GNC 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 5. INCOME TAXES (Continued)

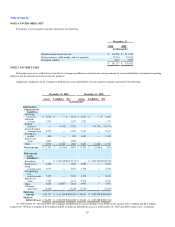

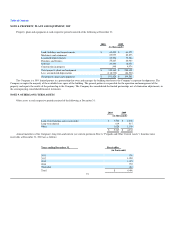

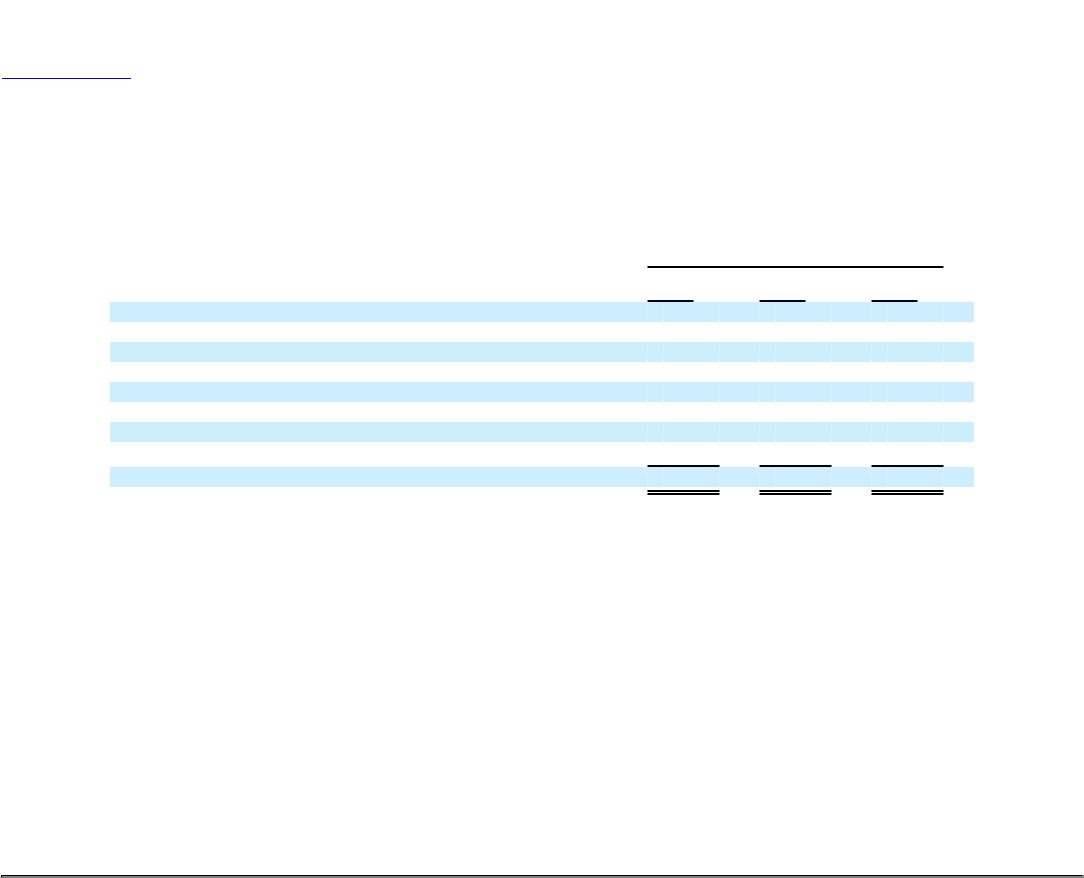

The following table summarizes the differences between the Company's effective tax rate for financial reporting purposes and the federal statutory tax

rate.

Year Ended December 31,

2010 2009 2008

Percent of pretax earnings:

Statutory federal tax rate 35.0% 35.0% 35.0%

Increase (reduction) resulting from:

State income tax, net of federal tax benefit 0.9% 2.6% 2.6%

Other permanent differences 0.6% 0.9% 1.2%

International operations, net of foreign tax credits 0.1% (0.6%) —

Federal tax credits and income deductions (4.1%) (1.4%) (2.5%)

Tax impact of uncertain tax positions and other 1.6% 0.9% 0.6%

Effective income tax rate 34.1% 37.4% 36.9%

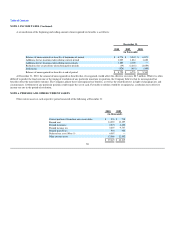

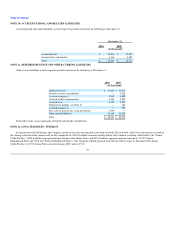

Due to the Company being able to fully utilize its remaining federal net operating losses in 2009, the Company was able to realize additional federal

income tax benefits during 2010 related to certain federal tax credits and incentives. In addition, at December 31, 2010 and 2009, the Company had a liability

of $8.7 million and $6.8 million, respectively, for unrecognized tax benefits. The Company recognizes interest and penalties accrued related to unrecognized

tax benefits in income tax expense. Accrued interest and penalties were $2.9 million and $2.2 million as of December 31, 2010 and 2009, respectively.

As of December 31, 2010, the Company is not aware of any positions for which it is reasonably possible that the total amounts of unrecognized tax

benefits will significantly increase or decrease within the next 12 months.

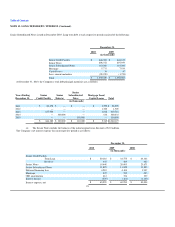

The Company files a consolidated federal tax return and various consolidated and separate tax returns as prescribed by the tax laws of the state and local

jurisdictions in which it and its subsidiaries operate. The Company has been audited by the Internal Revenue Service, ("IRS"), through its March 15, 2007 tax

year. The IRS commenced an examination of the Company's 2005, 2006 and short period 2007 federal income tax returns in February 2008. The IRS issued

an examination report in the second quarter of 2009, the Company received notification from the IRS that the Joint Committee of Taxation had completed its

review and had taken no exceptions to the conclusions reached by the IRS. As such the Company recorded a discrete tax benefit of $0.9 million for the

reduction of its liability of unrecognized tax benefits. The Company has various state and local jurisdiction tax years open to examination (earliest open period

2004), and the Company also has certain state and local jurisdictions currently under audit. As of December 31, 2010, the Company believes that it is

appropriately reserved for any potential federal and state income tax exposures.

87