GNC 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

a wholly owned subsidiary of Koninklijke (Royal) Numico N.V. (collectively, "Numico"). In December 2003, we purchased all of the outstanding equity

interests of General Nutrition Companies, Inc. In connection with a corporate reorganization, General Nutrition Companies, Inc. was merged with and into us

in December 2008, with us surviving the merger.

General Nutrition Companies, Inc. was founded in 1935 by David Shakarian who opened its first health food store in Pittsburgh, Pennsylvania. Since

that time, the number of stores has continued to grow, and General Nutrition Companies, Inc. began producing its own vitamin and mineral supplements as

well as foods, beverages, and cosmetics. General Nutrition Companies, Inc. was acquired in August 1999 by Numico Investment Corp. and, prior to its

acquisition, was a publicly traded company listed on the Nasdaq National Market.

Industry Overview

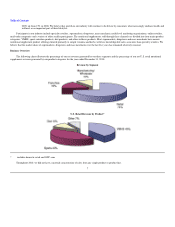

We operate within the large and growing U.S. nutritional supplements industry. According to Nutrition Business Journal's Supplement Business Report

2010, our industry generated $26.9 billion in sales in 2009 and an estimated $28.7 billion in 2010, and is projected to grow at an average annual rate of

approximately 5.3% through 2015. Our industry is highly fragmented, and we believe this fragmentation provides large operators, like us, the ability to

compete more effectively due to scale advantages. We generate a significant portion of our sales revenue from strong performing sports nutrition and VMHS

products.

According to Nutrition Business Journal, sports nutrition products represented approximately 10.9% of the total U.S. nutritional supplements industry in

2009, and the category is expected to grow at a 7.2% CAGR from 2010 to 2015, representing the second-fastest growing product category in the nutritional

supplements industry. By way of comparison, sports nutrition products, grouped in a manner consistent with Nutrition Business Journal's data, generated

approximately 43% of our company-owned retail sales for 2010.

According to Nutrition Business Journal, VMHS products represented approximately 60.8% of the total U.S. nutritional supplement industry in 2009,

and the category is expected to grow at a 5.3% CAGR from 2010 to 2015. By way of comparison, VMHS products, grouped in a manner consistent with

Nutrition Business Journal's data, generated approximately 40% of our company-owned retail sales for 2010.

We expect several key demographic, healthcare, and lifestyle trends to drive the continued growth of our industry. These trends include:

Increasing awareness of nutritional supplements across major age and lifestyle segments of the U.S. population. We believe that, primarily as a

result of increased media coverage, awareness of the benefits of nutritional supplements is growing among active, younger populations,

providing the foundation for our future customer base. Based on our Gold Card Program data, customers age 19 to 29 years old represented

approximately 26% of our sales in 2010, which is an increase of 8% from 2006. In addition, the average age of the U.S. population is increasing

and data from the United States Census Bureau indicates that the number of Americans age 65 or older is expected to increase by approximately

52% from 2000 to 2015. We believe that these consumers are likely to increasingly use nutritional supplements, particularly VMHS products,

and generally have higher levels of disposable income to pursue healthier lifestyles.

Increased focus on fitness and healthy living. We believe that consumers are trying to lead more active lifestyles and becoming increasingly

focused on healthy living, nutrition and supplementation. According to the Nutrition Business Journal's Supplement Business Report 2010, 18%

of the United States adult population were regular or heavy users of vitamins in

6

•

•