GNC 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

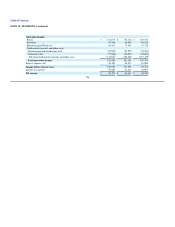

NOTE 17. STOCKHOLDER'S EQUITY (Continued)

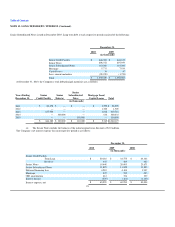

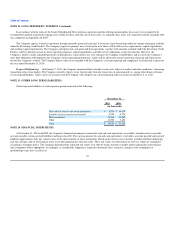

The accumulated balances of other comprehensive income and their related tax effects included as part of the consolidated financial statements are as

follows:

Before tax amount Tax Benefit

(Expense) Net Other

Comprehensive Income (Loss)

Foreign

currency

translation

Unrealized

Gain/(Loss)

on Derivatives

Unrealized

Gain/(Loss)

on Derivatives

Foreign

currency

translation

Unrealized

Gain/(Loss)

on Derivatives Total

($ in thousands)

Balance at

December 31,

2008 $ (2,035) $ (18,902) $ 6,880 $ (2,035) $ (12,022)$(14,057)

Foreign

currency

translation

adjustment 4,172 — — 4,172 — 4,172

Unrealized gain

on

derivatives

designated as

cash flow

hedge, net of

tax — 4,223 (1,537) — 2,686 2,686

Balance at

December 31,

2009 2,137 (14,679) 5,343 2,137 (9,336) (7,199)

Foreign

currency

translation

adjustment 1,334 — — 1,334 — 1,334

Unrealized gain

on

derivatives

designated as

cash flow

hedge, net of

tax — 7,210 (2,625) — 4,585 4,585

Balance at

December 31,

2010 $ 3,471 $ (7,469) $ 2,718 $ 3,471 $ (4,751)$ (1,280)

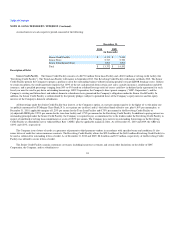

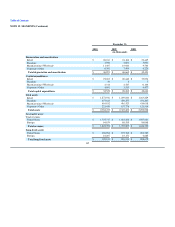

NOTE 18. STOCK-BASED COMPENSATION PLANS

Stock Options

The Company utilizes the Black Scholes model to calculate the fair value of options. The resulting compensation cost is recognized in the Company's

financial statements over the option vesting period. At December 31, 2010, the net unrecognized compensation cost was $6.1 million and is expected to be

recognized over a weighted average period of approximately 1.4 years.

In 2007, the board of directors of Parent (the "Parent Board") and Parent's stockholders approved and adopted the GNC Acquisition Holdings Inc. 2007

Stock Incentive Plan (the "2007 Stock Plan"). The purpose of the 2007 Stock Plan is to enable the Company to attract and retain highly qualified personnel

who will contribute to the success of the Company. The 2007 Stock Plan provides for the granting of stock options, restricted stock and other stock based

awards. The 2007 Stock Plan is available to certain eligible employees, directors, consultants or advisors as determined by the administering committee of the

Parent Board. The total number of shares of Parent's Class A common stock reserved and available for the 2007 Stock Plan is 10.4 million shares. Stock

options under the 2007 Stock Plan generally are granted with exercise prices at or above fair market value, typically vest over a four or five-year period and

expire ten years from the date of grant. No stock appreciation rights, restricted stock, deferred stock or performance shares have been granted under the 2007

Stock Plan.

103