GNC 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

our employees, including our Named Executive Officers, are more closely aligned to the interests of our stockholders.

Under the terms of the 2007 Stock Plan, the Compensation Committee is responsible for administering the 2007 Stock Plan and making any award

determinations. The Compensation Committee does not delegate any function of the stock option grants. The Compensation Committee intends for stock

option grants generally to be considered on an annual basis, except for new hires, promotions, and special performance recognition. Awards are generally

granted only after the release of material information, such as quarterly or annual earnings, or at other times if the circumstances of the grant are evidenced

and no action is taken with respect to the date of the grant that would constitute, or create the appearance of, a manipulation of the award exercise price.

The Compensation Committee sets the exercise price per share for stock option grants at an amount greater than or equal to the fair market value per

share of our Parent's Class A common stock on the applicable grant date. However, our Parent's Class A common stock has not been publicly traded. The

Compensation Committee has used a valuation methodology in which the fair market value of our Parent's Class A common stock is based on our Parent's

business enterprise value and, in situations deemed appropriate by the Compensation Committee, discounted to reflect the lack of marketability associated

with our Parent's Class A common stock.

The maximum number of shares of stock that may be granted under the 2007 Stock Plan was established in February 2008 and is 10,419,178 shares. All

options granted expire 10 years after the date of grant. Upon the occurrence of a change in control (defined as any sale, lease, exchange or other transfer of all

or substantially all of our Parent's assets, certain consolidations, mergers and plans of share exchange involving our Parent and certain liquidations or

dissolutions of our Parent), all outstanding stock awards may, in the discretion of the Compensation Committee, become fully vested and exercisable, be

cashed out and cancelled in exchange for an amount equal to the transaction consideration less any applicable exercise price, or be exchanged for equivalent

awards based on the surviving corporation's shares.

If an option holder ceases to be employed by us for any reason, his or her non-vested stock options and other non-vested awards under the 2007 Stock

Plan will terminate immediately. If an option holder dies while employed by us or any of our subsidiaries or is terminated due to disability without having

fully exercised vested stock options, the option holder, or in the case of the option holder's death, the executors or administrators, or legatees or heirs, of the

option holder's estate, shall have the right to exercise the stock options to the extent that such option holder was entitled to exercise the stock options on the

date of his or her death for one year after the date of the option holder's termination. Upon an option holder's termination of employment by us without cause

or by the option holder voluntarily, the option holder will have the right to exercise the stock options to the extent that such option holder was entitled to

exercise the stock options on the date of his or her termination for 90 days and 60 days, respectively, after such date.

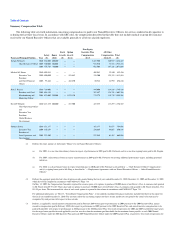

How We Chose Amounts and/or Formulas for Each Element

Base Salary. The Compensation Committee intends to set the base salary for our Named Executive Officers at a level to attract and retain a strong

motivated leadership team, but not so high that it creates a negative perception with our employees generally, stockholders or holders of our debt. Each

Named Executive Officer's current and prior compensation is considered in setting future compensation. In addition, we review the compensation practices of

other companies. Base salary amounts are determined by complexity and level of position as well as market comparisons.

Each year, we perform a market analysis with respect to the compensation of all of our Named Executive Officers. Although we do not use

compensation consultants, we participate in various surveys and use the survey data for market comparisons. Currently, we use surveys with both base

129