GNC 2011 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

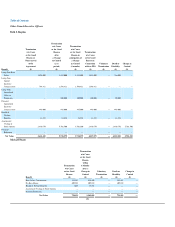

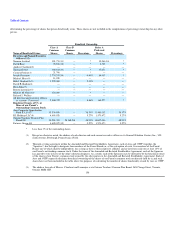

Consists entirely of shares issuable upon exercise of options which are currently exercisable or which will become exercisable within

60 days of the Ownership Date.

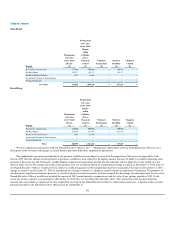

Ms. Kaplan is a member of Axcel Managers LLC, the managing member of Axcel Partners III LLC, and of SK Limited Partnership, a

member of Axcel Partners III LLC. Axcel Partners III LLC holds 318,693 shares of Class A common stock and 128,861 shares of

Series A preferred stock. Ms. Kaplan disclaims beneficial ownership of the shares owned by Axcel Partners III LLC. The address of

each of Axcel Managers LLC, SK Limited Partnership and Axcel Partners III LLC is 10955 Nacirema Lane, Stevenson, Maryland,

21153.

The address of Mr. Kaplan is c/o Ares Management LLC, 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067.

Mr. Kaplan is a Senior Partner in the Private Equity Group of Ares Management and member of Ares Partners Management

Company LLC ("Ares Partners"), both of which indirectly control Ares. Mr. Kaplan expressly disclaims beneficial ownership of the

shares owned by Ares.

The address of Mr. Klos is c/o Ares Management LLC, 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067. Mr. Klos

is a Principal in the Private Equity Group of Ares Management. Mr. Klos expressly disclaims beneficial ownership of the shares owned

by Ares.

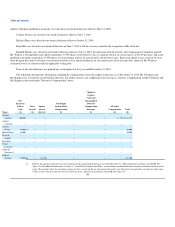

Reflects shares owned by Ares acquired in connection with the Merger. The general partner of Ares is ACOF Management II, L.P.

("ACOF Management II") and the general partner of ACOF Management II is ACOF Operating Manager II, L.P. ("ACOF Operating

Manager II"). ACOF Operating Manager II is indirectly owned by Ares Management which, in turn, is indirectly controlled by Ares

Partners (together with ACOF Management II, ACOF Operating Manager II and Ares, the "Ares Entities"). Ares Partners is managed

by an executive committee comprised of Mr. Kaplan, Michael Arougheti, Gregory Margolies, Antony Ressler and Bennett Rosenthal.

Each of the members of the executive committee expressly disclaims beneficial ownership of the shares of stock of our Parent owned

by Ares. Each of the Ares Entities (other than Ares, with respect to the securities owned by Ares) and the partners, members and

managers of the Ares Entities and the executive committee of Ares Partners expressly disclaims beneficial ownership of these shares.

The address of each Ares Entity is 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067.

Refers to shares owned by KL Holdings LLC acquired in connection with the Merger. The manager of KL Holdings LLC is Lowell J.

Milken who expressly disclaims beneficial ownership of these shares. The owners of KL Holdings LLC include Knowledge

Industries LLC (which may be deemed to have a controlling interest in the entity), Birch LLC and Lantana LLC; each of which

expressly disclaims beneficial ownership of these shares. The beneficial owners of Knowledge Industries LLC are Michael R. and Lori

A. Milken, each of whom expressly disclaims beneficial ownership of all shares held by KL Holdings LLC. The address of KL

Holdings LLC is 1250 Fourth Street, Santa Monica, California 90401.

Refers to shares owned by OTPP acquired in connection with the Merger. Each of Mr. Claerhout, Mr. Leemrijse and Roman Duch may

be deemed to have the power to dispose of the shares held by OTPP because of a delegation of authority from the Board of Directors of

OTPP, and each expressly disclaims beneficial ownership of such shares. As the owner of Class B common stock, OTPP may, at any

time, elect to convert shares of Class B common stock into an equal number of shares of Class A common stock, or convert shares of

Class A common stock into an equal number of shares of Class B common stock. The table above does not reflect (i) shares of Class B

common stock issuable upon conversion of Class A common stock or (ii) shares of Class A common stock issuable upon conversion of

Class B common stock. The address of Ontario Teachers' Pension Plan Board is 5650 Yonge Street, Toronto, Ontario M2m 4H5.

Consists of (i) 59,626 shares directly held by Mr. Axelrod and acquired in connection with the Merger, (ii) 292,314 shares issuable

upon exercise of options which are currently exercisable or which will become exercisable within 60 days of the Ownership Date, and

(iii) 29,813 shares directly held by AS Skip, LLC ("AS Skip"), of which Mr. Axelrod is the managing member.

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

157