GNC 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Warehousing and Distribution Costs. Unallocated warehousing and distribution costs increased $1.4 million, or 2.7%, to $55.0 million for the year

ended December 31, 2010 compared to $53.6 million for the same period in 2009. The increase in costs was primarily due to increases in distribution wages

and fuel costs.

Corporate Costs. Corporate overhead costs increased $4.4 million, or 6.1%, to $77.0 million for the year ended December 31, 2010 compared to

$72.6 million for the same period in 2009. This increase was due to increases in compensation expenses, incentives, and health insurance costs offset by

decreases in other SG&A expenses. In addition, we incurred $3.5 million of non-recurring expenses, principally related to the exploration of strategic

alternatives.

Interest Expense

Interest expense decreased $4.5 million, or 6.3%, to $65.5 million for the year ended December 31, 2010 compared to $70.0 million for the same period

in 2009. This decrease was primarily attributable to decreases in interest rates on the variable portion of our debt in 2010 compared to 2009.

Income Tax Expense

We recognized $50.9 million of income tax expense (or 34.1% of pre-tax income) during the year ended December 31, 2010 compared to $41.6 million

(or 37.4% of pre-tax income) for the same period in 2009. During 2010, we recorded a valuation allowance adjustment of $3.1 million, which reduced income

tax expense. This valuation allowance adjustment reflected a change in circumstances that caused a change in judgment about the realizability of certain

deferred tax assets related to state net operating losses. As a result of being able to fully utilize our remaining federal net operating losses in 2009, we were

able to realize additional federal income tax benefits during 2010 related to certain federal tax credits and incentives.

Net Income

As a result of the foregoing, consolidated net income increased $28.6 million to $98.2 million for the year ended December 31, 2010 compared to

$69.6 million for the same period in 2009.

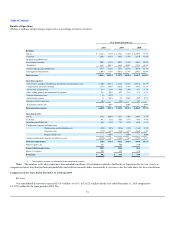

Comparison of the Years Ended December 31, 2009 and 2008

Revenues

Our consolidated net revenues increased $50.3 million, or 3.0%, to $1,707.0 million for the year ended December 31, 2009 compared to

$1,656.7 million for the same period in 2008. The increase was the result of increased sales in all of our segments.

Retail. Revenues in our Retail segment increased $37.0 million, or 3.0%, to $1,256.3 million for the year ended December 31, 2009 compared to

$1,219.3 million for the same period in 2008. The increase from 2008 to 2009 included an increase of $31.6 million in our same store sales and an increase of

$5.9 million from our non-same store sales. The same store sales increase includes GNC.com revenue, which increased $10.8 million, or 29.9%, to

$46.8 million, compared to $36.0 million in 2008. Sales increases occurred in the major product categories of VMHS and sports nutrition. Sales in the diet

category were negatively impacted by the Hydroxycut recall that occurred in May 2009. Our domestic company-owned same store sales, including our

internet sales, improved by 2.8% for the year ended December 31, 2009 compared to the same period in 2008. For the year ended December 31, 2009,

Canadian retail revenue decreased by $0.5 million in U.S. dollars, primarily due to the volatility of the U.S. dollar. In local currency, however, Canadian retail

revenue increased by CAD $6.3 million. This increase was primarily a result of an increase of

54