GNC 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

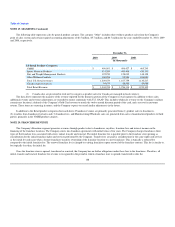

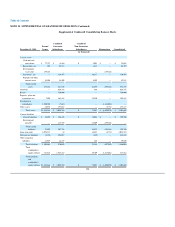

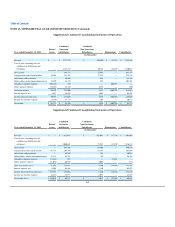

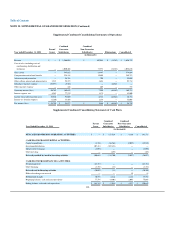

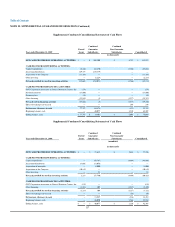

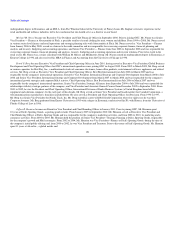

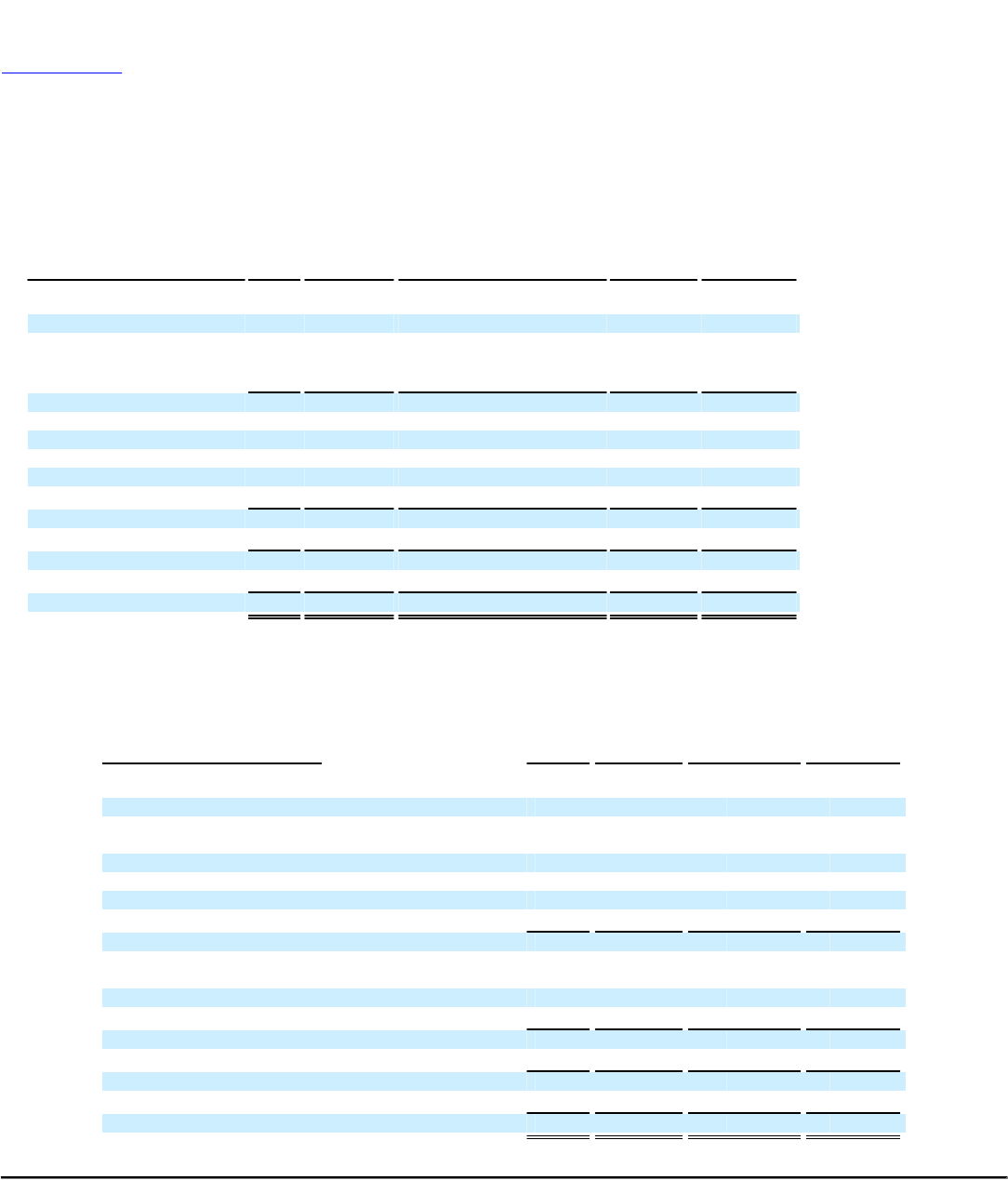

NOTE 25. SUPPLEMENTAL GUARANTOR INFORMATION (Continued)

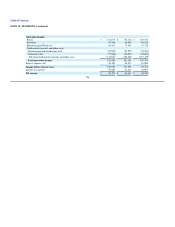

Supplemental Condensed Consolidating Statements of Operations

Year ended December 31, 2008

Parent/

Issuer

Combined

Guarantor

Subsidiaries

Combined

Non-Guarantor

Subsidiaries Eliminations Consolidated

(in thousands)

Revenue $ — $ 1,566,054 $ 102,018 $ (11,343) $ 1,656,729

Cost of sales, including costs of

warehousing, distribution and

occupancy — 1,020,402 73,571 (11,343) 1,082,630

Gross profit — 545,652 28,447 — 574,099

Compensation and related benefits — 234,188 15,605 — 249,793

Advertising and promotion — 54,351 709 — 55,060

Other selling, general and administrative 2,215 92,893 3,624 — 98,732

Subsidiary (income) expense (58,977) (5,565) — 64,542 —

Other (income) expense — 126 607 — 733

Operating income (loss) 56,762 169,659 7,902 (64,542) 169,781

Interest expense, net 4,242 77,579 1,179 — 83,000

