GNC 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

Table of Contents

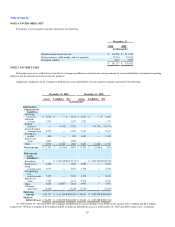

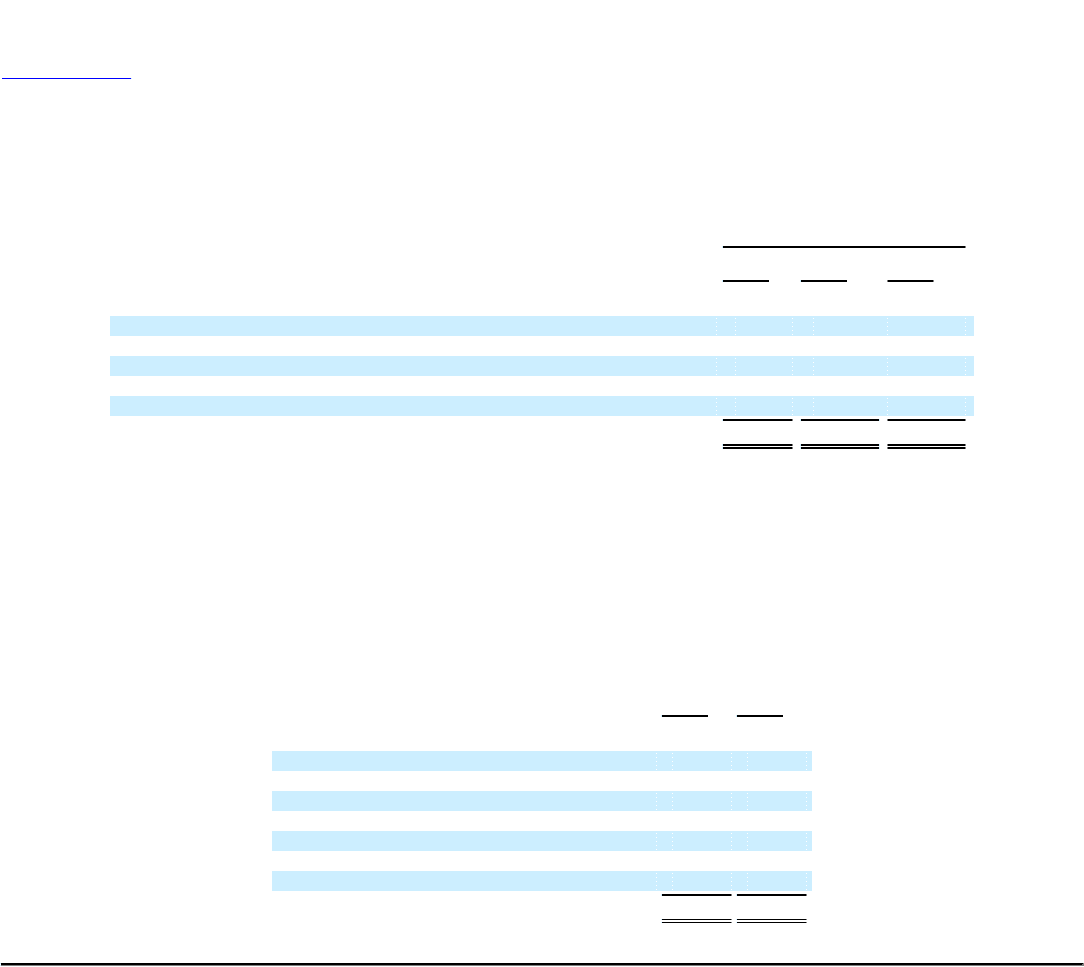

NOTE 5. INCOME TAXES (Continued)

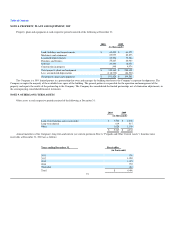

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

December 31,

2010 2009 2008

(in thousands)

Balance of unrecognized tax benefits at beginning of period $ 6,776 $ 5,542 $ 6,871

Additions for tax positions taken during current period 1,027 1,881 1,620

Additions for tax positions taken during prior periods 1,880 2,108 —

Reductions for tax positions taken during prior periods (39) (2,264) (2,059)

Settlements (924) (491) (890)

Balance of unrecognized tax benefits at end of period $ 8,720 $ 6,776 $ 5,542

At December 31, 2010, the amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate is $8.7 million. While it is often

difficult to predict the final outcome or the timing of resolution of any particular uncertain tax position, the Company believes that its unrecognized tax

benefits reflect the most likely outcome. The Company adjusts these unrecognized tax benefits, as well as the related interest, in light of changing facts and

circumstances. Settlement of any particular position could require the use of cash. Favorable resolution would be recognized as a reduction to its effective

income tax rate in the period of resolution.

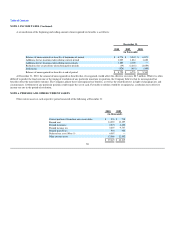

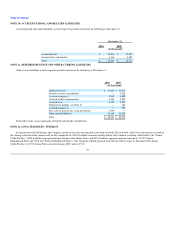

NOTE 6. PREPAIDS AND OTHER CURRENT ASSETS

Other current assets at each respective period consisted of the following at December 31:

2010 2009

(in thousands)

Current portion of franchise note receivables $ 976 $ 718

Prepaid rent 14,003 13,397

Prepaid insurance 2,974 4,452

Prepaid income tax 3,607 9,737

Prepaid payroll tax 992 923

Deferred tax asset (Note 5) 4,007 —

Other current assets 13,066 12,992

$ 39,625 $ 42,219

88