GNC 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

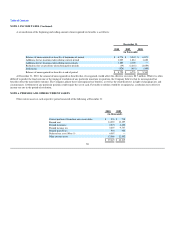

Table of Contents

NOTE 2. BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

their full termination value, which approximates the fair value of derivatives including accrued interest.

Recently Issued Accounting Pronouncements

Fair Value

In January 2010, the FASB issued ASU 2010-06 "Improving Disclosures about Fair Value Measurements". ASU 2010-06 requires additional

disclosures about fair measurements including transfers in and out of Levels 1 and 2 and more disaggregation for the different types of financial instruments.

This ASU became effective for annual and interim reporting periods beginning after December 15, 2009 for most of the new disclosures and for periods

beginning after December 15, 2010 for the new Level 3 disclosures. Comparative disclosures are not required in the first year the disclosures are required. The

adoption of this standard did not have any impact on the Company's consolidated financial statements.

Other

In December 2009, the FASB issued ASU No. 2009-17, "Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities",

which incorporates into the FASB Codification amendments to FASB Interpretation No. 46(R), "Consolidation of Variable Interest Entities", made by

Statement of Financial Accounting Standard No. 167, "Accounting for Variable Interest Entities", to require that a comprehensive qualitative analysis be

performed to determine whether a holder of variable interests in a variable interest entity also has a controlling financial interest in that entity. In addition, the

amendments require that the same type of analysis be applied to entities that were previously designated as qualified special-purpose entities. The

amendments were effective as of January 1, 2010. The adoption of ASU No. 2009-17 did not have a material impact on the Company's consolidated financial

position, results of operations, and cash flows.

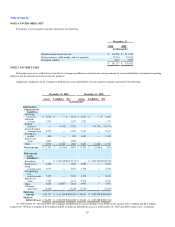

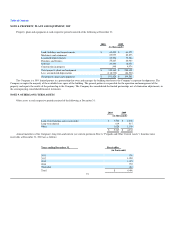

NOTE 3. RECEIVABLES

Receivables at each respective period consisted of the following:

December 31,

2010 2009

(in thousands)

Trade receivables $ 100,545 $ 90,832

Other 3,711 4,889

Allowance for doubtful accounts (1,564) (1,789)

Related party 1,941 423

$ 104,633 $ 94,355

84