Income (loss) before income taxes 52,520 92,080 6,723 (64,542) 86,781

Income tax (benefit) expense (2,260) 33,103 1,158 — 32,001

Net income (loss) $ 54,780 $ 58,977 $ 5,565 $ (64,542) $ 54,780

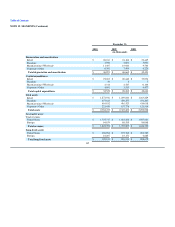

Supplemental Condensed Consolidating Statements of Cash Flows

Year Ended December 31, 2010

Parent/

Issuer

Combined

Guarantor

Subsidiaries

Combined

Non-Guarantor

Subsidiaries Consolidated

(in thousands)

NET CASH PROVIDED BY OPERATING ACTIVITIES: $ — $ 137,529 $ 4,186 $ 141,715

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures (3,701) (26,764) (2,057) (32,522)

Investment/distribution 107,481 (107,481) — —

Merger of the Company (3,096) — — (3,096)

Other investing — (455) — (455)

Net cash provided by (used in) investing activities 100,684 (134,700) (2,057) (36,073)

CASH FLOWS FROM FINANCING ACTIVITIES:

Dividend payment (28,384) — — (28,384)

Other financing (1,708) (13) — (1,721)

Net cash used in financing activities (30,092) (13) — (30,105)

Effect of exchange rate on cash — — 15 15

Net increase in cash 70,592 2,816 2,144 75,552

Beginning balance, cash and cash equivalents 77,797 (4,801) 2,093 75,089

Ending balance, cash and cash equivalents $ 148,389 $ (1,985) $ 4,237 $ 150,641

116