GNC 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTE 18. STOCK-BASED COMPENSATION PLANS (Continued)

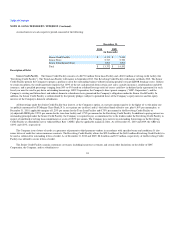

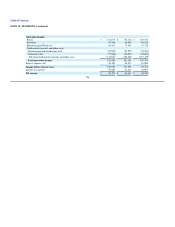

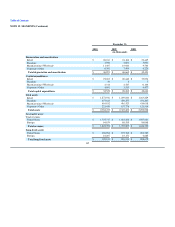

The following table outlines Parent's total stock options activity:

Total Options

Weighted

Average

Exercise Price

Outstanding at December 31, 2009 9,263,640 $ 7.27

Granted 680,000 12.58

Exercised (13,876) 7.91

Forfeited (518,325) 8.19

Expired (67,251) 6.25

Outstanding at December 31, 2010 9,344,188 $ 7.60

Exercisable at December 31, 2010 5,031,731 $ 6.82

Stock-based compensation expense for the years ended December 31, 2010, 2009 and 2008 was $3.2 million, $2.9 million, and $2.6 million,

respectively.

As of December 31, 2010, the weighted average remaining contractual life of outstanding options was 6.6 years. At December 31, 2010, the weighted

average remaining contractual life of exercisable options was 6.1 years. The weighted average fair value of options granted during 2010, 2009 and 2008 was

$2.65, $3.19, and $1.17, respectively.

The Black Scholes model utilizes the following assumptions in determining a fair value: price of underlying stock, option exercise price, expected

option term, risk-free interest rate, expected dividend yield, and expected stock price volatility over the option's expected term. As the Company has had

minimal exercises of stock options through December 31, 2010, 2009 and 2008 option term has been estimated by considering both the vesting period, which

is typically for the successor and predecessor plans, five and four years, respectively, and the contractual term of ten and seven years, respectively. As the

Company's underlying stock is not publicly traded on an open market, the Company utilized its current peer group average to estimate the expected volatility.

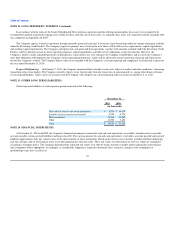

The assumptions used in the Company's Black Scholes valuation related to stock option grants made during the years ended December 31, 2010, 2009 and

2008 were as follows:

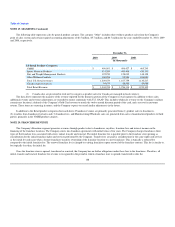

2010 2009 2008

Dividend yield 0.00% 0.00% 0.00%

Expected option life 7.5 years 7.5 years 7.5 years

Volatility factor percentage of market price 31.5% - 33.00% 34.20% - 44.60% 26.00% - 28.40%

Discount rate 2.49% - 3.28% 0.43% - 3.28% 3.08% - 3.64%

As the Black-Scholes option valuation model utilizes certain estimates and assumptions, the existing models do not necessarily represent the definitive

fair value of options for future periods. Assumptions used in the Black-Scholes option valuation model include the fair value of the stock, as the stock is not

publicly traded, and volatility. The fair value of the stock is estimated based upon the net enterprise value of the Company, discounted to reflect the lack of

liquidity and control associated with the stock. Volatility is estimated based upon the volatility in a sample peer group of companies. The average estimated

fair value of Holdings Class A common stock for the years ended December 31, 2010, 2009 and 2008 were $9.89, $5.95, and $5.17 per share, respectively.

104