GNC 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

On September 1, 2009, David Berg joined the Company as its Executive Vice President of Global Business Development and Chief Operating Officer,

International. In connection with his employment, our Parent's compensation committee granted Mr. Berg certain options (the "Preferred Stock Options") to

purchase 12,750 shares of our Parent's Series A preferred stock pursuant to the terms of a preferred stock option agreement (the "Preferred Stock Option

Agreement"). The Preferred Stock Options are not governed by the 2007 Stock Plan, and the grant was not approved by our or our Parent's security holders.

The Preferred Stock Options have an exercise price equal to $5.00 per share (plus accrued and unpaid dividends through the date of exercise). A portion of the

Preferred Stock Options vested on the first anniversary of his employment. The balance vests on the second anniversary; provided that Mr. Berg is permitted

to exercise his vested Preferred Stock Options only within the seven day period following each vesting date. If Mr. Berg does not exercise his vested Preferred

Stock Options within such exercise period, then such vested Preferred Stock Options terminate and expire. See Item 11, "Executive Compensation —

Employment and Separation Agreements".

On September 8, 2010, pursuant to the terms of the Preferred Stock Option Agreement, Mr. Berg exercised options to purchase 4,749 shares of our

Parent's Series A preferred stock at an exercise price of $5.00 per share plus accrued and unpaid dividends through September 7, 2010 for an aggregate

purchase price of $33,480.

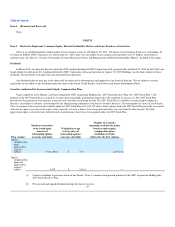

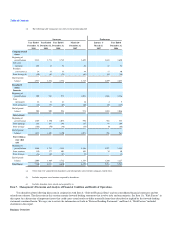

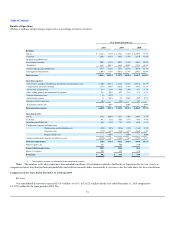

Item 6. Selected Financial Data.

The selected consolidated financial data presented below as of December 31, 2010 and 2009 and for the years ended December 31, 2010, 2009 and

2008 are derived from our audited consolidated financial statements and footnotes included in this report. The selected consolidated financial data presented

below as of December 31, 2007 and 2006, and for the periods from March 16, 2007 to December 31, 2007 (the "2007 Successor Period" and, collectively with

the years ended December 31, 2010, 2009 and 2008, the "Successor Periods") and from January 1, 2007 to March 15, 2007, and for the year ended

December 31, 2006, are derived from our audited consolidated financial statements and footnotes, which are not included in this report. The selected

consolidated financial data as of December 31, 2006 and for the period January 1, 2007 to March 15, 2007 and for the year ended December 31, 2006

represent the period during which GNC Parent Corporation was owned by an investment fund managed by Apollo Management V, L.P. ("Apollo").

Holdings, together with its wholly owned subsidiary, GNC Acquisition Inc., entered into the Merger Agreement with GNC Parent Corporation on

February 8, 2007. On March 16, 2007, the Merger was consummated. As a result of the Merger, the consolidated statement of operations for the successor

period includes the following: interest and amortization expense resulting from the issuance of the Senior Notes and the Senior Subordinated Notes; and

amortization of intangible assets related to the Merger. Further, as a result of purchase accounting, the fair values of our assets on the date of the Merger

became their new cost basis.

44