Bank USA in January 2009, resulting in US$8.0 billion of net funding benefit to HSBC Finance. HSBC Finance is eligible to participate in the US Federal Reserve's Commercial... -

Page 242

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Liquidity and funding > HSBC Holdings // Market risk > Sensitivity / VAR HSBC Holdings (Audited) HSBC Holdings' primary sources of cash are interest and capital receipts from its subsidiaries, which it deploys in short-term bank deposits... -

Page 243

...-trading portfolios include positions that arise from the interest rate management of HSBC's retail and commercial banking assets and liabilities, financial investments designated as available for sale and held to maturity, and exposures arising from HSBC's insurance operations. Market risk arising... -

Page 244

...structural foreign exchange risk is monitored using sensitivity analysis. See page 429. 2 The interest rate risk on the fixed-rate securities issued by HSBC Holdings is not included in the Group VAR. The management of this risk is described on page 249. 3 Credit spread VAR is reported for the credit... -

Page 245