GNC 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

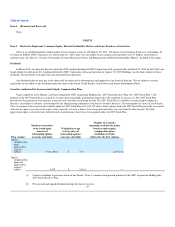

Table of Contents

The following trends and uncertainties in our industry could affect our operating performance as follows:

broader consumer awareness of health and wellness issues and rising healthcare costs may increase the use of the products we offer and

positively affect our operating performance;

interest in, and demand for, condition-specific products based on scientific research may positively affect our operating performance if we can

timely develop and offer such condition specific products;

the effects of favorable and unfavorable publicity on consumer demand with respect to the products we offer may have similarly favorable or

unfavorable effects on our operating performance;

a lack of long-term experience with human consumption of ingredients in some of our products could create uncertainties with respect to the

health risks, if any, related to the consumption of such ingredients and negatively affect our operating performance;

increased costs associated with complying with new and existing governmental regulation may negatively affect our operating performance; and

a decline in disposable income available to consumers may lead to a reduction in consumer spending and negatively affect our operating

performance.

Executive Overview

Our recent results of operations reflect steady growth, including through a difficult economic environment and despite a short-term reduction in revenue

that we experienced in 2009 due to the Hydroxycut recall. For the year ended December 31, 2010, we achieved revenue growth of 6.8%, operating income

growth of 18.4% and net income growth of 41.0% compared to the same period in 2009. Operating income growth resulted from higher sales and margins in

our retail and franchise segments and effective cost controls on unallocated expenses. Net income growth resulted primarily from higher operating income,

lower interest expense, and a lower effective tax rate.

Recent revenue growth in our domestic retail segment has been driven primarily by increases in the sports nutrition category resulting from new product

introductions. In addition, we have experienced significant growth in our GNC.com business primarily as a result of our redesigned website. Our domestic

retail comparable store sales increased 5.6% in 2010 compared to 2009. Included in this increase is a 26.2% increase in our GNC.com business. In recent

periods, our domestic franchise business has achieved increased product sales despite a lower store base. Sales in the international franchise business have

grown steadily as a result of an increased store base and strong organic sales growth.

Our manufacturing strategy is designed to provide our stores with proprietary products at the lowest possible cost, and utilize additional capacity to

promote production efficiencies and enhance our position in the third-party contract business. Under this strategy, our third-party manufacturing sales grew

3.8% and 38.7% in 2009 and 2008, respectively, over the prior year periods. For the year ended December 31, 2010, our manufacturing segment experienced

reduced sales in contract manufacturing compared to 2009, partially offset by higher product sales to Rite Aid, www.drugstore.com and PetSmart. The

reduction in the contract manufacturing business reflects a transition period during which we are moving from low margin commodity contracts to higher

margin, specialty product contracts.

We also continue to invest in opportunities to expand our brand beyond our existing domestic company-owned footprint and partner with companies

like PepsiCo and PetSmart to develop new

48

•

•

•

•

•

•