GNC 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

accrues at the rate of 10.75% per year from March 16, 2007 and is payable semi-annually in arrears on March 15 and September 15 of each year, beginning on

September 15, 2007.

We may redeem some or all of the Senior Subordinated Notes at any time, at specified redemption prices. If we experience certain kinds of changes in

control, we must offer to purchase the Senior Subordinated Notes at 101% of par plus accrued interest to the purchase date.

The Senior Subordinated Notes indenture contains certain limitations and restrictions on our and our restricted subsidiaries' ability to incur additional

debt beyond certain levels, pay dividends, redeem or repurchase our stock or subordinated indebtedness or make other distributions, dispose of assets, grant

liens on assets, make investments or acquisitions, engage in mergers or consolidations, enter into arrangements that restrict our ability to pay dividends or

grant liens and engage in transactions with affiliates. In addition, the Senior Subordinated Notes indenture restricts our and certain of our subsidiaries' ability

to declare or pay dividends to our stockholders.

Proposed Refinancing. On February 7, 2011, we announced that we intend to enter into, subject to market and other conditions, a financing

transaction with certain lenders. We currently expect the transaction to consist of a $1.2 billion term loan facility with a term of seven years and an

$80 million revolving credit facility with a term of five years. We currently expect to use the proceeds from the new facility, if consummated, together with

cash on hand, to refinance our existing indebtedness, including all outstanding indebtedness under the Senior Credit Facility, the Senior Notes and the Senior

Subordinated Notes, to fund a dividend to our Parent for the redemption of a portion of its Series A preferred stock, and to pay related fees and expenses. We

refer to this transaction and the expected use of proceeds collectively as the "Refinancing". We currently expect to consummate the Refinancing in March

2011; however, there can be no assurance that we will complete the Refinancing either on terms acceptable to us or at all.

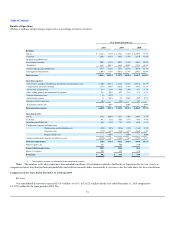

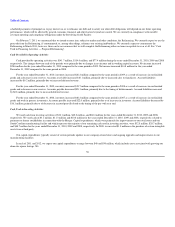

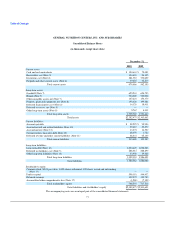

Contractual Obligations

The following table summarizes our future minimum non-cancelable contractual obligations at December 31, 2010:

Payments due by period

(in millions) Total Less than

1 year 1-3 years 4-5 years After 5 years

Long-term debt

obligations(1) $1,060.1 $ 28.1 $ 621.4 $ 300.6 $ 110.0

Scheduled interest

payments(2) 177.6 59.1 99.9 18.6 —

Operating lease

obligations(3) 430.8 110.9 153.8 88.5 77.6

Purchase

commitments(4)

(5) 19.8 9.7 4.3 4.0 1.8

$1,688.3 $ 207.8 $ 879.4 $ 411.7 $ 189.4

These balances consist of the following debt obligations: (a) $644.4 million for the Senior Credit Facility based on a variable interest

rate; (b) $300.0 million for our Senior Notes based on a variable interest rate; (c) $110.0 million for our Senior Subordinated Notes

with a fixed interest rate; and (d) $5.7 million for our mortgage with a fixed interest rate. Repayment of the Senior Credit Facility is

based on the current amortization schedule and does not take into account any unscheduled payments that may occur due to our future

cash positions.

The interest that will accrue on the long-term obligations includes variable rate payments, which are estimated using the associated

LIBOR index as of December 31, 2010. The Senior Credit Facility uses the three month LIBOR index while the Senior Notes use the

six month LIBOR index. Also included in the scheduled interest payments is the activity associated with

(1)

(2)

61