GNC 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 24. RELATED PARTY TRANSACTIONS (Continued)

proprietary brand name GNC WELLbeING®. Carmen Fortino, who serves as one of Parent's directors, was the Managing Director, a member of the board of

directors and a stockholder of Lifelong's parent company. The aggregate value of the products the Company purchased from Lifelong was $2.3 million and

$3.3 million for the 2010 and 2009 fiscal years, respectively. Effective December 31, 2010, Lifelong's parent company was sold to a third party and

Mr. Fortino resigned his positions at Lifelong.

Product Development and Distribution Agreement. On June 3, 2010, General Nutrition Corporation, a wholly owned subsidiary of the Company,

and Lifelong entered into a Product Development and Distribution Agreement (the "Lifelong Agreement"), pursuant to which General Nutrition Corporation

and Lifelong will develop a branded line of supplements to be manufactured by Lifelong. As described above, Mr. Fortino was the Managing Director, a

member of the board of directors and a stockholder of Lifelong's parent company. Products manufactured under the Lifelong Agreement and sold in the

Company's stores will be purchased by the Company from Lifelong; products sold outside of the Company's stores will be subject to certain revenue sharing

arrangements. For the year ended December 31, 2010, the Company made $1.3 million in product purchases from Lifelong under the Lifelong Agreement.

Effective December 31, 2010, Lifelong's parent company was sold to a third party and Mr. Fortino resigned his positions at Lifelong.

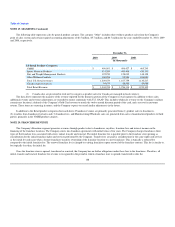

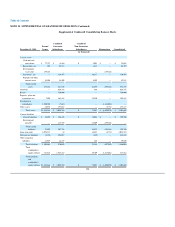

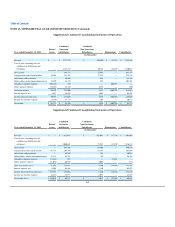

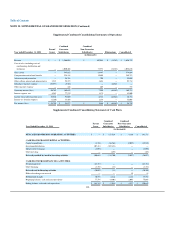

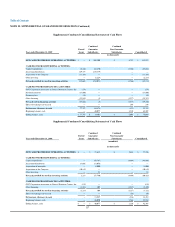

NOTE 25. SUPPLEMENTAL GUARANTOR INFORMATION

As of December 31, 2010 the Company's debt included its Senior Credit Facility, Senior Notes and Senior Subordinated Notes. The Senior Credit

Facility has been guaranteed by GNC Corporation and the Company's existing and future direct and indirect material domestic subsidiaries. The Senior Notes

are general non collateralized obligations of the Company, are effectively subordinated to the Company's Senior Credit Facility to the extent of the value of

the collateral securing the Senior Credit Facility and are senior in right of payment to all existing and future subordinated obligations of the Company,

including its Senior Subordinated Notes. The Senior Notes are unconditionally guaranteed on a non collateralized basis by all of the Company's existing and

future direct and indirect material domestic subsidiaries. The Senior Subordinated Notes are general non collateralized obligations and are guaranteed on a

senior subordinated basis by the Company's existing and future direct and indirect material domestic subsidiaries and rank junior in right of payment to the

Company's Senior Credit Facility and Senior Notes. The guarantors are the same for the Senior Credit Facility, Senior Notes and Senior Subordinated Notes.

Non-guarantor subsidiaries include the remaining direct and indirect foreign subsidiaries. The subsidiary guarantors are 100% owned, directly or indirectly,

by the Company. The guarantees are full and unconditional and joint and several. Investments in subsidiaries are accounted for under the equity method of

accounting.

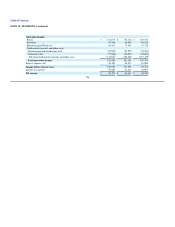

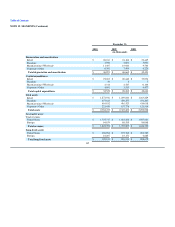

Presented below are condensed consolidated financial statements of the Company as the parent/issuer, and the combined guarantor and non-guarantor

subsidiaries for the years ended December 31, 2010, 2009 and 2008. Intercompany balances and transactions have been eliminated.

The Company reorganized its corporate structure effective January 1, 2009. Certain guarantor subsidiaries were merged with and into the Company (the

"Parent/Issuer"), which remained the Parent/Issuer after the reorganization; certain other guarantor subsidiaries were merged with and into each other.

Supplemental guarantor information for periods prior to January 1, 2009 reflect the corporate structure that existed prior to the reorganization.

112