GNC 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

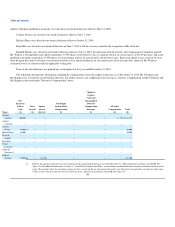

reasonable compensation for the non-competition covenant and could eliminate or reduce the reduction amount.

The employment agreements for Mr. Fortunato and Ms. Kaplan provide for accelerated vesting of stock options on a change in control. The 2007 Stock

Plan provides that, in the event of a change in control, unvested stock options generally may be fully vested, cancelled for fair value or substituted for awards

that substantially preserve the applicable terms of the stock options. We have assumed for purposes of the table that upon a change in control,

Messrs. Nuzzo's, Dowd's and Berg's unvested stock options would be substituted for awards that substantially preserve the applicable terms of the stock

options. In the event that in the exercise of discretion by the Compensation Committee, Messrs. Nuzzo's, Dowd's and Berg's unvested stock options would

have become vested in connection with a change in control on December 31, 2010, the value of their vested options as of such would have been:

Mr. Nuzzo — $803,700; Mr. Dowd — $1,411,200; and Mr. Berg — $1,542,003.

Finally, although there is no requirement to do so or guarantee that it would have been paid, we have assumed that, in the exercise of discretion by the

Compensation Committee, our Named Executive Officers would have been paid their prorated annual incentive compensation for the year in which their

employment was terminated based on a hypothetical termination date of the end of that year, other than in the case of voluntary termination without good

reason or a termination by us for cause.

Upon a termination of employment on December 31, 2010, the shares of our Parent's Class A common stock owned by our Named Executive Officers

other than Mr. Fortunato and Ms. Kaplan would have been subject to repurchase by our Parent or its designee for a period of 180 days (270 days upon

termination because of death or disability) following the termination based on fair value as determined by the Parent Board.

Director Compensation

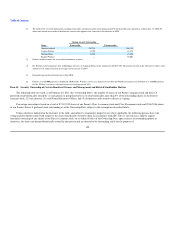

Pursuant to our director compensation policy, effective as of August 15, 2007, we compensate our directors as follows: (i) our non-employee chairman

receives an annual retainer of $200,000 and (ii) our non-employee directors receive an annual retainer of $40,000. The annual retainer paid to each of our non-

employee directors, including our non-employee chairman, is generally paid in four equal, quarterly installments every March, June, September and

December with respect to our second, third, fourth and first fiscal quarters, respectively. Directors are not entitled to any additional cash compensation such as

fees for attending meetings.

Each non-employee director is entitled to receive a grant of non-qualified stock options to purchase a minimum of 35,000 shares of our Parent's Class A

common stock. The stock options granted to each of our non-employee directors were granted under the 2007 Stock Plan, are subject to vesting in equal

annual installments on the first five anniversaries of the date of grant, and have a term of five years, subject to such non-employee director's continued service

as a director until the applicable vesting date. Any director or chairman who is employed by Ares Management, OTPP and other purchasers in connection

with the Merger is not entitled to any retainers or stock option grants.

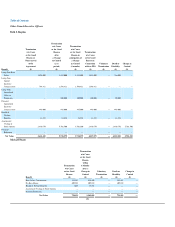

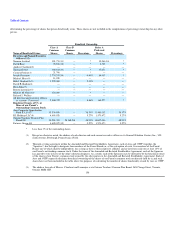

The table below sets forth information with respect to compensation for our directors for 2010.

David B. Kaplan was appointed as a member of our board of directors effective as of February 7, 2007. Norman Axelrod and Jeffrey B. Schwartz were

appointed as members of our board of directors effective as of March 16, 2007. As stated above, any employee employed by Ares Management or OTPP is

not entitled to any additional compensation for serving as director.

153