GNC 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

The Company has interest rate swap agreements outstanding that effectively converted notional amounts of an aggregate $550.0 million of debt from

floating to fixed interest rates. The four outstanding agreements mature between April 2011 and September 2012. During the second quarter of 2009, the

Company entered into one of its derivative contracts that consisted of an interest rate swap with a bought floor that effectively converted a notional amount of

$150.0 million of the Senior Floating Rate Toggle Notes due 2014 (the "Senior Notes") from a floating to a fixed rate, effective September 2009. The floor is

intended to replicate the optionality present in the original debt agreement, providing an equivalent offset in the interest payments.

Amounts reported in accumulated other comprehensive income related to derivatives will be reclassified to interest expense as interest payments are

made on the Company's variable-rate debt. During the year ending December 31, 2011, the Company estimates that an additional $6.6 million will be

reclassified as an increase to interest expense under the Company's current debt structure.

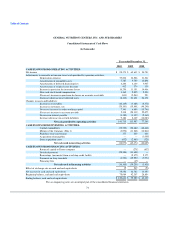

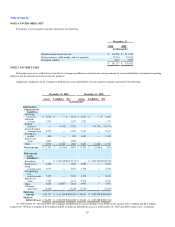

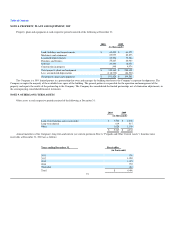

Components of gains and losses recorded in the consolidated balance sheet and consolidated income statements for the years ended December 31, 2010

and 2009 are as follows:

2010

Derivatives in Cash

Flow Hedging

Relationships

Amount of Gain or

(Loss) Recognized

in OCI on

Derivative

(Effective Portion)

Location of Gain or

(Loss) Reclassified

from Accumulated

OCI into Income

(Effective Portion)

Amount of Gain or

(Loss) Reclassified

from Accumulated

OCI into Income

(Effective Portion)

(in thousands)

Interest Rate Products $ (7,393)Interest income/ (expense) $ (14,602)

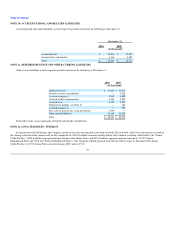

2009

Derivatives in Cash

Flow Hedging

Relationships

Amount of Gain or

(Loss) Recognized

in OCI on

Derivative

(Effective Portion)

Location of Gain or

(Loss) Reclassified

from Accumulated

OCI into Income

(Effective Portion)

Amount of Gain or

(Loss) Reclassified

from Accumulated

OCI into Income

(Effective Portion)

(in thousands)

Interest Rate Products $ (9,024)Interest income/ (expense) $ (13,247)

During the years ended December 31, 2010 and 2009, there was no amount recorded as ineffective from accumulated other comprehensive income.

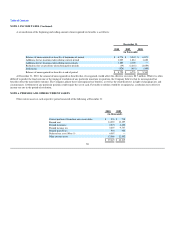

Under the Company's agreements with its derivative counterparty, if the Company defaults on any of its indebtedness, including default where

repayment of the indebtedness has not been accelerated by the lender, then the Company could also be declared in default on its derivative obligations.

As of December 31, 2010, the settlement value of derivatives in a net liability position related to these agreements was $10.6 million, including accrued

interest of $2.9 million but excluding adjustments for nonperformance risk. If the Company had breached any of these provisions at December 31, 2010, it

could have been required to settle its obligations under the agreements at

83