GNC 2011 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2011 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

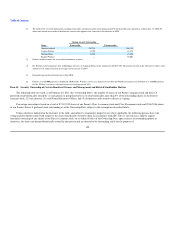

Table of Contents

Under all circumstances, Messrs. Nuzzo's, Dowd's and Berg's unvested equity awards will be forfeited as of the date of the executive's termination.

Mr. Berg's employment agreement provides for the payment of a signing bonus of $200,000. Fifty percent of such signing bonus was paid following the

execution of such employment agreement, provided, that if Mr. Berg is terminated for "cause" or resigns without "good reason" prior to the second

anniversary of the commencement of his employment, Mr. Berg will repay such amount in full. The remaining fifty percent was paid in September 2010.

Mr. Berg's employment agreement also provides that, in connection with the commencement of his employment, Mr. Berg was granted certain options

to purchase 37,250 shares of our Parent's Class A common stock pursuant to the 2007 Stock Plan at a per share exercise price of $7.91, which vest in two

equal installments upon the first and second anniversaries of the commencement of his employment and are exercisable for a period of seven days thereafter.

Mr. Berg was also granted certain options to purchase 12,750 shares of our Parent's Series A preferred stock at a per share exercise price equal to $5.00 plus

accrued and unpaid dividends through the date of purchase on terms consistent with the 2007 Stock Plan, which vest in two equal installments upon the first

and second anniversaries of the commencement of his employment and are exercisable for a period of seven days thereafter.

General

The employment agreements for our Named Executive Officers contain:

terms of confidentiality concerning trade secrets and confidential or proprietary information which may not be disclosed by the executive except

as required by court order or applicable law; and

certain non-competition and non-solicitation provisions which restrict the executive and certain relatives from engaging in activities against our

interests or those of our subsidiaries during the term of employment and, in the case of Mr. Fortunato and Ms. Kaplan, eighteen months

following the termination of employment, and in the case of the other Named Executive Officers, for the longer of the first anniversary of the

date of termination of employment or the period during which the executive receives termination payments.

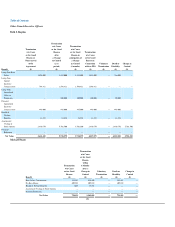

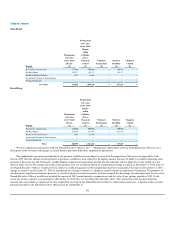

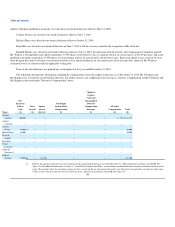

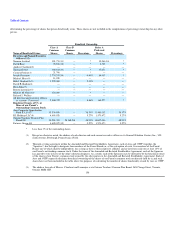

Potential Termination or Change-in-Control Payments

The following tables summarize the value of the compensation that our Named Executive Officers would have received if they had terminated

employment on December 31, 2010 under the circumstances shown or if we had undergone a change in control on such date. The tables exclude

(1) compensation amounts accrued through December 31, 2010 that would be paid in the normal course of continued employment, such as accrued but unpaid

salary, and (2) vested account balances under our 401(k) Plan that are generally available to all of our salaried employees. Where applicable, the amounts

reflected for the prorated annual incentive compensation in 2010 are the amounts that will be paid to our Named Executive Officers in March 2011 under the

2010 Incentive Plan, since the hypothetical termination date is the last day of the fiscal year for which the bonus is to be determined.

Where applicable, the information in the tables uses a fair market value per share of $14.09 as of December 31, 2010 for our Parent's Class A common

stock. Since the Merger, the Compensation Committee has used a valuation methodology in which the fair market value of our Parent's Class A common

stock is based on its business enterprise value and, in situations deemed appropriate by the Compensation Committee, may be discounted to reflect the lack of

marketability associated with our Parent's Class A common stock.

149

•

•