GNC 2011 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

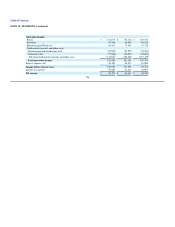

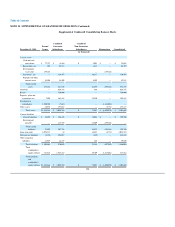

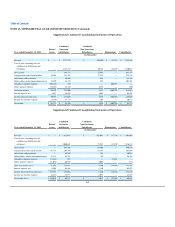

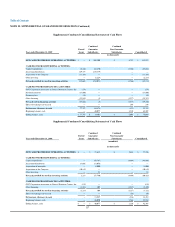

NOTE 23. FAIR VALUE MEASUREMENTS (Continued)

The following is a description of the valuation methodologies used for these items, as well as the general classification of such items pursuant to the fair

value hierarchy of the standard on Fair Value Measurements and Disclosures:

Other Current Liabilities and Other Long-term Liabilities. — Other current liabilities and long-term liabilities classified as Level 1 consist of

liabilities related to the Company's non-qualified deferred compensation plan. The liabilities related to these plans are adjusted based on changes in the fair

value of the underlying employee-directed investment choices. Since the employee-directed investment choices are exchange traded equity indexes with

quoted prices in active markets, the liabilities are classified within Level 1 on the fair value hierarchy. Other current liabilities and long-term liabilities

classified as Level 2 consist of the Company's interest rate swaps. The derivatives are a pay-variable, receive-fixed interest rate swaps based on a LIBOR rate.

Fair value is based on a model-derived valuation using the LIBOR rate, which is an observable input in an active market. Therefore, the Company's derivative

is classified as Level 2 on the fair value hierarchy.

In addition to the above table, the Company's financial instruments also consist of cash and cash equivalents, accounts receivable, accounts payable and

long-term debt. The Company did not elect to value its long-term debt with the fair value option in accordance with the standard on Financial Instruments.

The Company believes that the recorded values of all of its other financial instruments approximate their fair values because of their nature and respective

durations.

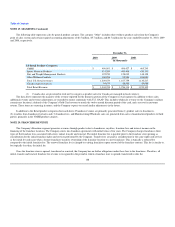

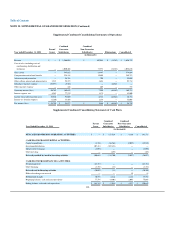

NOTE 24. RELATED PARTY TRANSACTIONS

Management Services Agreement. Upon consummation of the Merger, the Company entered into a services agreement with Parent . Under the

agreement, Parent agreed to provide the Company and its subsidiaries with certain services in exchange for an annual fee of $1.5 million, as well as customary

fees for services rendered in connection with certain major financial transactions, plus reimbursement of expenses and a tax gross-up relating to a non-tax

deductible portion of the fee. For the years ended December 31, 2010 and 2009, $5.7 million and $4.2 million, respectively, had been paid pursuant to this

agreement.

Credit Facility. Upon consummation of the Merger, the Company entered into the Senior Credit Facility, under which various funds affiliated with

one of the Company's sponsors, Ares, are lenders. Under the Senior Credit Facility, these affiliated funds have made term loans to the Company in the amount

of $65.0 million and $62.1 million, as of the consummation of the Merger and December 31, 2009, respectively. In addition, as of December 31, 2010, an

aggregate of $2.9 million in principal and $11.0 million in interest has been paid to affiliates of Ares in respect of amounts borrowed under the Senior Credit

Facility. Borrowings under the Senior Credit Facility have accrued interest at a weighted average rate of $4.6% per year.

Lease Agreements. At December 31, 2010, General Nutrition Centres Company, a wholly owned subsidiary of the Company, was party to 19 lease

agreements, as lessee, with Cadillac Fairview Corporation, a direct wholly owned subsidiary of OTPP, as lessor, with respect to properties located in Canada.

For the years ended December 31, 2010, 2009 and 2008, the Company paid $2.8 million, $2.4 million and $2.5 million, respectively, under the lease

agreements and as of December 31, 2010, the aggregate future minimum lease payments under the lease agreements was $19.3 million. Each lease was

negotiated in the ordinary course of business on an arm's length basis.

Product Purchases. During the Company's 2010 fiscal year, it purchased certain fish oil and probiotics products manufactured by Lifelong

Nutrition, Inc. ("Lifelong") for resale under its

111