GNC 2011 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

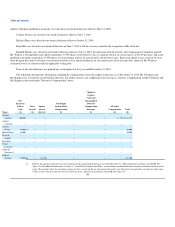

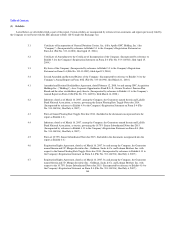

Andrew Claerhout and Romeo Leemrijse were elected to our board of directors effective May 14, 2009.

Carmen Fortino was elected to our board of directors effective July 17, 2007.

Michael Hines was elected to our board of directors effective October 21, 2009.

Brian Klos was elected to our board of directors on June 7, 2010 to fill the vacancy created by the resignation of Mr. Schwartz.

Richard Wallace was elected to our board of directors effective July 14, 2010. In connection with his election, the Compensation Committee granted

Mr. Wallace a non-qualified stock option to purchase 17,500 shares of our Parent's Class A common stock at an exercise price of $11.09 per share, and a non-

qualified stock option to purchase 17,500 shares of such common stock at an exercise price of $16.63 per share. Each stock option (i) has a term of 10 years

from the grant date and (ii) becomes vested and exercisable in five equal installments on each anniversary of the election date, subject to Mr. Wallace's

continued service as a director until the applicable vesting date.

None of our other directors was granted any stock options for the year ended December 31, 2010.

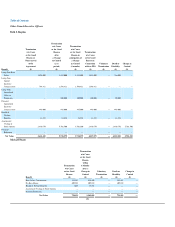

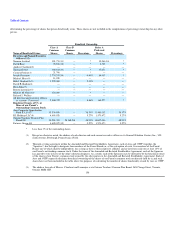

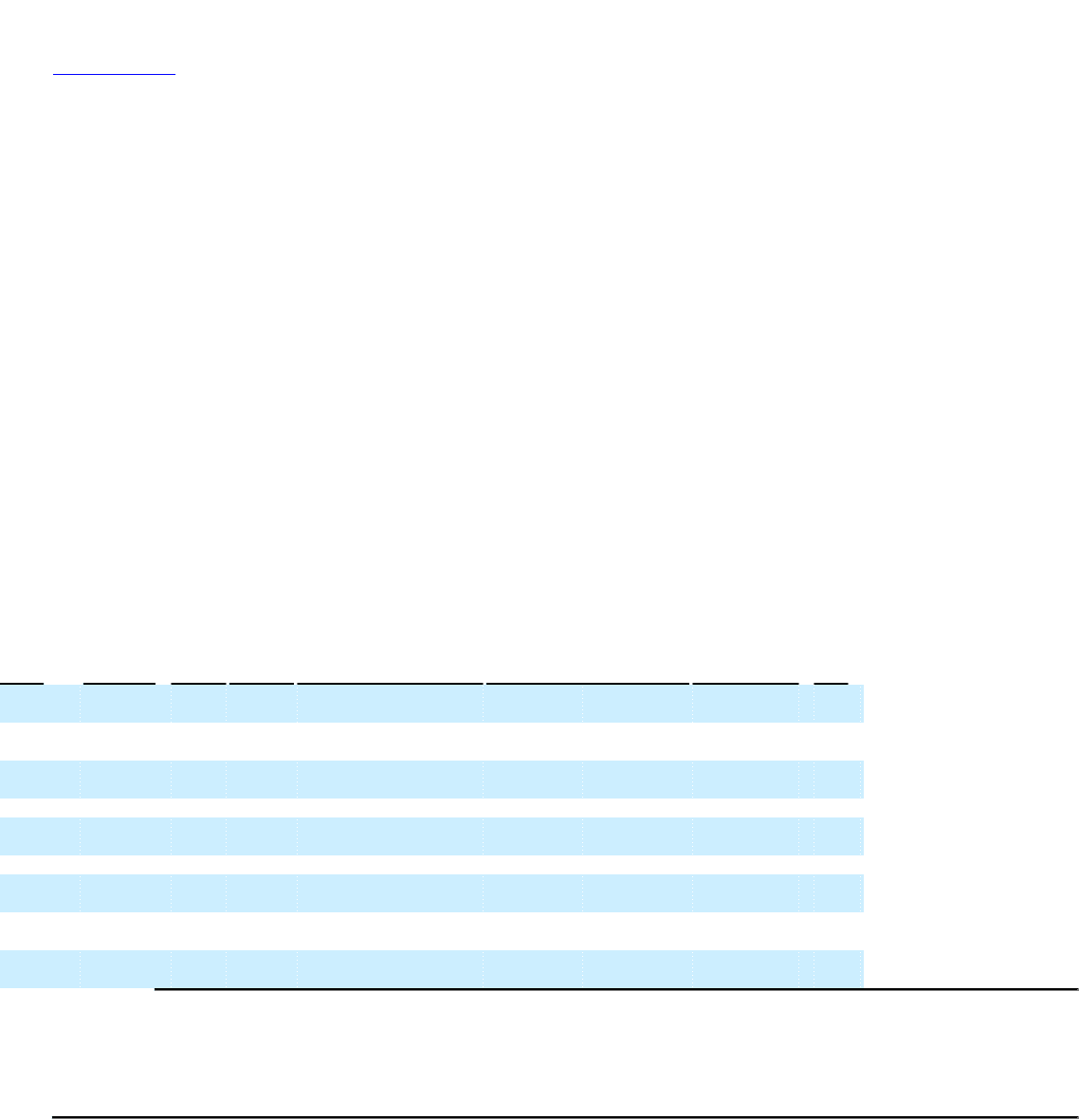

The following table presents information regarding the compensation of our non-employee directors as of December 31, 2010. Mr. Fortunato and

Ms. Kaplan serve as members of our board of directors, but neither receives any compensation for serving as a director. Compensation for Mr. Fortunato and

Ms. Kaplan is discussed under "Executive Compensation" above.

Name

Fees

Earned or

Paid in

Cash

($)

Stock

Awards

($)

Option

Awards

($)(1),(2)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension

Value and

Non-qualified

Deferred

Compensation

Earnings

($)

All Other

Compensation

($)

Total

($)

Norman

Axelrod 200,000 — — — — 11,795(3) 211,795

Andrew

Claerhout — — — — — — —

Carmen

Fortino 40,000(4) — — — — — 40,000

Michael Hines 40,000 — — — — — 40,000

David B.

Kaplan — — — — — — —

Brian Klos — — — — — — —

Romeo

Leemrijse — — — — — — —

Jeffrey B.

Schwartz(5) — — — — — — —

Richard

Wallace 30,000(6) — 121,100 — — — 151,100

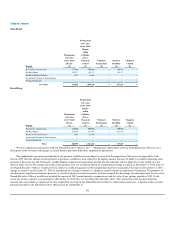

Reflects the aggregate grant date fair value of option awards granted during the fiscal year ended December 31, 2010 computed in accordance with FASB ASC

Topic 718. For additional information, see Note 18, "Stock-Based Compensation Plans", to our audited consolidated financial statements included elsewhere in this

report. The amounts reflect the accounting expense for these awards and do not correspond to the actual value that may be recognized by such persons with respect

to these awards. The grant date fair value was $3.46 per share, calculated in accordance with FASB ASC Topic 718.

(1)

154