GNC 2011 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Product Development and Distribution Agreement

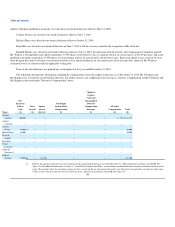

On June 3, 2010, General Nutrition Corporation, our wholly owned subsidiary, and Lifelong entered into a Product Development and Distribution

Agreement (the "Lifelong Agreement"), pursuant to which General Nutrition Corporation and Lifelong will develop a branded line of supplements to be

manufactured by Lifelong. As described above, Mr. Fortino was the Managing Director, a member of the board of directors and a stockholder of Lifelong's

parent company. Products manufactured under the Lifelong Agreement and sold in our stores will be purchased by us from Lifelong; products sold outside of

our stores will be subject to certain revenue sharing arrangements. For the year ended December 31, 2010, we made $1.3 million in product purchases from

Lifelong under the Lifelong Agreement. Effective December 31, 2010, Lifelong's parent company was sold to a third party and Mr. Fortino resigned his

positions at Lifelong.

Stock Purchase

During the third and fourth quarters of 2008, our Parent issued to Axcel Partners III, LLC 273,215 shares of its Class A common stock at a price of

$6.82 per share, for an aggregate purchase price of $1.9 million, and 45,478 shares of its Class A common stock at a price of $7.08 per share, for an aggregate

purchase price of $0.3 million, respectively, and 110,151 and 18,710 shares of its Series A preferred stock of our parent at a price of $5.00 per share plus

accrued and unpaid dividends through the dates of purchase, for an aggregate purchase price of $0.6 million and $0.1 million, respectively. Ms. Kaplan, who

serves as a director and as our President and Chief Merchandising and Marketing Officer, is a member of Axcel Managers LLC, the managing member of

Axcel Partners III LLC, and of SK Limited Partnership, a member of Axcel Partners III LLC.

Stock Purchase Agreement

In February 2010, Holdings and GNC entered into a Stock Purchase Agreement with Guru Ramanathan, Senior Vice President, Chief Innovation

Officer of GNC, in connection with Mr. Ramanathan's previous purchase, in June 2008, of 14,885 shares of our Parent's Class A common stock at a price of

$6.93 per share, for an aggregate purchase price of $103,153, and 4,961 shares of our Parent's Series A preferred stock at a price of $5.6637 per share, for an

aggregate purchase price of $28,097.62.

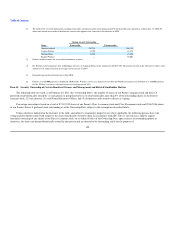

Director Independence

As of February 24, 2011, our board of directors was comprised of Norman Axelrod, Andrew Claerhout, Carmen Fortino, Joseph Fortunato, Michael

Hines, Beth J. Kaplan, David B. Kaplan, Brian Klos, Romeo Leemrijse and Richard J. Wallace. Pursuant to the voting agreement in the Amended and

Restated Stockholders Agreement, Messrs. Axelrod, Kaplan and Klos were designated by ACOF and Messrs. Claerhout, Fortino and Leemrijse were

designated by OTPP. Ms. Kaplan and Messrs. Hines and Wallace were jointly designated by our sponsors. Mr. Fortunato was elected to the board of directors

pursuant to the Amended and Restated Stockholders Agreement, which provides that our chief executive officer shall sit on our board. We have no securities

listed for trading on a national securities exchange or in an automated inter-dealer quotation system of a national securities association which has requirements

that a majority of our board of directors be independent.

Review, Approval or Ratification of Transactions with Related Persons

Although we have not adopted formal procedures for the review, approval or ratification of transactions with related persons, the Parent Board reviews

potential transactions with those parties we have identified as related parties prior to the consummation of the transaction, and we adhere

160